Highlights

- New targets for pellet production and biomass sales

- Biomass pellet production – targeting 8Mt pa by 2030 (currently c.4Mt)

- Biomass pellet sales to third parties – targeting 4Mt pa by 2030 (currently c.2Mt)

- Continued progress with UK BECCS(1) and biomass cost reduction

- BECCS at Drax Power Station – targeting 8Mt pa of negative CO2 emissions by 2030

- Biomass cost reduction – continuing to target biomass production cost of $100/t(2)

- £3bn of investment in opportunities for growth 2022 to 2030

- Pellet production, UK BECCS and pumped storage

- Self-funded and significantly below 2x net debt to Adjusted EBITDA(3) in 2030

- Development of additional investment opportunities for new-build BECCS

- Targeting 4Mt pa of negative CO2 emissions outside of UK by 2030

- Targeting returns significantly in excess of the Group’s cost of capital

Will Gardiner, Drax Group CEO, said:

“Drax has made excellent progress during 2021 providing a firm foundation for further growth. We have advanced our BECCS project – a vital part of the East Coast Cluster that was recently selected to be one of the UK’s two priority CCS projects. And we’re now setting out a strategy to take the business forward, enabling Drax to make an even greater contribution to global efforts to reach net zero.

“We believe Drax can deliver growth and become a global leader in sustainable biomass and negative emissions and a UK leader in dispatchable, renewable generation. We aim to double our sustainable biomass production capacity by 2030 – creating opportunities to double our sales to Asia and Europe, where demand for biomass is increasing as countries transition away from coal.

“As a global leader in negative emissions, we’re going to scale up our ambitions internationally. Drax is now targeting 12 million tonnes of carbon removals each year by 2030 by using bioenergy with carbon capture and storage (BECCS). This includes the negative emissions we can deliver at Drax Power Station in the UK and through potential new-build BECCS projects in North America and Europe, supporting a new sector of the economy, which will create jobs, clean growth and exciting export opportunities.”

Capital Markets Day

Drax is today hosting a Capital Markets Day for investors and analysts.

Will Gardiner and members of his leadership team will update on the Group’s strategy, market opportunities and development projects. The day will outline the significant opportunities Drax sees to grow its biomass supply chain, biomass sales and BECCS, as well as long-term dispatchable generation from biomass and pumped storage.

Purpose and ambition

The Group’s purpose is to enable a zero carbon, lower cost energy future and its ambition is to be a carbon negative company by 2030. The Group aims to realise its purpose and ambition through three strategic pillars, which are closely aligned with global energy policies, which increasingly recognise the unique role that biomass can play in the fight against climate change.

Strategic pillars

- To be a global leader in sustainable biomass pellets

- To be a global leader in negative emissions

- To be a leader in UK dispatchable, renewable generation

The development of these pillars remains underpinned by the Group’s continued focus on safety, sustainability and biomass cost reduction.

A Global leader in sustainable biomass pellets

Drax believes that the global market for sustainable biomass will grow significantly, creating opportunities for sales to third parties in Asia and Europe, BECCS, generation and other long-term uses of biomass. Delivery of these opportunities is supported by the expansion of the Group’s biomass pellet production capacity.

The Group has 13 operational pellet plants with nameplate capacity of c.4Mt, plus a further two plants currently commissioning and other developments/expansions which will increase this to c.5Mt once complete.

Drax is targeting 8Mt of production capacity by 2030, which will require the development of over 3Mt of new biomass pellet production capacity. To deliver this additional capacity Drax is developing a pipeline of organic projects, principally focused on North America. Drax expects to take a final investment decision on 0.5-1Mt of new capacity in 2022, targeting returns significantly in excess of the Group’s cost of capital.

Underpinned by this expanded production capacity, Drax aims to double sales of biomass to third parties to 4Mt pa by 2030, developing its market presence in Asia and Europe, facilitated by the creation of new business development teams in Tokyo and London.

Drax is a major producer, supplier and user of biomass, active in all areas of the supply chain with long-term relationships and almost 20 years of experience in biomass operations. The Group’s innovation in coal-to-biomass engineering, supply chain management and leadership in negative emissions can be deployed alongside its large, reliable and sustainable supply chain to support customer decarbonisation journeys with long-term partnerships.

Drax expects to sell all the biomass it produces, based on an appropriate market price, typically with long-term index-linked contracts.

Continued focus on cost reduction

In 2018 the Group’s biomass production cost was $166/t(2). At the H1 2021 results, through a combination of fibre sourcing, operational improvements and capacity expansion (including the acquisition of Pinnacle Renewable Energy Inc), the production cost had reduced to $141/t(2). Drax’s aims to use the combined expertise of Drax and Pinnacle to apply learnings and cost savings across its portfolio and continues to target $100/t(2) (£50/MWh equivalent(4)) by 2027.

A Global leader in negative emissions

The Intergovernmental Panel on Climate Change(5) and the Coalition for Negative Emissions(6) have both outlined a clear role for BECCS in delivering the negative emissions required to limit global warming to 1.5oC above pre-industrial levels and to achieve net zero by 2050, identifying a requirement of between 2bn and 7bn tonnes of negative emissions globally from BECCS.

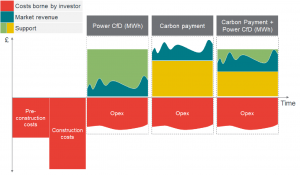

Separately, the UK Government has recently published its Net Zero Strategy and Biomass Policy Statement reaffirming the established international scientific consensus that sustainable biomass is renewable and that it will play a critical role in helping the UK achieve its climate targets. It also signposted an ambition for at least 5Mt pa of negative emissions from BECCS and Direct Air Capture by 2030, 23Mt pa by 2035 and up to 81Mt pa by 2050. The reports commit the Government to the development during 2022 of a financial model to support BECCS to meet these requirements.

Subject to the right regulatory environment, Drax plans to transform Drax Power Station into the world’s biggest carbon capture project using BECCS to permanently remove 8Mt of CO2 emissions from the atmosphere each year by 2030. The project is well developed, the technology is proven and an investment decision could be taken in 2024 with the first BECCS unit operational in 2027 and a second in 2030, subject to the right investment framework.

The Group aims to build on this innovation with a new target to deliver 4Mt of negative CO2 emissions pa from new-build BECCS outside of the UK by 2030 and is currently developing models for North American and European markets.

A UK leader in dispatchable, renewable generation

The UK’s plans to achieve net zero by 2050 will require the electrification of heating and transport systems, resulting in a significant increase in demand for electricity. Drax believes that over 80% of this could be met by intermittent renewable and inflexible low-carbon energy sources – wind, solar and nuclear. However, this will only be possible if the remaining power sources can provide the dispatchable power and non-generation system support services the power system requires to ensure security of supply and to limit the cost to the consumer.

Long-term biomass generation and pumped storage hydro can provide these increasingly important services. Drax Power Station is the UK’s largest source of renewable power by output and the largest dispatchable plant. The Group is continuing to develop a lower cost operating model for this asset, supported by a reduction in fixed costs associated with the end of coal operations.

Drax is also developing an option for new pumped storage – Cruachan II – which could take a final investment decision in 2024 and be operational by 2030, providing an additional 600MW of dispatchable long-duration storage to the power system.

In its Smart Systems and Flexibility plan (July 2021), the UK Government described long-duration storage technologies as essential for achieving net zero and has committed to take actions to de-risk investment for large-scale and long-duration storage.

Capital allocation and dividend

Strategic capital investment (3Mt of new biomass pellet production capacity, BECCS at Drax Power Station and Cruachan II) is expected to be in the region of £3bn between 2022 and 2030, backed by long-term contracted cashflows and targeting high single-digit returns and above.

No final investment decision has been taken on any of these projects and both BECCS and Cruachan II remain subject to further clarity on regulatory and funding mechanisms.

The Group believes these investments can be self-funded through strong cash generation over the period with net debt to Adjusted EBITDA significantly below 2x at the end of 2030, providing flexibility to support further investment, such as new-build BECCS as these options develop.

Drax remains committed to the capital allocation policy established in 2017, noting that average annual dividend growth was around 10% in the last 5-years.

Webcast and presentation material

The event will be webcast from 10.00am and the material made available on the Group’s website from 7:00am. Joining instructions for the webcast and presentation are included in the links below.

https://secure.emincote.com/client/drax/drax016

Notes:

(1) BioEnergy Carbon Capture and Storage.

(2) Free on Board – cost of raw fibre, processing into a wood pellet, delivery to Drax port facilities in US and Canada, loading to vessel for shipment and overheads.

(3) Earnings before interest, tax, depreciation, amortisation, excluding the impact of exceptional items and certain remeasurements.

(4) From c.£75/MWh in 2018 to c.£50/MWh, assuming a constant FX rate of $1.45/£.

(5) Coalition for Negative Emissions (June 2021).

(6) Intergovernmental Panel on Climate Change (August 2021).

Enquiries:

Drax Investor Relations: Mark Strafford

+44 (0) 7730 763 949

Media:

Drax External Communications: Ali Lewis

+44 (0) 7712 670 888

Website: www.drax.com

Forward Looking Statements

This announcement may contain certain statements, expectations, statistics, projections and other information that are or may be forward-looking. The accuracy and completeness of all such statements, including, without limitation, statements regarding the future financial position, strategy, projected costs, plans, investments, beliefs and objectives for the management of future operations of Drax Group plc (“Drax”) and its subsidiaries (the “Group”), including in respect of Pinnacle Renewable Energy Inc. (“Pinnacle”), together forming the enlarged business, are not warranted or guaranteed. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on circumstances that may occur in the future. Although Drax believes that the statements, expectations, statistics and projections and other information reflected in such statements are reasonable, they reflect the Company’s current view and beliefs and no assurance can be given that they will prove to be correct. Such events and statements involve significant risks and uncertainties. Actual results and outcomes may differ materially from those expressed or implied by those forward-looking statements. There are a number of factors, many of which are beyond the control of the Group, which could cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements. These include, but are not limited to, factors such as: future revenues being lower than expected; increasing competitive pressures in the industry; and/or general economic conditions or conditions affecting the relevant industry, both domestically and internationally, being less favourable than expected; change in the policy of key stakeholders, including governments or partners or failure or delay in securing the required financial, regulatory and political support to progress the development of Drax and its operations. We do not intend to publicly update or revise these projections or other forward-looking statements to reflect events or circumstances after the date hereof, and we do not assume any responsibility for doing so.

END

Pumped storage / hydro – good operational and system support performance

Pumped storage / hydro – good operational and system support performance