The Strategy provides an important steer on the short-, medium- and long-term use of biomass in the UK’s 2050 Net Zero target.

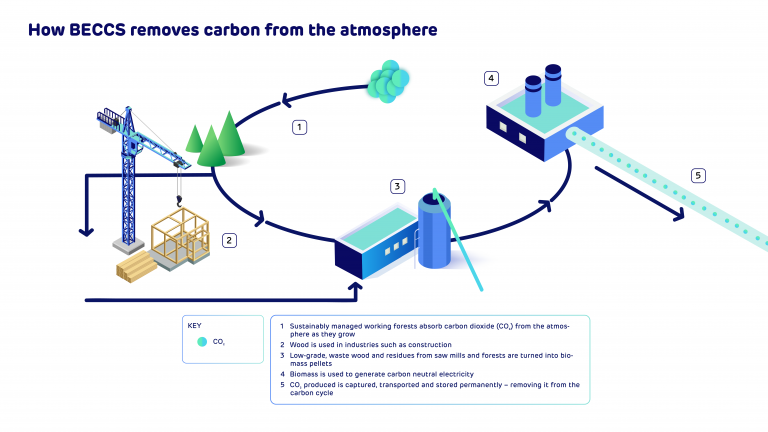

With the Government’s Strategy in hand, I am more certain than ever on two things. First, that there remains a clear and powerful role for biomass and BECCS in helping the UK balance harder to abate sectors, like aviation, and reach Net Zero.

And secondly, that bioenergy with carbon capture and storage (BECCS) has a vital role to play in our global energy transition – and that Drax is well placed to deliver.

Why we should be confident

In developing the Strategy, the Government has considered several factors including: availability of biomass and the priorities for end use; impacts on air quality; the sustainability of biomass use; as well as the role of BECCS in helping to reach our long-term climate goals.

The ‘Priority Use Framework’ evaluates where biomass would be most sustainably and efficiently used across sectors, given supply constraints. This framework is an important tool, which has been developed with four key principles in mind; sustainability; air quality; the circular economy and resource efficiency; and ability to support us getting to Net Zero.

Critically, the Priority Use Framework states that:

- In the short-term (2020s) government will continue to facilitate sustainable biomass deployment through a range of incentives and requirements covering power, heat and transport

- In the medium-term (to 2035) government intends to further develop biomass use for utilities such as heat and power with a view to where possible transition to BECCS

- Biomass for use in BECCS should be prioritised in the long term (to 2050)

It’s very encouraging to see Government recognise the important role that biomass plays in our energy transition in both the short and medium term, as well as its prioritisation of BECCS in the long term.

Although there are various routes for deploying BECCS across different industries, the strategy further prioritises the deployment of BECCS on existing biomass generation plants with established supply chains, further supported by the development of the Power-BECCS business model for the first BECCS projects.

The Strategy is also promising as it presents an evidence-driven basis for long-term policy stability and I believe if the Government continues in this direction, it will draw investment to the UK’s bioenergy industry.

Why this is critical for the country

Biomass has already played an important role in supporting energy security while helping the UK decarbonise, displacing fossil fuels with a source of renewable, dispatchable power. Our work has also made a significant contribution to the UK economy, adding an estimated £1.8 billion to the UK GDP and supporting 17,800 jobs in 2021 alone.

And, looking to the future, BECCS presents an enormous opportunity to the UK.

Early investment in this critical technology has the potential to support energy security, and climate targets whilst creating jobs and making the UK a leader in the potentially trillion-dollar global CDR market.

This work needs to happen now – nearly all realistic pathways to limit warming to 1.5C require the carbon removal technology and renewable power BECCS offers, and expert voices at the UN’s Intergovernmental Panel on Climate Change, the UK’s Climate Change Committee, and Forum for the Future have said that carbon removals will be needed to address the climate crisis.

Today’s Strategy is a clear signal from Government that they recognise the importance of BECCS and the urgency with which we must employ it within the UK.

Why this is encouraging for Drax

Drax is an international, growing, sustainable business at the heart of global efforts to deliver Net Zero and energy security and I believe the Strategy we have seen from Government today is a clear indication of their support for the work that we do.

With BECCS, Drax has the ability to become a global leader in carbon removals technology. We are engaged in formal discussions with the UK Government about the project and, providing these are successful, we plan to invest billions in transforming Drax Power Station into the world’s largest carbon removals project. The prioritisation of BECCS within the Priority Use Framework shows the Government is aligned to this vision.

As we look forward

We welcome the Government’s Biomass Strategy and will continue to unpack what it means for our business over the coming days and weeks with a mind to our next steps.

Government must now ensure that as it progresses its consultation on biomass sustainability that that process is equally evidence-driven and ensures that science-based methods drive the policy forward. We hope to continue to work alongside Government to support these efforts.

Our formal discussions with the UK Government on BECCS and a ‘bridging mechanism’ to support the transition to BECCS have been productive, but to realise the scale of the ambition included in the Government’s Strategy, we need commitment through the delivery of a clear business model that supports BECCS.

Today’s support from Government brings us a big step closer and we look forward to continuing the work.

Will Gardiner

CEO

Drax

Total investment would be in the region of $2 billion per plant with a target FID in 2026 and commercial operation by 2030. The capital cost reflects the construction of new-build power generation as well as carbon capture and storage (CCS) systems.

Total investment would be in the region of $2 billion per plant with a target FID in 2026 and commercial operation by 2030. The capital cost reflects the construction of new-build power generation as well as carbon capture and storage (CCS) systems.