The year is 2035. Cars cruise clean streets without the need for a driver, our household appliances are all connected and communicate with one another, and all of it is powered by electricity – specifically low-carbon electricity.

It’s been 10 years since Great Britain’s last coal power station shut down, and across the country wind turbines are generating more electricity than fossil fuels and nuclear energy combined, pushing carbon emissions to a new low.

This isn’t a vision of a green-minded sci-fi novel, this is the forecast for Great Britain in less than 20 years’ time. This sustainable, low-carbon future of 2035 is a significant evolution from today in 2018 and it comes despite a rising population, a continued shift to urban living and an expected rise in power demand.

Great Britain gets power hungry

If we transport back to the here and now of the late 2010s, it would be easy to expect electricity demand to drop by 2035. In fact, since 2005 electricity demand has been on a steady decline as a result of more efficient appliances and the decline of heavy industry.

By the mid-2020s, however, this trend is expected to reverse. But with the likelihood that appliances will grow more efficient and no sign of heavy industry coming back to British shores, what will drive this growing demand?

Two of the major contributors will be the electrification of transport and the heating system. With the government setting 2040 as the end date for the sale of diesel and petrol vehicles, preparations are already underway for a fully electrified transport network – but it won’t just be restricted to roads.

Train networks and even potentially planes could switch from fossil fuels to electric, increasing demand from the transport sector by 128% between 2015 and 2035. Electric vehicles (EVs) alone are predicted to add 25 terawatt hours (TWh) of electricity demand by 2035, according to a report by Bloomberg New Energy Finance. However, this will be dependent on significant investment in the necessary charging infrastructure to enable a decarbonised transport network across the country.

Added to this will be extra demand from a shift in how we heat our homes. If planning goes ahead and pilot projects are completed, low-carbon, electric heating is expected to begin rolling out in the next decade and will involve the phasing out of gas boilers in favour of electric heat pumps. But as with EV adoption, this will require major government investment and incentives to grow electric heating beyond the 7% of UK homes that use it today.

An electrified heat network will add a greater strain on the electricity system, particularly in winter months when demand is high. The result is a forecast increase of 40 GW in demand during peak times – the mornings and the evenings.

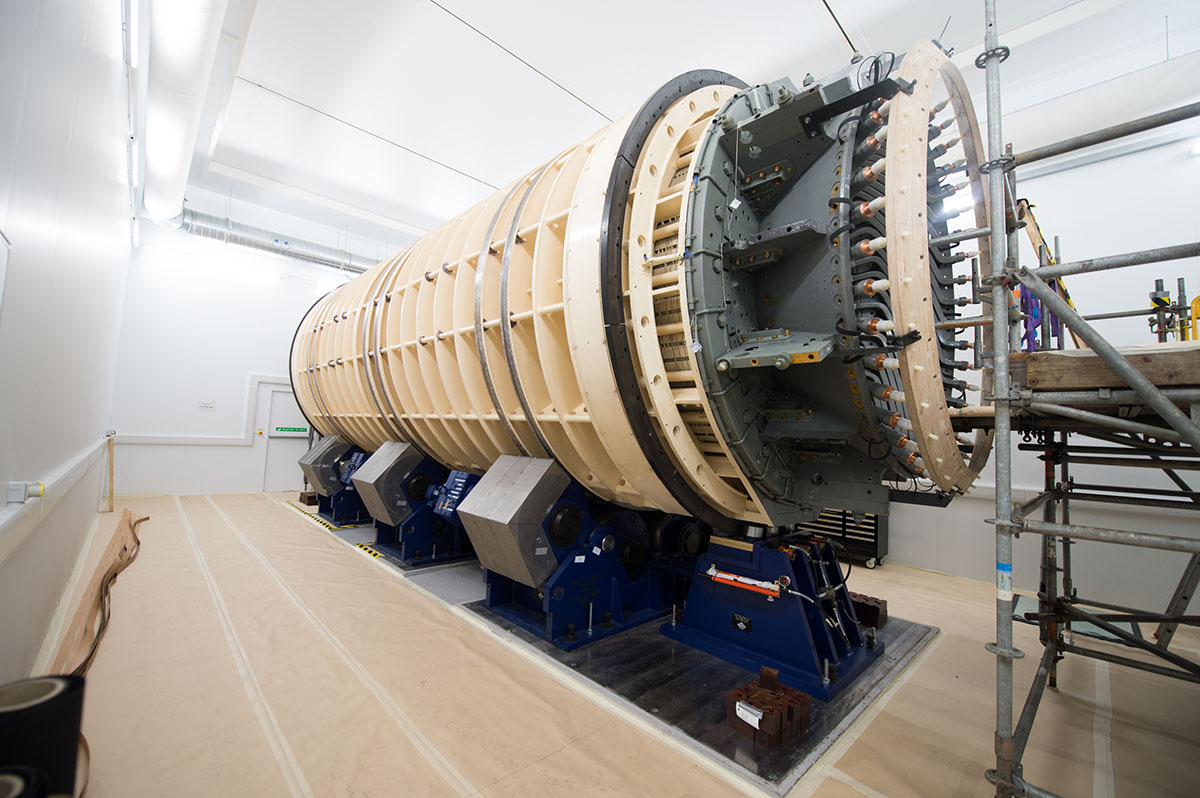

These peak times for electricity consumption will be the greatest test for the grid as intermittent renewables meet more and more of the country’s demand. It raises the question: how we will cope with cold, still and dark November evenings? One solution is the growing role of large scale electricity storage.

By 2035 technological advances are expected to bring electricity storage to 8 GW of installed capacity – double the size of Drax, the UK’s biggest power station. It is also likely that the abilities of EVs as electricity suppliers (delivering excess electricity back to the grid once plugged in overnight) will play an increasing role in meeting demand.

But to ensure this is possible, it will require advances in another sector with a great impact on our power system: technology. This is not just about how technology could enable advances, but how much electricity it’s likely to use.

The internet of everything and a smarter grid

By 2035, chip manufacturer ARM predicts there will be more than one trillion internet of things (IoT) devices globally. This smart technology will be able to turn everything from your morning coffee maker to your bed into intelligent machines, gathering masses of data that can be used to optimise and personalise daily life.

Powering all these devices, let alone the vast plains of servers holding all the data they gather, is one of the great challenges for the IoT industry. However, as much as smart devices will demand energy, they will also help save it.

Thanks to smart, connected devices, traffic lights will turn off when there are no cars, offices will turn off lights when there is no one in a room and homes will understand your energy needs better and tailor appliance usage to your habits. At a larger scale, the introduction of artificial intelligence will allow the entire grid to connect and work in harmony with every one of the billions of devices taking energy from it.

A fully-intelligent system like this will allow grid operators to smooth out peaks in demand by, for example, charging EVs overnight when there is less demand. It means that while there will be an overall greater demand for electricity in 2035, the ‘shape’ of demand may differ from the accentuated peaks of the current system.

Renewable reaction to demand

At its heart, the increasing electrification of our transport, utilities and technology has been driven by a few specific goals, one of which is lowering our reliance on fossil fuels and reducing carbon emissions. It’s positive, then, that all projections towards 2035 have us making significant strides towards this vision.

Coal will have been completely removed from the electricity system, while gas generation will drop to just 70.8 TWh – down from the 112.2 TWh expected in 2018, according to Bloomberg’s forecast. In its place, wind will become the greatest source of our electricity producing 138.5 TWh in 2035, up from 52.3 TWh in 2018. The watershed year for wind power will come in 2027 when wind first overtakes gas to become the biggest contributor to the grid thanks to significant increases in capacity.

Nuclear will still play an important role in the energy mix, contributing 45.8 TWh, while solar will more than double in generation from 12 TWh in 2018 to 25 TWh in 2035 – the same amount of power produced by all of California’s solar panels in 2016.

The results of this continued move to lower carbon sources will be significant. Carbon emissions from electricity in 2035 are expected to be 23.81 gCO2/MJ (grammes of carbon dioxide per megajoule) – less than half what is expected in 2018. And while there will be many major changes in the electricity system over the next 17 years, it is this that is perhaps the most important and optimistic.