The North of England has long been a proving ground for the kind of engineering innovations that have transformed the world. The heartland of the First Industrial Revolution, it is now at the centre of a new revolution focused on clean energy production and sustainable power, led by organisations like Drax.

Europe’s largest decarbonisation project

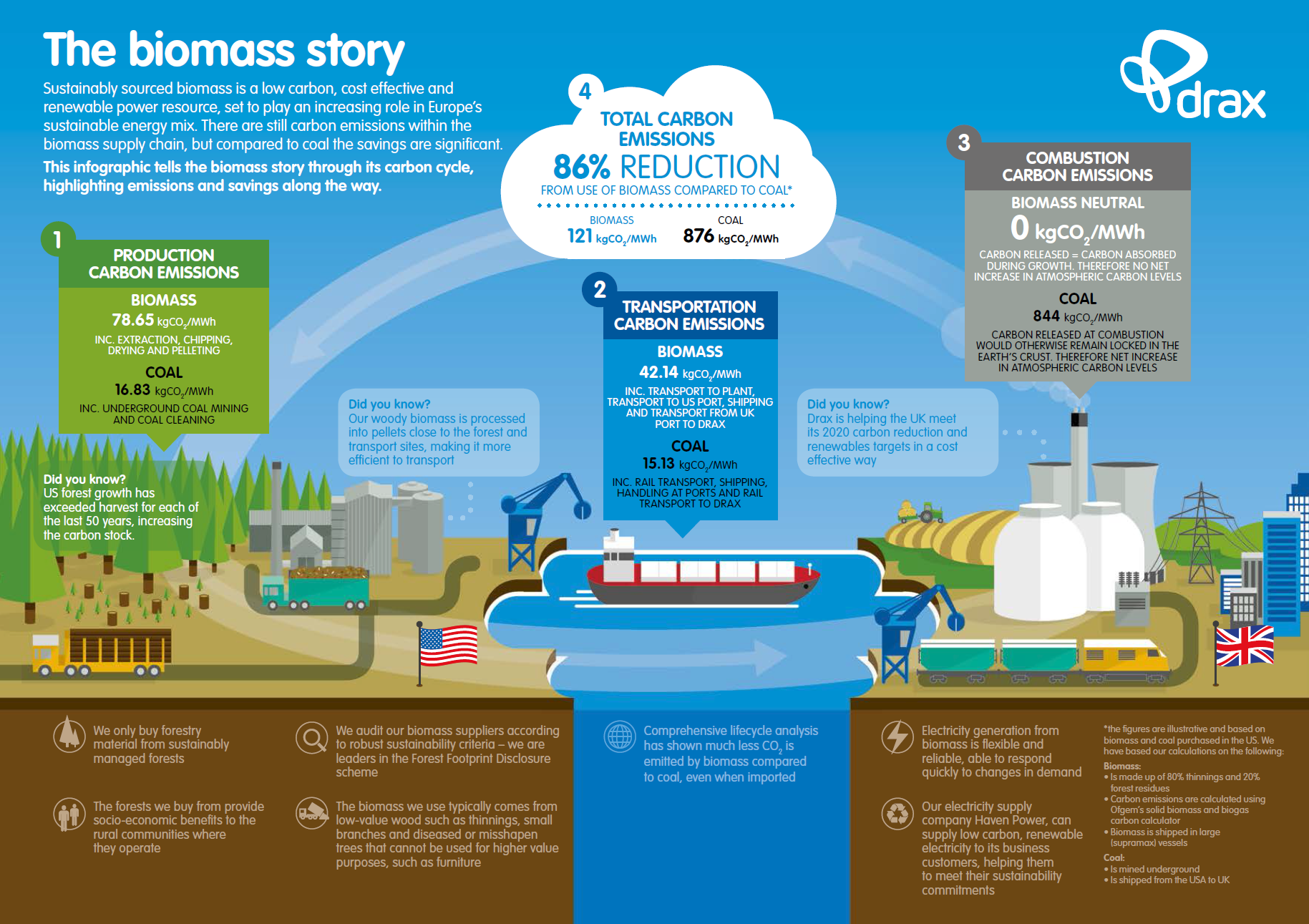

Over the last decade, Drax has been carrying out a major high-tech engineering and infrastructure project to upgrade half its generating units to use sustainable biomass in place of coal.

These converted units now produce enough electricity to power Birmingham, Leeds, Sheffield, Liverpool, Manchester and Newcastle – all using compressed wood pellets, cutting carbon emissions by more than 80%.

But more than just having environmental benefits, it’s provided a huge boost to the economy.

Boosting the UK economy

In 2015, Drax contributed more than £1 billion to the UK’s GDP and supported some 14,000 jobs across the country.

“The economic benefit has reached all parts of the country,” says CEO Dorothy Thompson. “We’ve been the catalyst for rejuvenation and growth across the Northern Powerhouse, with port expansion on the coasts of East Yorkshire, the North West and North East.”

This boost was particularly significant in the North, where Drax generated over £620 million for the local economy.

Innovation driving a better future for Britain

It’s these kinds of innovative upgrades that are helping to tackle the urgent environmental challenges that our society faces as we make the transition to lower carbon and renewable power, and changing the way we think about producing energy in the UK.

Having nurtured the Industrial Revolution, today the North of England is again the focus of a major paradigm shift. Where once coal fields and smoke stacks dominated the local landscape, now Drax’s giant biomass storage domes speak of a new future for the region, for the UK, and for renewable energy production as a whole.

To find out more about how Drax has benefited the UK’s economy, please visit https://www.draximpact.co.uk/