The wood supply catchment area for Drax’s LaSalle BioEnergy biomass pellet plant in mid-Louisiana is dominated by larger scale private forest owners that actively manage and invest in their forest for saw-timber production. Eighty-three per cent (83%) of the forest is in private ownership and 60% of this area is in corporate ownership.

The Drax Biomass pellet mill uses just 3.2% of the roundwood in the market and therefore has limited impact or influence on the overall trends. By contrast, the pulp and paper industry consumes 74% of the total pulpwood demand as the most dominant market for low grade fibre.

Forest in LaSalle catchment area

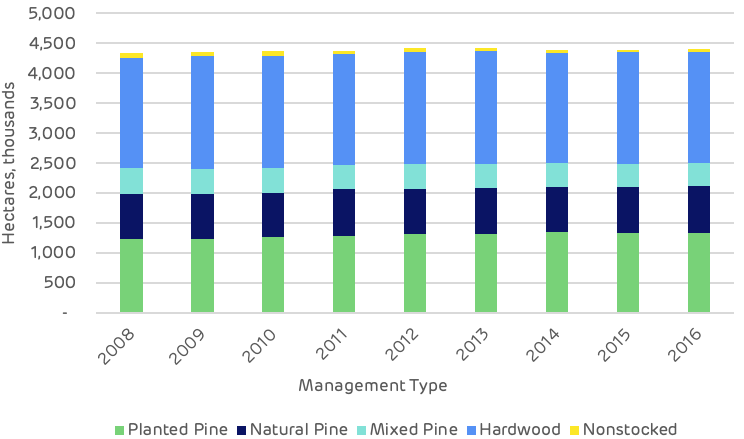

The catchment area has seen an increase in total timberland area of 71 thousand hectares (ha) since 2008, this is primarily due to planting of previously non-stocked land. Hardwood areas have remained stable but planted pine has increased, replacing some of the naturally regenerated mixed species areas. The data below shows that deforestation or conversion from pure hardwood to pine is not occurring.

Timberland area by management type

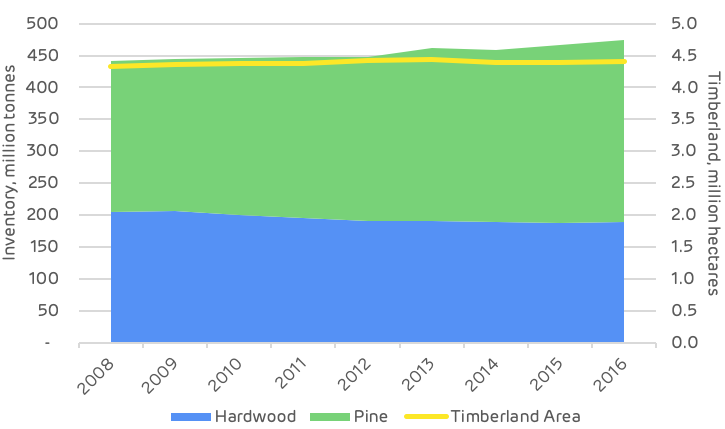

The overall quantity of stored carbon, or the inventory of the standing wood in the forest, has increased by 7% or 32.6 million metric tonnes since 2008. This total is made up of a 49 million tonne increase in the quantity of pine and a 16 million tonne decline in the quantity of hardwood. Since the area of pure hardwood forest has remained stable, this decline is likely to be due to the conversion of mixed stands to pure pine in order to increase saw-timber production and to provide a better return on investment for corporate owners.

Historic area and timberland inventory

Forest in LaSalle catchment area

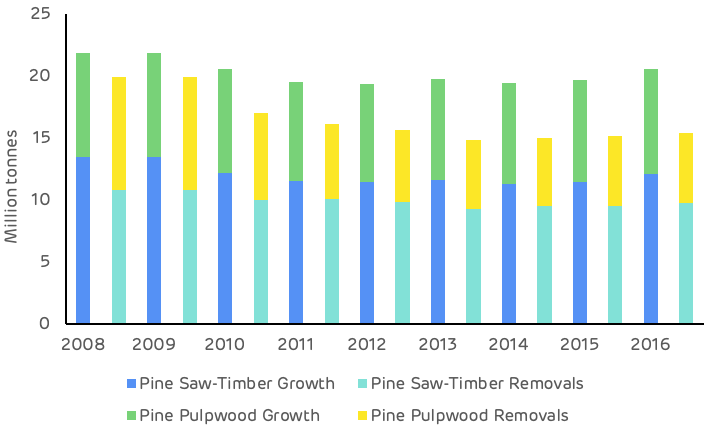

The growth-to-drain ratio and the surplus of unharvested pine growth has been increasing year-on-year from two million tonnes in 2008 to over five million tonnes in 2016.

This suggests that the LaSalle BioEnergy plant (which almost exclusively utilises pine feedstocks) has not had a negative impact on the growth-to-drain ratio and the surplus of available biomass.

The latest data (2016) indicates that the ratio for pine pulpwood is 1.54 and for pine saw-timber 1.24 and that this has been increasing each year for both categories.

Historic growth and removals by species

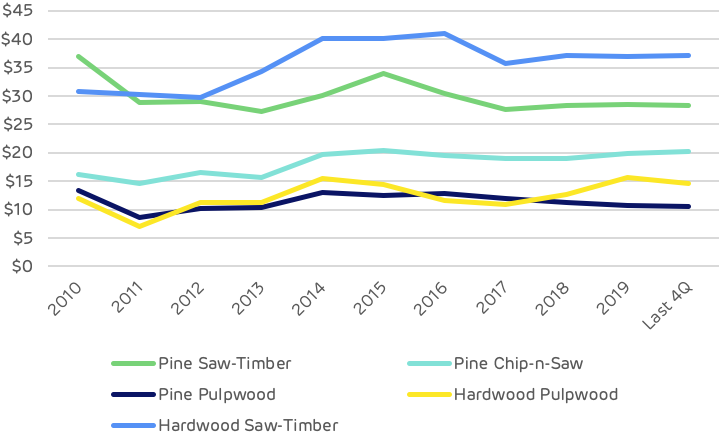

Stumpage prices for all product categories declined between 2010 and 2011. This was followed by a peak around 2015-16 with the recovery in demand post-recession and prices then stabilised from 2016 to 2019. The data indicates that there has been no adverse impact to pine pulpwood prices as a result of biomass demand. In fact, pine pulpwood prices are now nearly 20% lower than in 2014 as shown on the chart below.

LaSalle BioEnergy market historic stumpage prices, USD$:tonne

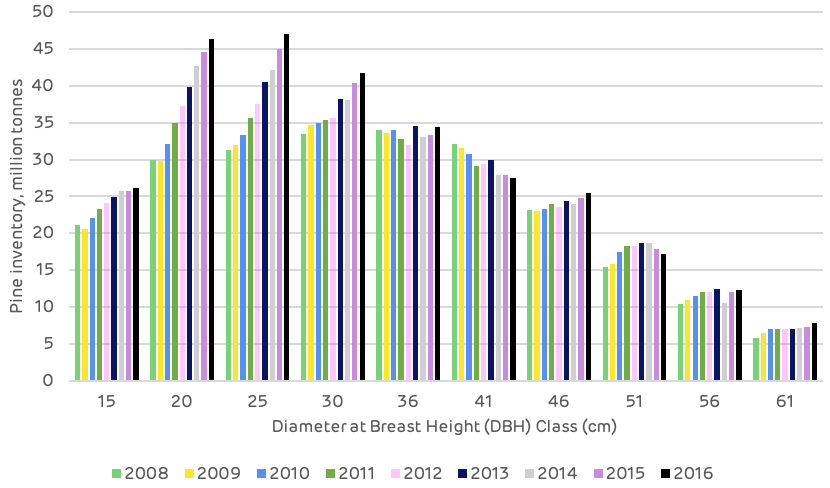

The character of the pine timberland is one of a maturing resource, increasing in the average size of each tree. The chart below chart shows a significant increase in the quantity of timber in the mid-range size classes, indicating a build-up of future resources for harvesting for both thinning and final felling for sawtimber production.

With balanced market demand, the supply of fibre in this catchment area should remain plentiful and sustainable in the medium term.

Historic pine inventory by DBH (diameter at breast height) class

Forisk summary of the impact of LaSalle BioEnergy on key trends and metrics in this catchment area

Is there any evidence that bioenergy demand has caused …

Deforestation

No

Change in forest management practices

No

Diversion from other markets

Possibly. Bioenergy plants compete with pulp/paper and oriented strand board (OSB) mills for pulpwood and residual feedstocks. There is no evidence that these facilities reduced production as a result of bioenergy markets, however.

Increase in wood prices

No. There is no evidence that bioenergy demand increased stumpage prices in the market.

Reduction in growing stock of timber

No

Reduction in sequestration of carbon / growth rate

No

Increase in harvesting above the sustainable yield

No

The impact of bioenergy on forest markets in the LaSalle catchment is …

Growing stock

Neutral

Growth rates

Neutral

Forest area

Neutral

Wood prices

Neutral

Markets for solid wood

Neutral to Positive. Access to viable residual markets benefits users of solid wood (i.e. lumber producers).

Forest in LaSalle catchment area