NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE IN OR INTO AUSTRALIA, CANADA OR JAPAN OR IN ANY OTHER JURISDICTION IN WHICH OFFERS OR SALES OF SECURITIES WOULD BE PROHIBITED BY APPLICABLE LAW. PLEASE SEE THE IMPORTANT NOTICES AT THE END OF THIS RELEASE.

On 26 April 2018, Drax Group plc’s (“Drax”) indirect wholly owned subsidiary, Drax Finco plc, completed and settled its offering (the “Offering”) of U.S. dollar denominated senior secured notes due November 2025 (the “Notes”), in an aggregate principal amount of $300.0 million.

Further to the notice of conditional redemption published on April 13, 2018 (the “Notice”), the funds are sufficient, together with cash on hand, to pay the Redemption Price (as defined in the Notice) for all of the outstanding £200,000,000 Senior Secured Floating Rate Notes due 2022 (the “Notes”), including applicable premium, in full, and to pay all related expenses in respect of the redemption on or prior to the Redemption Date (as defined in the Notice), which Notes have been conditionally called to be redeemed on 1 May 2018. As such, the Refinancing Condition (as defined in the Notice) has been satisfied, and the redemption of the Notes will occur on 1 May 2018.

Accrued and unpaid interest on the Notes from 1 February 2018 to, but not including, 1 May 2018 will be paid to holders of record on 15 April 2018 in the aggregate amount of £2,230,180.27.

Enquiries:

Drax Investor Relations:

Mark Strafford

Media:

Drax External Communications:

Ali Lewis

Website: www.drax.com

Cautionary Statement

This release is for information purposes only and does not constitute a prospectus or any offer to sell or the solicitation of an offer to buy any security in the United States of America or in any other jurisdiction. Securities may not be offered or sold in the United States of America absent registration or an exemption from registration under the U.S. Securities Act of 1933, as amended (the “Securities Act”). The Notes will be offered in a private offering exempt from the registration requirements of the Securities Act and will accordingly be offered only to (i) qualified institutional buyers pursuant to Rule 144A under the Securities Act and (ii) certain non-U.S. persons outside the United States in compliance with Regulation S under the Securities Act. No indebtedness incurred in connection with any other financing transactions will be registered under the Securities Act.

This communication is directed only at persons who (i) have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 as amended (the “Order”), (ii) are persons falling within Article 49(2)(a) to (d) (“high net worth companies, unincorporated associations, etc.”) of the Order, (iii) are persons who are outside the United Kingdom, and (iv) are persons to whom an invitation or inducement to engage in investment activity (within the meaning of section 21 of the Financial Services and Markets Act 2000) in connection with the issue or sale of any notes may otherwise lawfully be communicated or caused to be communicated (all such persons together being referred to as “relevant persons”). Any investment activity to which this communication relates will only be available to, and will only be engaged in with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents.

This announcement is not a public offering in the Grand Duchy of Luxembourg or an offer of securities to the public in any European Economic Area member state that has implemented Directive 2003/71/EC, and any amendments thereto (together with any applicable implementing measures in any member state, the “Prospectus Directive”).

Manufacturer target market (MiFID II product governance) is eligible counterparties and professional clients only (all distribution channels). No PRIIPs key information document (KID) has been prepared as the Notes are not available to retail investors in the European Economic Area.

Forward Looking Statements

This release includes forward-looking statements within the meaning of the securities laws of certain applicable jurisdictions. These forward-looking statements can be identified by the use of forward-looking terminology, including, but not limited to, terms such as “aim”, “anticipate”, “assume”, “believe”, “continue”, “could”, “estimate”, “expect”, “forecast”, “guidance”, “intend”, “may”, “outlook”, “plan”, “predict”, “project”, “should”, “will” or “would” or, in each case, their negative, or other variations or comparable terminology. These forward-looking statements include, but are not limited to, all statements other than statements of historical facts and include statements regarding Drax’s intentions, beliefs or current expectations concerning, among other things, Drax’s future financial conditions and performance, results of operations and liquidity, strategy, plans, objectives, prospects, growth, goals and targets, future developments in the markets in which Drax participate or are seeking to participate, and anticipated regulatory changes in the industry in which Drax operate. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors because they relate to events and depend on circumstances that may or may not occur in the future. Readers are cautioned that forward-looking statements are not guarantees of future performance and are based on numerous assumptions. Given these risks and uncertainties, readers should not rely on forward looking statements as a prediction of actual results.

END

“2017 was an important year for the Group with the development of our strategy, a new dividend policy and the departure of Dorothy Thompson who announced her intention to stand down as CEO. I would like to thank Dorothy for her enormous contribution to the Group over the last 13 years.

“2017 was an important year for the Group with the development of our strategy, a new dividend policy and the departure of Dorothy Thompson who announced her intention to stand down as CEO. I would like to thank Dorothy for her enormous contribution to the Group over the last 13 years.

Italy

Italy

Netherlands

Netherlands

Hungary

Hungary  Portugal

Portugal

Spain

Spain

Bulgaria

Bulgaria  Croatia

Croatia  Kosovo

Kosovo Montenegro

Montenegro  Poland

Poland  Romania

Romania Serbia

Serbia Slovakia

Slovakia  Slovenia

Slovenia  Spain

Spain

Cyprus

Cyprus  Estonia

Estonia  Iceland

Iceland  Latvia

Latvia  Lithuania

Lithuania  Luxembourg

Luxembourg  Malta

Malta  Norway

Norway  Sweden

Sweden  Switzerland

Switzerland

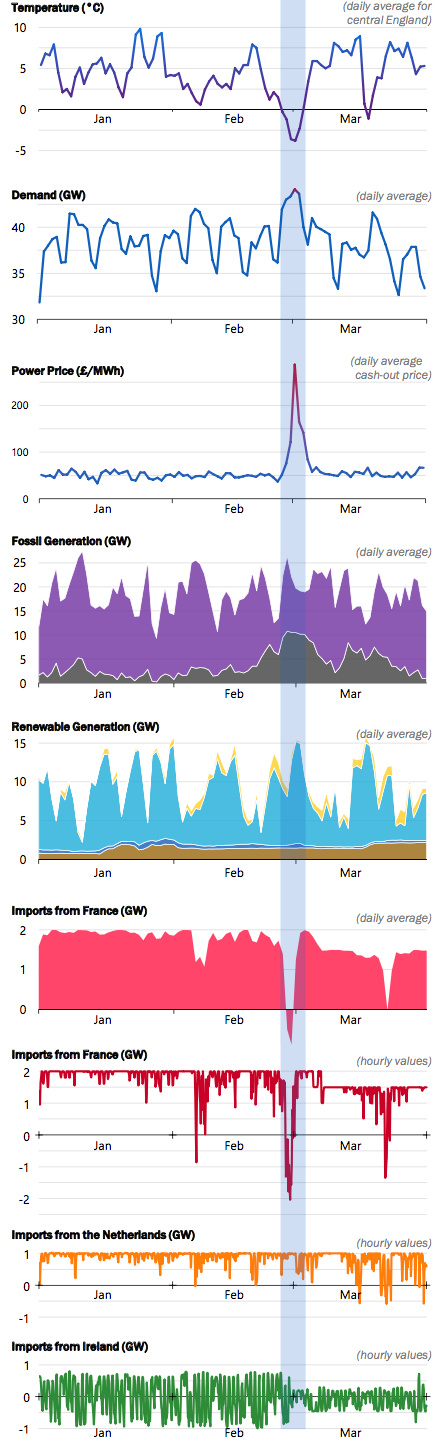

Thursday 1 March was the coldest spring day on record, averaging –3.8°C. The six days from 26 February to 3 March (highlighted in blue) were the coldest Britain has been since Christmas 2010.

Thursday 1 March was the coldest spring day on record, averaging –3.8°C. The six days from 26 February to 3 March (highlighted in blue) were the coldest Britain has been since Christmas 2010.