RNS Number : 4161K

Drax Group plc

(“Drax” or the “Company”; Symbol: DRX)

Highlights

-

Robust trading and operational performance in first three months of 2020

-

Strong contracted forward power sales supporting 2020-21 earnings visibility

-

2020 full year Adjusted EBITDA(1) currently in line with consensus(2) inclusive of £60 million estimated potential impact from Covid-19

-

Principally lower power demand and increased bad debt risk in Customers business

-

Lower ROC(3) recycle prices in Generation, partially offset by system support services

-

Strong balance sheet at 31 March 2020 – net debt: £818 million, available cash and committed cash facilities: £663 million

-

2019 final dividend of 9.5 pence per share (£37 million) to be paid in respect of 2019 performance, as previously announced – subject to shareholder approval at AGM

-

Strategic focus remains on biomass supply chain expansion and cost reduction

Electricity pylon near Cruachan Power Station, Argyll and Bute [Click to view/download]

Will Gardiner, Drax Group CEO, said:

“With our strong balance sheet, robust trading and operational performance, and resilient sustainable biomass supply chain, Drax is in a strong position to support its employees, business customers and communities during the Covid-19 crisis, while continuing to generate returns for shareholders.

Drax Group CEO Will Gardiner in the control room at Drax Power Station. Click to view/download.

“As an important part of the UK’s critical national infrastructure, we recognise our responsibility to support the country’s response to Covid-19. We have strong business continuity plans in place and are in close contact with the UK Government. Our dedicated teams across England, Scotland and Wales, supported by our US biomass colleagues and business partners, are working around the clock to generate and supply the flexible, low-carbon and renewable electricity the UK needs, not least to the 250,000 businesses, including care homes, hospitals and schools we supply.

“The Group is also providing support for communities and others affected by Covid-19.

“Nevertheless, it is still early in this pandemic. As Covid-19 continues to develop, we remain vigilant in looking to protect all our stakeholders and will report further if there are significant changes to our outlook for 2020.”

Trading, operational performance and outlook

The trading and operational performance of the Group has been robust in the first three months of 2020.

While the impact of Covid-19 is still unfolding, the Group’s expectations for 2020 Adjusted EBITDA are currently in line with consensus inclusive of an estimated potential impact from Covid-19 of £60 million, principally in relation to its Customers business.

Full year expectations for the Group remain underpinned by good operational availability for the remainder of 2020.

In the Customers business, the consequences of Covid-19 are only now starting to become visible. It is expected to result in reduced demand and a potential increase in bad debt, which represents a major sensitivity, particularly in the SME(4) market. As a result, Drax has significantly increased its expectation of potential customer business failures and higher bad debt.

Assuming the continued impact of Covid-19 throughout 2020, Drax now expects a full year Adjusted EBITDA loss for the Customers business. The Group will closely monitor the impact on the Customers business and update the market accordingly.

In Generation, the Group’s expectations for the full year reflect a reduction in ROC recycle prices resulting from reduced power demand. Drax expects to partially offset this through increased activity in system support services across its generation portfolio.

The performance of the Generation business is dependent on the continuation of biomass deliveries to Drax Power Station. Biomass generation is currently the most material area of activity for the Group and a protracted suspension of the supply chain could lead to lower levels of biomass generation, resulting in a reduction in the Group’s expectations for the full year. At present there has been no impact from Covid-19 and the Group has a good supply of biomass throughout the supply chain, which continues to be robust and functioning well.

Engineer climbs cooling tower at Drax Power Station [Click to view/download]

Generation

During the first three months of 2020 Drax’s generation portfolio performed well with good asset availability and optimisation of generation underpinning a strong financial performance.

The business benefits from a strong forward power sales position through 2022 which, combined with index-linked renewable schemes and capacity payments, provides a high level of earnings visibility, helping to protect the business from the current weakness in UK power prices.

In response to Covid-19, Drax has implemented robust business continuity procedures across its sites to protect employees and contractors and ensure continued operation. In addition to operating strategically important infrastructure, the components of the Group’s UK supply chain are considered key sectors allowing continued operation.

The Group’s biomass supply chain has a high level of operational redundancy designed to mitigate any potential disruption. Drax sources biomass from suppliers across North America and Europe, including the Group’s own facilities in Louisiana and Mississippi. In the UK, Drax utilises dedicated port facilities at Hull, Immingham, Tyne and Liverpool, with a capacity of eleven million tonnes, providing supply chain capacity in excess of the Group’s annual biomass usage of over seven million tonnes.

Sustainable biomass wood pellets destined for Drax Power Station unloaded from the Zheng Zhi bulk carrier at ABP Immingham [Click to view/download]

Biomass generation has performed well in the first three months of 2020. Whilst Covid-19 has not had any measurable impact on biomass generation to date, a sustained reduction in electricity demand could result in a reduction in ROC recycle prices in the current compliance period. The Group has adjusted its expectations for the full year but the precise impact will be dependent on the depth and duration of any reduction in demand. Drax expects to partially offset this through increased activity in system support services across its generation portfolio.

Engineer at Cruachan Power Station [Click to view/download]

Thermal generation is performing in line with Drax’s expectations.

Pellet Production

LaSalle BioEnergy wood pellet manufacturing plant in Louisiana [Click to view/download]

At present there has been no disruption to production caused by Covid-19, although the State of Louisiana is experiencing a high number of cases. The semi-automated nature of the pellet production process limits the need for individuals to be in contact with each other and this has been enhanced by robust business continuity procedures to further reduce the risk to employees and contractors.

Drax continues to monitor developments closely and notes that energy, rail, port and forestry are designated key sectors in the USA allowing continued operation.

Customers

The Group’s Customers business, which sells power, gas and energy services to the I&C(6) and SME markets has seen a significant reduction in demand as a result of Covid-19. The Group has been working to assess the potential impact of this demand reduction, the increased risk of business failure and bad debt. The impact is expected to be most pronounced in the SME market, which represents c.30 percent of monthly billing. The impact is expected to be partially mitigated by credit insurance in respect of certain customers.

Balance sheet

At 31 December 2019 Drax had £404 million of cash, which increased to £454 million at 31 March 2020.

The Group’s plan for 2020 included capital investment of £230-£250 million, with half of this assigned to strategic investment in biomass expansion and cost reduction. Whilst the Group continues to see its biomass strategy as both a primary long and short-term source of value, Drax is reviewing the timing of its investment programme in 2020 and in the short-term investment is expected to be lower.

At 31 March 2020 net debt had reduced to £818m million and Drax continues to target around 2 x net debt to EBITDA for the full year.

The Group has available cash and committed facilities of £663 million including a cash line available within a £315 million Revolving Credit Facility (RCF), which is currently undrawn and matures in April 2021. The Group has an ESG facility with final maturity in 2022 and a £350m sterling bond which matures in 2022. The Group has a further $500 million fixed rate USD bond maturing in 2025 and infrastructure private placement loans maturing through 2024-2029.

The Group’s facilities include a maintenance covenant which, if triggered, requires a minimum EBITDA level requirement around 40% of 2020 current consensus Adjusted EBITDA. Customary covenants apply to all other facilities.

The Group’s rolling five-year foreign exchange hedge book continues to provide protection from the recent weakness in sterling to 2025. The Group actively manages risk limits with counterparties providing forward foreign exchange contracts and the current weakness in sterling has led to the rebasing of a number of contracts, resulting in the acceleration of cash flows from these contracts to the benefit of Drax.

Contracted power sales

As at 16 April 2020, the power sales contracted for 2020, 2021 and 2022 were as follows:

| 2020 | 2021 | 2022 |

| Power sales (TWh) comprising: | 16.7 | 9.6 | 4.3 |

| – Fixed price power sales (TWh) | 17.1 | 10.1 | 4.3 |

| Of which CfD unit (TWh) | 3.8 | | |

| At an average achieved price (£ per MWh) | 53.2 | 49.4 | 48 |

| – Gas hedges (TWh) | -0.4 | -0.5 | - |

| At an achieved price (pence per therm) | 1.7 | 32 | - |

Merchant power prices remain an important part of the Group’s earnings, but by focusing on flexible, renewable and low-carbon generation, which includes index-linked renewable schemes, capacity payments and system support services, the impact of power prices has reduced.

Exposure to merchant power prices by generation asset class

- Biomass CfD – power produced by this unit is remunerated based on an index-linked strike price and underpinned by a private law contract which runs until March 2027. At baseload the unit is expected to produce over 5TWh per year. The current strike price is c.£116/MWh and taken together with a biomass cost at or below c.£75/MWh gives a margin of over £40/MWh and an annual contribution to gross profit of over £200 million, with daily cash settlement in 30 days

- Biomass ROC – ROC buyout prices are index-linked and extend to March 2027, acting as a premium on UK power prices. The buyout price for the current compliance period is £50.05 per ROC. Annual generation is in the region of 9-10 TWh, with the associated power sold up to two years forward, providing strong earnings visibility over the period 2020-21

- Hydro – a small but profitable volume of merchant power generation (144MW) with zero fuel cost

- Pumped storage – operates in the system support services market and carries little net exposure to merchant power prices

- Coal – commercial generation will end in March 2021, ahead of which date Drax will utilise its residual coal stock to realise further cash flows

- Gas – the Group’s mid-merit CCGT(7) assets have power forward sales for 2020. To the extent that gas prices continue to set the price of power, the clean spark spread from these assets is expected to be maintained at or around current levels in future periods

Engineer working in PPE at Rye House Power Station in Hertfordshire [Click to view/download]

Investment in biomass to increase capacity and reduce cost

Biomass sustainability remains at the heart of the Group’s activities and building a long-term future for sustainable biomass remains the Group’s strategic objective. Drax remains focused on reducing biomass costs to a level which makes biomass generation in the UK economically viable when the existing renewable schemes end in 2027.

An engineer looks up at flue gas desulphurisation unit (FGD) at Drax Power Station. The massive pipe would transport flue gas from the Drax boilers to the carbon capture and storage (CCS) plant for CO2 removal of between 90-95%. [Click to view/download]

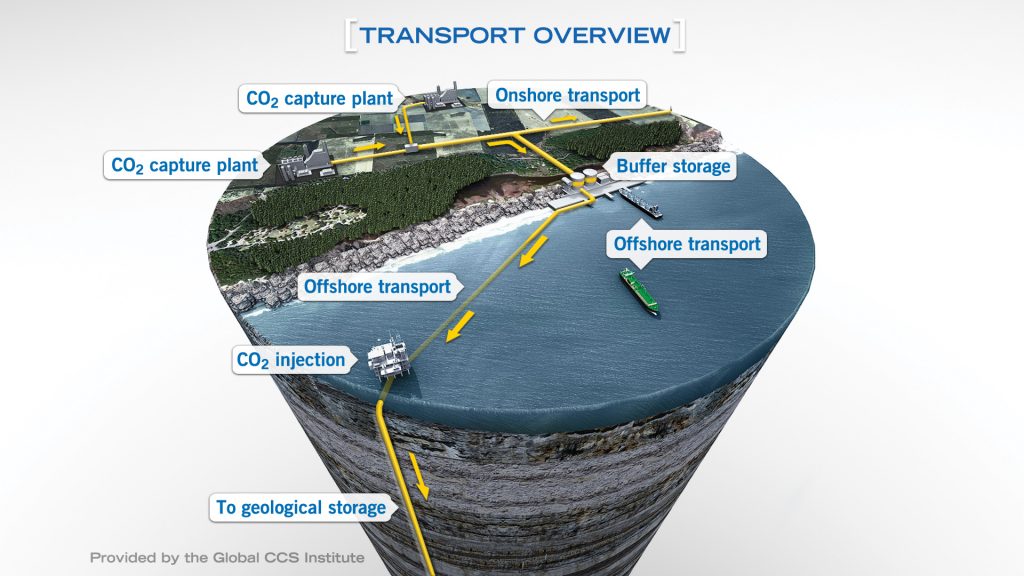

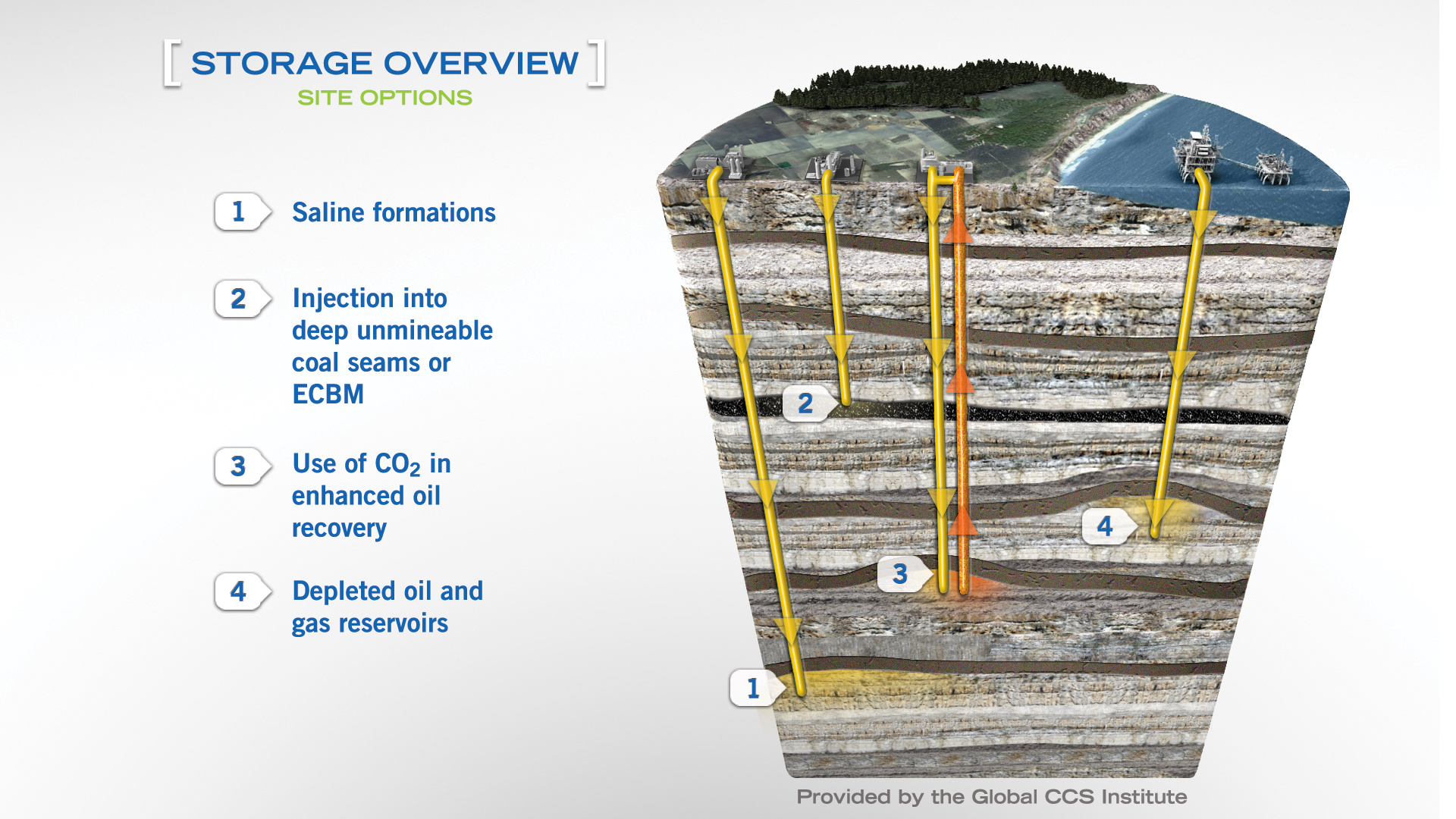

By 2027 these activities would enable Drax to develop a biomass generation business operating without the current renewable schemes and potentially the development of BECCS(8), subject to the right support from the UK Government. Drax notes the incremental progress and support announced for carbon capture and storage at the UK Government’s Budget in March 2020.

These efforts support the Group’s ambition to become a carbon negative company by 2030.

In addition, the Group is exploring options to service biomass demand in other markets – Europe, North America and Asia.

Capital allocation and dividend

The Group remains committed to its capital allocation policy established in 2017, through which it aims to maintain a strong balance sheet; invest in the core business; pay a sustainable and growing dividend and return surplus capital beyond investment requirements.

A final dividend of 9.5 pence per share in respect of 2019 performance was proposed at the 2019 Full Year Results on 27 February 2020 and, subject to shareholder approval at today’s Annual General Meeting, will be paid on 15 May 2020.

An interim dividend of 6.4 pence per share was paid in October 2019, making the total dividend in relation to 2019 performance 15.9 pence per share.

In determining the continued appropriateness of the dividend, the Board has considered a range of factors – trading performance, current liquidity, the outlook for the year in the context of Covid-19, as well as the steps being taken to support all stakeholders. The Board believes payment of the final dividend remains consistent with the Group’s commitment to stakeholders.

Drax will update on its expectations for the 2020 full year dividend at the 2020 interim results on 29 July 2020.

Enquiries:

Drax Investor Relations: Mark Strafford

+44 (0) 1757 612 491

Media:

Drax External Communications: Ali Lewis

+44 (0) 7712 670 888

Website: www.drax.com/uk

END