Internet of things (IoT) technology, which connects everyday appliances to one another allowing them to collect data and become ‘smart’, presents an exciting view of the modern home or workspace.

The future IoT-enabled office or household is one with autonomous appliances, remote-operated thermostats, and fridges that monitor their contents and reorder supplies when they run low. You may never go hungry again.

There’s arguably an even brighter future for the IoT’s potential in industry – it can bring about value through applications like predictive maintenance and performance optimisation.

On paper these two scenarios – that of industrial optimisation and convenience throughout our daily lives – might seem worlds away. But James Robbins, Chief Information Officer at Drax, is thinking about how to bring them together – particularly when it comes to energy use.

Central to the approach is a question: could a better understanding of how households and businesses use energy change how it’s generated and provided?

The importance of data

At its heart, the IoT is about data. What data you collect and how you use it determines what value you can create, says Robbins. He explains: “Whether you’re talking about the IoT, big data, artificial intelligence [AI] or robotics – they’re all the modernisation of information collection and use.”

And nowhere is this more applicable than at a large-scale power station. “At Drax we’re used to managing what’s basically our own private IoT in the station,” he explains. “The real-time control systems we have for the generators and the Grid are essentially a bunch of sensors tied to a central network.” These sensors collect data from the power station, which then help optimise it for better performance.

The same approach to data collection can have benefits for bill payers, too.

Tracking energy use in the workspace and home

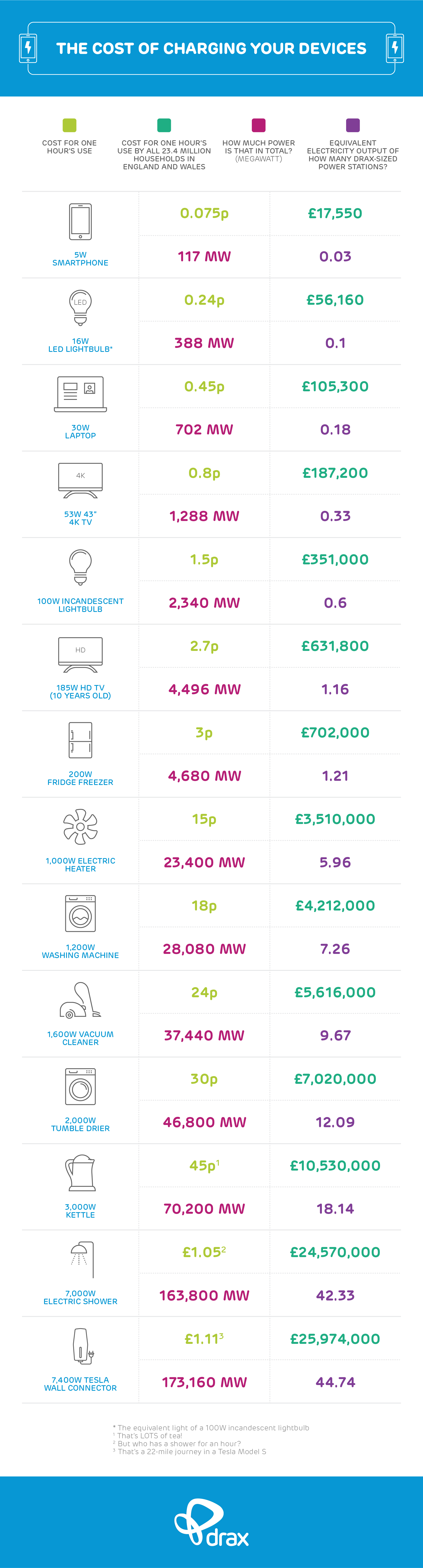

Connected devices like smart meters can bring a precise level of insight into energy usage in the home and places of work, which can benefit both end users and suppliers of heat and power. Electricity generators and heating fuel suppliers can use this data to better manage their output by being able to predict how and when it will be required. For end users, it can help them and their energy suppliers more accurately track what they use, where they use it and how they could use it more efficiently.

For example, using IoT technology a gas or wood pellet for heat supplier may be able to identify that a home can make substantial cost savings just by turning down their heating by one degree. “Sensors and smart technology can give us that insight,” says Robbins.

This level of optimisation is already possible to a degree using existing tools, but Robbins sees a future with greater possibilities. For example, with comprehensive datasets, suppliers can compare business owners’ energy use with others in the same sector and region to highlight efficiencies.

“The whole thing is about making it easier for us to serve the customer,” says Robbins. And the better the dataset, the more exotic the services could be.

“Just looking at meters means we can only really talk to the bill payer. But who else in the home or workplace could we engage with to get them to conserve energy? For instance, we could develop a game for child in the house that’s linked to energy use, where they get points for turning off lights or turning down heating,” he explains.

The gamification of energy use is – at this stage – just an idea, Robbins says, but it is exactly the kind of thing that better data allows energy suppliers and generators to think about.

A challenging journey, but an exciting one

The IoT approach to energy generation and use won’t be without its challenges – security being one major concern. But there will also be substantial technical and standardisation issues any provider keen to leverage IoT must tackle to make it a truly effective technology.

“In the 80s, you couldn’t play a VHS cassette in a Betamax player,” Robbins explains. “The compatibility issue with IoT could be an even bigger problem – all these gadgets need to be built into an architecture that can handle them and make them work together.”

Consider the so-called smart meter that provides data for a customer’s itemised bill. The bill payer is told that a tumble dryer in their home is using a significant proportion of the power they are paying for. The problem is that their appliances and devices have not been meshed together in a way that gives the system sufficient context about the customer’s situation. In the worst-case scenario, the customer asks for a refund and switches supplier because they don’t actually have a tumble dryer.

Robbins and his team are working with Drax suppliers to make sure that compatibility and context don’t become a problem. He aims to ensure that unintended consequences in the Group’s use of IoT are only of the positive variety. By investing in back-office infrastructure that can use big data processing to ingest and analyse meter data down to the 10-second level, Drax can take advantage of smart tech when it arrives in earnest.

It’s an exciting period of technological advancement – but as Robbins is keen to point out, it’s only the start.

“It’ll probably only be over the next few years that we actually begin to really understand how to leverage IoT data, when we pass the tipping point of user adoption. When that happens, we’ll be starting a very exciting journey with a clearer purpose – to spot and solve meaningful problems faced by people and businesses, in context, in real-time.”