By Dr Iain Staffell, Imperial College London

As our energy mix changes and a different weather challenge has been taking up the headlines, latest analysis from Electric Insights has revealed that the need for reliable low-carbon generation when the wind doesn’t blow and the sun doesn’t shine is becoming more important. Dr Iain Staffell took a look at the data.

“Dunkelflaute” must surely be an early contender for the 2025 Oxford Dictionary word of the year. A German word meaning “dark doldrums”, it is used in the energy world to describe a dark, cold, calm spell of weather during which very little energy can be generated with wind or solar power.

In December and January, Britain has faced two spells of so-called Dunkelflaute. The first, hitting around the 12 December, saw wind – the largest source of energy in the UK last year overall – drop to 6% of total supply. In response, gas power stations ramped up to their highest output ever recorded, supplying more than 73% of Britain’s electricity and sending power prices soaring. Wind output dropped suddenly again in the New Year causing prices to hit £2,900/MWh (40 times their average) on 8 January.

This winter has again demonstrated some of the challenges we must address in reaching a clean power system by 2030. The combination of a long cold snap and low wind speeds left Britain’s power system relying heavily on natural gas and imports, drawing down the nation’s gas storage to ‘concerningly low’ levels, and coming close to generation falling short of peak demand. Options for low-carbon flexibility are urgently needed – both investing in new technologies and maintaining existing sources – as electricity supply and demand become more dependent on the weather.

Daily average electricity mix in Britain during mid-December, highlighting the Dunkelflaute period, and the difference between output from dispatchable technologies which we control, and those that are driven by the weather or foreign power markets.

Gas was not the only technology to help during the shortfall. Biomass and hydro plants increased their output by 40% and 60% on the peak day (12 December) compared to the weekends before and after. While this helped meet the shortfall of wind, the impact was muted as Britain has relatively little capacity of either technology. In previous years, coal power stations would have also helped to meet demand, but the last one closed in September. Pumped hydro and batteries helped meet the evening peak on the 12th, but these only supply power for a few hours, and so cannot help with multi-day shortages.

Interconnection with neighbouring countries also provides flexibility, but on the 12th when we most needed them, imports from abroad fell by half relative to the surrounding days. Britain’s neighbours were suffering from the same wind drought, as weather systems are often the size of continents. More power could have flowed into Britain, but only if our prices rose high enough. This exposes a key problem with relying on interconnection to solve capacity shortages, which leaves countries competing for limited supply of power at the same time.

Altogether, this leaves gas as the only large-scale source of flexibility in the country. This is a risky proposition on three fronts: affordability, energy security, and our climate goals.

The cost of our gas dependence: We are still reeling from the gas price crisis. Gas is very much the ‘crutch’ of the grid, and British electricity is more strongly swayed by gas prices than in any other European country, as we have so few alternatives for flexible generation (no coal, limited hydro and biomass, and less storage than neighbouring countries). Gas sets the electricity price in 98% of hours, despite meeting only a third of electricity demand. That means Britain’s electricity prices track almost perfectly with gas prices, leaving consumers particularly vulnerable to price shocks, as seen during the recent gas price crisis.

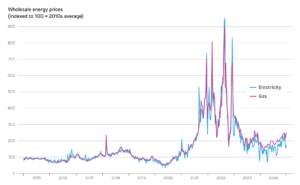

The change in electricity and natural gas prices on Britain’s wholesale markets over the last decade, indexed to the 2010–19 average. Gas prices increased by over 50% between February and December last year, dragging electricity prices up with them.

Energy security at risk: Relying so heavily on a single technology in times of system stress is leaving all our eggs in one basket. Capacity was tight on 12 December and 8 January, causing NESO to issue rare Capacity Market Notices, a ‘blackout prevention system’ used to encourage generators to prepare extra capacity just in case. Britain’s last coal plant has retired, all bar one nuclear plant is coming towards their end of life, and it is unclear if biomass will continue operating beyond 2027. This all comes just as peak electricity demand is expected to grow from electric vehicles, heat pumps, AI, and data centres. Unless more capacity is built or existing capacity has its lifetime extended, Capacity Market Notices will be increasingly likely in future.

The carbon challenge: Gas is the most polluting fuel remaining on the grid. In just five years, government aim to run a clean power system, meaning just 5% of electricity produced from fossil fuels, down from over 25% today. These plans include retaining almost all the current gas capacity to cover rare but intense periods of low renewable output. Put together, this means gas plants will see fewer operating hours in the future, just as coal plants did over the last decade. Either they will need to charge more for their output to cover costs, or the system needs to move more towards paying for availability than for output (e.g. capacity payments).

Phasing out gas will largely be achieved by scaling up wind and solar power, but that further intensifies the challenges posed by weather variability. Both the CCC and NESO recognise that a balanced approach is needed, using all the tools at our disposal – flexible low-carbon generation, long-duration energy storage, interconnectors and a continued (but increasingly limited) role for gas. Looking ahead, policy frameworks envisage the arrival of more low-carbon dispatchable power from 2030 onward. This includes power stations equipped with carbon capture and storage (CCS), hydrogen, and long-duration storage. All of these play little or no role in today’s power system, so the task now is to define a clear strategy for scaling and deploying these resources at pace, while avoiding cost escalation to consumers due to all the new investments. By planning for Britain’s future energy needs and taking strategic action now, government, industry and investors can break free from paying for volatile gas expensive imports, and seize the opportunity of clean, stable, and lower cost electricity.

Read the full article here or in the Q4 2024 Electric Insights report, coming soon.

This article was written by Dr Iain Staffell, Senior Lecturer at Imperial College London, as part of the Electric Insights project. Drax does not guarantee the accuracy, reliability or completeness of this content.