Last week it was Green GB Week, a nationwide campaign supported by the UK government, showcasing the country’s green credentials and progress in transitioning towards a low carbon world. It is therefore timely that ahead of the Autumn Budget, the energy industry should be speaking about measures, such as the Carbon Price Support mechanism, which are within the power of government to help keep Great Britain on track in meeting its decarbonisation goals.

Aurora Energy Research, a leading energy research and analytics firm, has produced fresh analysis that suggests that maintaining a higher carbon price is key to phasing out coal power generation and decarbonising the UK electricity sector in a timely, cost-effective manner.

Is the carbon price at risk?

In April 2013, HM Treasury introduced the ‘Carbon Price Support’ – a tax paid by coal and gas generators in Great Britain. In part, this was a response to low costs in the European ‘Emissions Trading System’ which requires generators to buy certificates against their emissions. At the time, the UK Government felt that these certificates were too cheap and wanted to impose a higher carbon price to drive a more modern, low-carbon energy mix.

This Carbon Price Support has had a huge impact, particularly on coal. Prior to its introduction, coal represented 50% of power generation but since it has fallen to record lows. 2017 saw the first day without any coal on the power system since the industrial revolution. Records continue to be broken throughout 2018, with coal generation falling to 1% during summer months.

This Carbon Price Support has had a huge impact, particularly on coal. Prior to its introduction, coal represented 50% of power generation but since it has fallen to record lows. 2017 saw the first day without any coal on the power system since the industrial revolution. Records continue to be broken throughout 2018, with coal generation falling to 1% during summer months.

However, 2018 has also seen prices within the Emissions Trading System surge. Prices started this year at €8/tonne and now seem to be steadying at roughly €20/tonne. This has created uncertainty over the future of the UK Carbon Price Support scheme. Many in energy, from power generators to environmental campaign groups are worried that the Treasury might respond to rising European prices by slashing the Carbon Price Support in this year’s Autumn Budget, which could threaten to undo the success the UK has had in decarbonising its energy mix.

The carbon price is needed to keep coal at bay

Aurora has tested the impacts of different trajectories for the carbon price going forward to 2040 and the implications are significant, particularly for coal.

Aurora’s analysis shows that if government maintains the current Carbon Price Support rate of £18/tonne, then at current EU ETS futures levels, coal should come off the GB power system in 2021-22. By contrast, the same analysis suggests that if Chancellor Philip Hammond were to reduce the Carbon Price Support to £7/tonne, then coal power stations would stay on the system until 2025 and increase generation during that time, as illustrated below.

Source: Aurora Energy Research

This would make it difficult for the UK to meet its carbon targets. The UK government has committed to reducing greenhouse gas emissions in line with 5-yearly ‘carbon budgets.’ Cutting the Carbon Price Support rate to £7/tonne would result in 29 million tonnes of additional carbon dioxide (CO2) during the 4th carbon budget period, which runs from 2023-27. This is an increase of almost 20% on total power sector emissions – against a carbon budget that the UK is currently on track to miss.

The cost of the carbon price

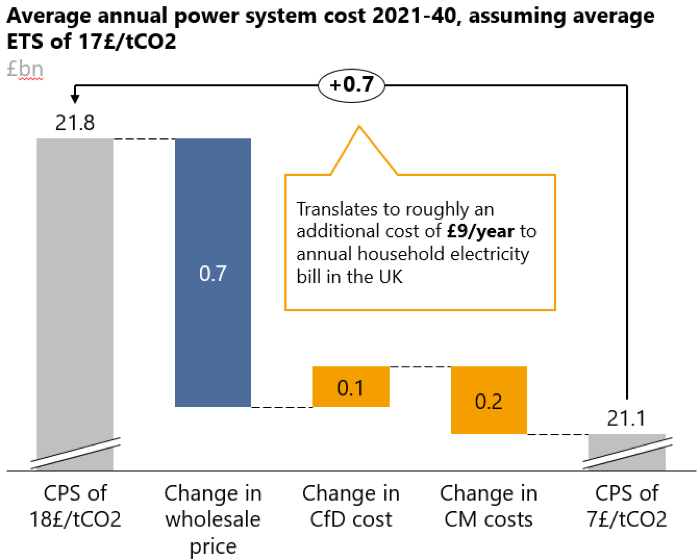

A higher carbon price raises electricity prices slightly, but the mechanics of this are complex and the rising price of electricity is somewhat offset by lower subsidy payments to low carbon generators. Comparing a ‘status quo’ scenario to one where the Carbon Price Support falls to £7/tonne raises annual power system costs by £700 million (average over 2021-40), which translates to roughly £9 a year on the average household’s electricity bill.

Source: Aurora Energy Research

Decarbonisation affects not just the future of GB’s power system, but also its international reputation and progress in meeting climate change targets. The Carbon Price Support has helped to make GB’s power system a success story in reducing carbon emissions while keeping costs reasonable.

There are always trade-offs to be made in policy but cutting the carbon price would threaten the progress Great Britain has made in decarbonising its energy mix, making it harder to meet emissions targets.