From school runs to goods deliveries, getting from A to B is crucial to life in modern Britain. However, a progress report by the Committee on Climate Change (CCC) found that in 2017 transport was the largest greenhouse gas (GHG)-emitting sector in the UK, accounting for 28% of total emissions. Within domestic transport, cars, vans and HGVs are the three most significant sources of emissions, accounting for 87% of the sector’s emissions.

A zero carbon future relies on a major shift away from petrol and diesel engines to electric transport. A recent report, Energy Revolution: A Global Outlook, by academics from Imperial College London and E4tech, commissioned by Drax, examines the decarbonisation efforts of 25 major countries. The report found the UK ranked sixth in sales of new electric vehicles (EVs) in the 12 months to September 2018 and seventh for the number of charging points available.

The government’s Road to Zero strategy outlines the country’s target for as many as 70% of new car sales to be ultra-low emission by 2030, alongside up to 40% of new vans. It has, however, been criticised by the Committee on Climate Change as not being ambitious enough. A committee of MPs has suggested 2032 becomes the official target date for banning new petrol and diesel cars, rather than 2040 called for in the strategy.

Even as the range of EVs on the market grows, getting more low-emission vehicles on roads will require incentives and infrastructure improvements. Here’s how some of the countries leading the shift to electrified transport are driving adoption.

Expanding charging infrastructure

One of major barriers to EV adoption is a lack of public charging facilitates, coupled with reliability issues across a network that includes both old hardware and a plethora of apps and different connections. No one wants to set off on a long journey unsure of whether they’ll be able to find a recharging point before their battery goes flat.

According to the Energy Revolution report, there is one charger for every 5,000 people in the UK, compared to one for every 500 people in Norway, the leading country for charging points. The Scandinavian country’s government has invested heavily in its policy of placing two fast charging stations for every 50 km of main road, covering 100% of the cost of installation.

Government support has also been crucial in second and third ranked countries, The Netherlands and Sweden, respectively. The Dutch Living Lab Smart Charging is a collaboration between government and private organisations to use wind and solar to change vehicles. While Sweden has combined its ‘Klimatklivet’ investment scheme for both public and private charge points, with experiments, such as charging roads.

China, where half of the world’s 300,000 charge points are located, has issued a directive calling for the construction of 4.8 million electric charging points around the country by 2020. It’s also assisting private investments to make charging stations more financially viable.

The UK’s Road to Zero Strategy is to expand charging infrastructure through a £400 million joint investment fund with private investors.

Drax’s Energising Britain report found the UK is on track to meet its 2030 target of 28,000 installed chargers ahead of time. However, deployment still clusters around London, the South East and Scotland.

More direct government incentives or policies may be needed to balance this disparity and in the UK, the Scottish Government is leading the pack with a 2032 ban on new petrol and diesel cars plus a range of initiatives including public charging networks and the Switched on Towns and City Fund.

Charging points are necessary for electrified roads. However, it’s a chicken-and-egg situation –more chargers don’t mean more EVs. Getting more EVs on roads also requires financial incentive.

Money makes the wheels go around

Putting infrastructure in place is one thing, but the reality is EVs are expensive, especially new ones and cold hard cash is an important driver of adoption.

Financial incentives have been a part of Norway’s policies since the 1980s, with the country’s high fuel prices, compared to the US for example, further helping to make EVs attractive. Current benefits for EV owners include: no import or purchase taxes, no VAT, no road tax, no road tolls, half price on ferries and free municipal parking. There are also non-financial incentives such as bus-lane usage.

Sweden, the second ranked country for new EV sales in 2018, is a similar case where high fuel prices are combined with a carrot-and-stick approach of subsidies for EVs and rising road taxes for fossil fuel-powered vehicles, including hybrids.

The UK has had a grant scheme in place since 2011, but last year removed hybrid vehicles from eligibility and dropped the maximum grant for new EV buyers from £4,500 to £3,500. EVs are also exempt from road taxes. In April 2019, Transport for London is implementing a Low Emissions Zone (ULEZ) which exempts EVs from a daily charge.

Subsidies for both buyers and vehicle manufacturers have been a cornerstone of China’s policies, with support coming up to around $15,000 per vehicle. Chinese EV buyers can also skip the lottery system for new license plates the country has in place to reduce congestion.

Heavy subsidies have allowed the country to claim as much as 50% of the entire EV passenger market, however, it makes change expensive and the government is now preparing to find a more sustainable way of driving adoption.

Preparing for transport beyond subsidies

China isn’t afraid to strong-arm manufacturers into building more EVs. Companies with annual sales of more than 30,000 vehicles are required to meet a quota of at least 10% EVs or hybrids. However, the government has begun to scale back subsidies in the hope it will drive innovation in areas such as batteries, robotics and automation, which will in turn reduce the price for end consumers.

Norway, which owes so much of its decarbonisation leadership in low-carbon transport to subsidies, is also grappling with how to move away from this model. As EVs creep increasingly towards the norm, the taxes lost through EV’s exclusions become more economically noticeable. While the government says the subsidies will remain in place until at least 2020, different political parties are calling to make the market commercially viable.

There is also concern the schemes only pass on savings to those who can afford new EV models, rather than the wider population, who face higher taxes for being unable to upgrade.

It’s not just governments’ responsibility to make new markets for EVs sustainable, but for business to innovate within the area too. Drax Group CEO Will Gardiner recently said his company must help to “ensure no-one is left behind through the energy revolution”.

That’s a view welcomed by politicians from all sides of the political spectrum concerned not just about mitigating man-made climate change but also to ensure a ‘just transition’ during the economy’s decarbonisation.

Energy and Clean Growth Minister Claire Perry spoke at an Aldersgate Group event in London in January:

“It’s been very easy, in the past, for concerns about the climate to be dismissed as the worries of the few, not the many. Luckily, we’ve been able to strip out a lot of the myths surrounding decarbonisation and costs –but we have to be mindful that this is a problem which will have to be solved by the many, not just the middle class.”

Many countries have set ambitious targets for when the ban of new petrol and diesel vehicles will come into effect. Government involvement and subsidies will be crucial but may prove economically challenging in the longer term.

Explore the full reports:

Energy Revolution: A Global Outlook

I. Staffell, M. Jansen, A. Chase, E. Cotton and C. Lewis (2018). Energy Revolution: Global Outlook. Drax: Selby.

Energising Britain: Progress, impacts and outlook for transforming Britain’s energy system

I. Staffell, M. Jansen, A. Chase, C. Lewis and E. Cotton, (2018). Energising Britain: Progress, impacts and outlook for transforming Britain’s energy system. Drax Group: Selby.

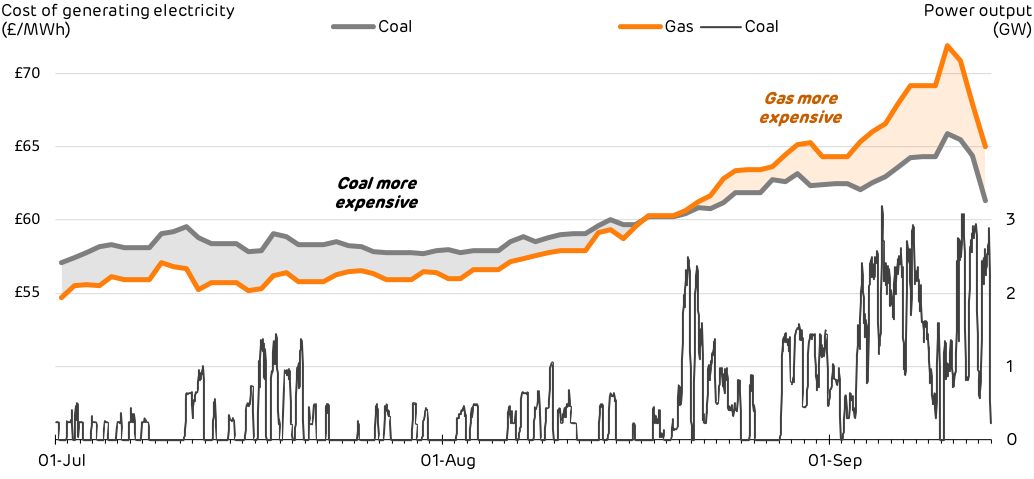

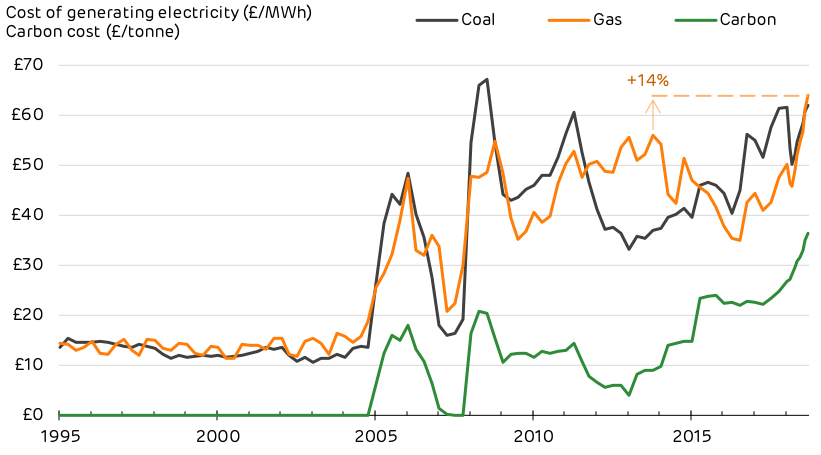

This Carbon Price Support has had a huge impact, particularly on coal. Prior to its introduction, coal represented 50% of power generation but since it has fallen to record lows. 2017 saw the first day without any coal on the power system since the industrial revolution. Records continue to be broken throughout 2018, with

This Carbon Price Support has had a huge impact, particularly on coal. Prior to its introduction, coal represented 50% of power generation but since it has fallen to record lows. 2017 saw the first day without any coal on the power system since the industrial revolution. Records continue to be broken throughout 2018, with

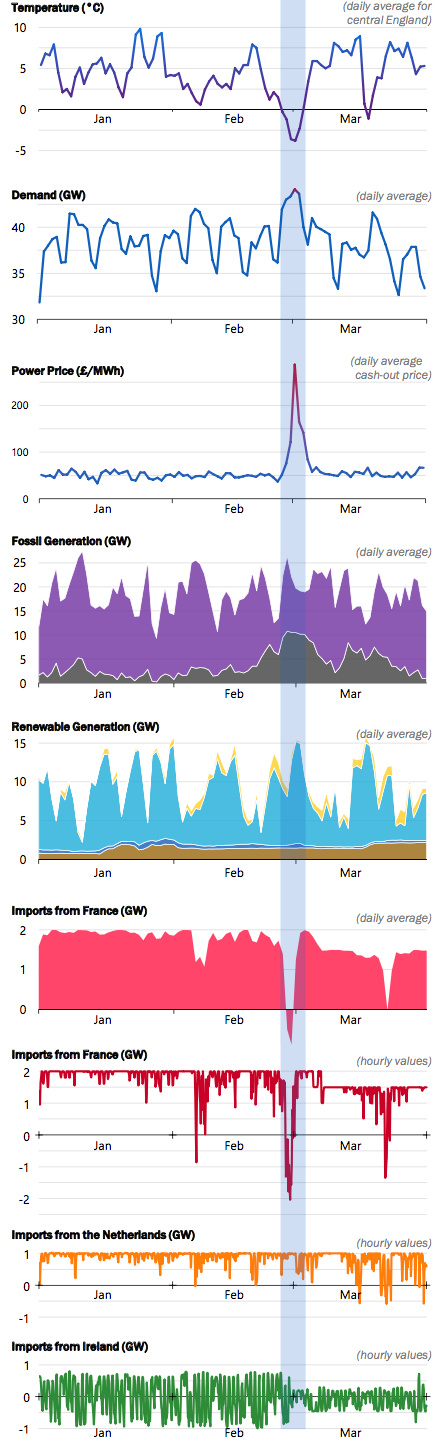

Thursday 1 March was the coldest spring day on record, averaging –3.8°C. The six days from 26 February to 3 March (highlighted in blue) were the coldest Britain has been since Christmas 2010.

Thursday 1 March was the coldest spring day on record, averaging –3.8°C. The six days from 26 February to 3 March (highlighted in blue) were the coldest Britain has been since Christmas 2010.