Annual report and accounts 2018 [PDF]

The UK is undergoing an energy revolution – a transition to a low-carbon economy requiring new energy solutions for power generation, heating, transport and the wider economy. Through our flexible, lower carbon electricity proposition and business to business (B2B) energy solutions, the Group is positioning itself for growth in this environment. More details can be seen on page 4 of our annual report.

Our purpose is to help change the way energy is generated, supplied and used.

Through addressing UK energy needs, and those of our customers, our strategy is designed to deliver growing earnings and cash flow, alongside significant cash returns for shareholders.

Our ambition is to grow our EBITDA to over £425 million by 2025, with over a third of those earnings coming from Pellet Production and B2B Energy Supply to create a broader, more balanced earnings profile. We intend to pay a sustainable and growing dividend to shareholders. Progression towards these targets is underpinned by safety, sustainability, operational excellence and expertise in our markets.

We made significant progress during 2017, but were below our expectations on the challenging scorecard targets we set ourselves in pellet production and biomass availability, the latter reflecting the significant incident we experienced on our biomass rail unloading facilities at the end of 2017, which extended into January 2018. Energy Supply performed well with Opus Energy in line with plan and Haven Power exceeding its targets. Through a combination of this performance and the progress of our strategy we have delivered EBITDA of £229 million, significantly ahead of 2016 (£140 million) and with each of our three businesses contributing positive EBITDA for the first time.

The Group scorecard is reported in full in the Remuneration Report (pp. 81-107 of our annual report) and the KPIs are also shown below. They reflect the diversity of our operations and our need to maintain clear focus on delivering operational excellence.

On a statutory basis we recorded a loss of £151 million, which reflects unrealised losses on derivative contracts, previously announced accounting policy on the accelerated depreciation on coal-specific assets as well as amortisation of newly- acquired intangible assets in Opus Energy. We also calculate underlying earnings, a profit after tax of £2.7 million, which excludes the effect of unrealised gains and losses on derivative contracts and, to assess the performance of the Group without the income statement volatility introduced by non-cash fair value adjustments on our portfolio of forward commodity and currency futures contracts.

During the year we refinanced our existing debt facilities, reducing our debt cost. We also confirmed a new dividend policy which will pay a sustainable and growing dividend (£50 million in respect of 2017), consistent with our commitment to a strong balance sheet and our ambitions for growth. At year end our net debt was £91 million below our 2x net debt to EBITDA target, providing additional headroom. There is more detail on our financial performance in the Group Financial Review on page 46 of our annual report.

In the US, our Pellet Production operations recorded year-on-year growth in output of 35%, with our first two plants now producing at full capacity. During the second half of 2017 we also completed the installation of additional capacity enabling our Morehouse and Amite facilities to handle a greater amount of residue material, supporting efforts to produce good quality pellets at the lowest cost.

As part of our target to expand our biomass self-supply capability we completed the acquisition of LaSalle Bioenergy (LaSalle) adding pellet production capacity. LaSalle commenced commissioning in November 2017 and due to its close proximity to our existing US facilities, once complete, will provide further opportunities for supply chain optimisation.

As in 2016, we benefited from the flexibility of self-supply. This often overlooked attribute of our supply chain enables us to manage biomass supply across the Power Generation business’ planned outage season and to benefit from attractively priced biomass cargoes in the short-term spot market.

In Power Generation, we experienced a significant incident on our biomass rail unloading facilities, including a small fire on a section of conveyor. We fully investigated the incident and following repairs over the Christmas period have now recommissioned the facility, with enhanced operating procedures. This is a timely reminder of the combustible nature of biomass and the need for strong controls and processes to protect our people and assets.

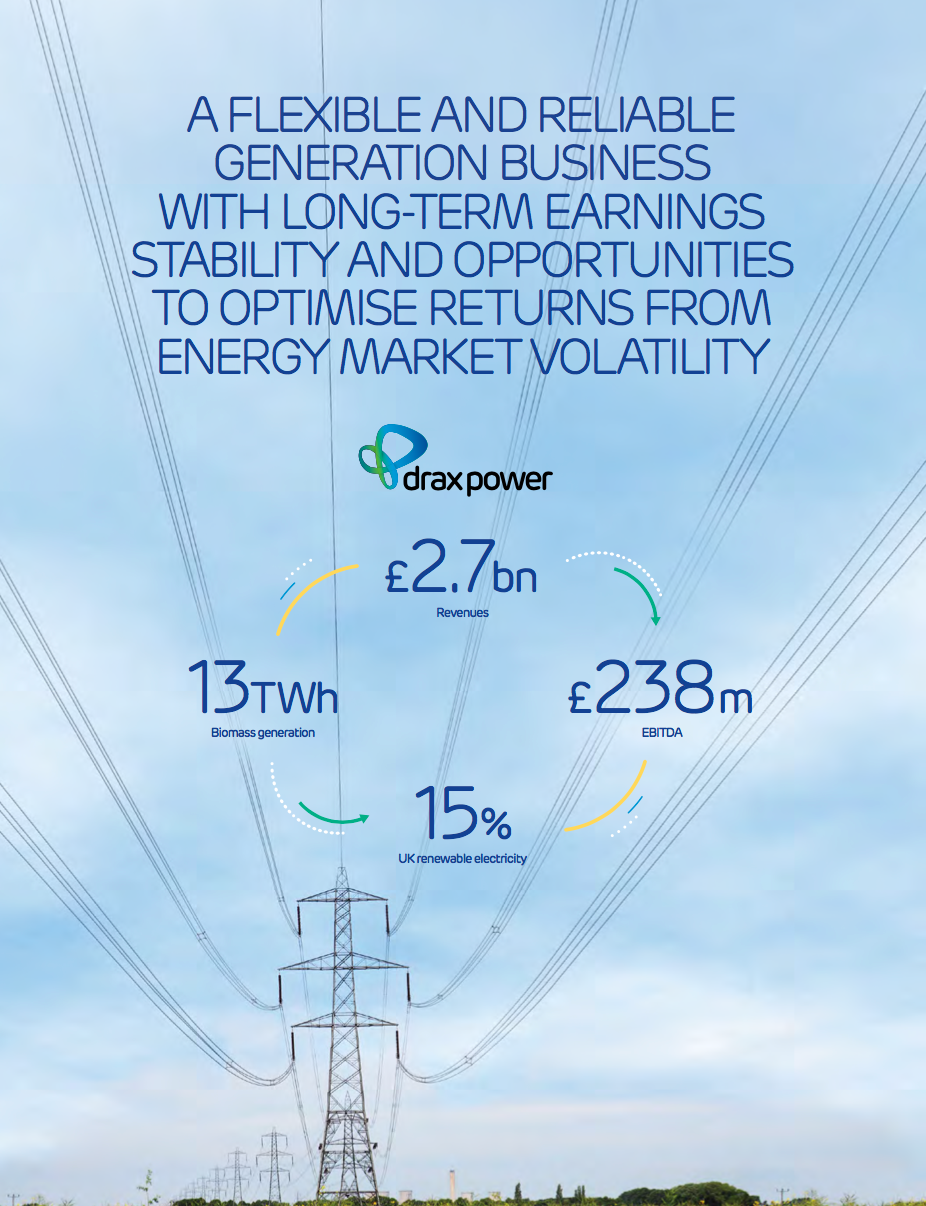

Our biomass units continued to produce high levels of renewable electricity from sustainable wood pellets for the UK market – Drax produced 15% of the UK’s renewable electricity – enough to power Sheffield, Leeds, Liverpool and Manchester combined. In doing so, we are making a vital contribution to the UK’s ambitious targets for decarbonisation across electricity generation, heating and transport – an 80% reduction by 2050 vs. 1990 levels.

We benefited from the first year of operation of our third biomass unit under the Contract for Difference (CfD) scheme which provides an index-linked price for the power produced until March 2027. The unit underwent a major planned outage between September and November, with a full programme of works successfully completed.

The flexibility, reliability and scale of our renewable generation, alongside an attractive total system cost, means we are strongly placed to play a long-term role in the UK’s energy mix. To that end we continue to see long-term biomass generation as a key enabler, allowing the UK Government to meet its decarbonisation targets and the system operator to manage the grid.

The UK Government recently confirmed support for further biomass generation at Drax Power Station and we now plan to continue our work to develop a low-cost solution for a fourth biomass unit, allowing us to provide even more renewable electricity, whilst supporting system stability at minimum cost to the consumer.

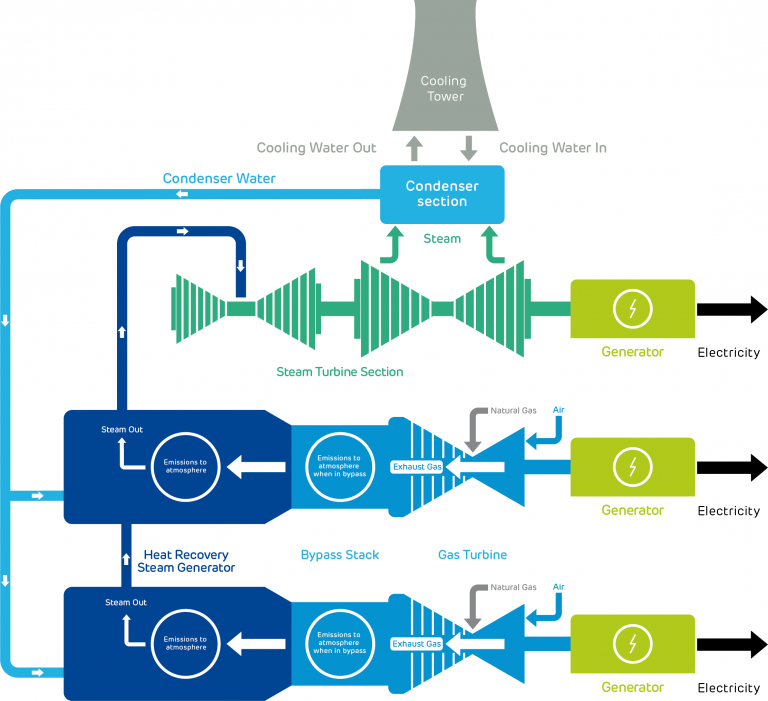

Our heritage is coal, but our future is flexible lower-carbon electricity. We are making progress with the development of four new standalone OCGT plants situated in eastern England and Wales and our work to develop options for coal-to-gas repowering with battery technologies. If these options would be supported by 15-year capacity market contracts, providing a clear investment signal and extending visibility of contract-based earnings out to the late 2030s.

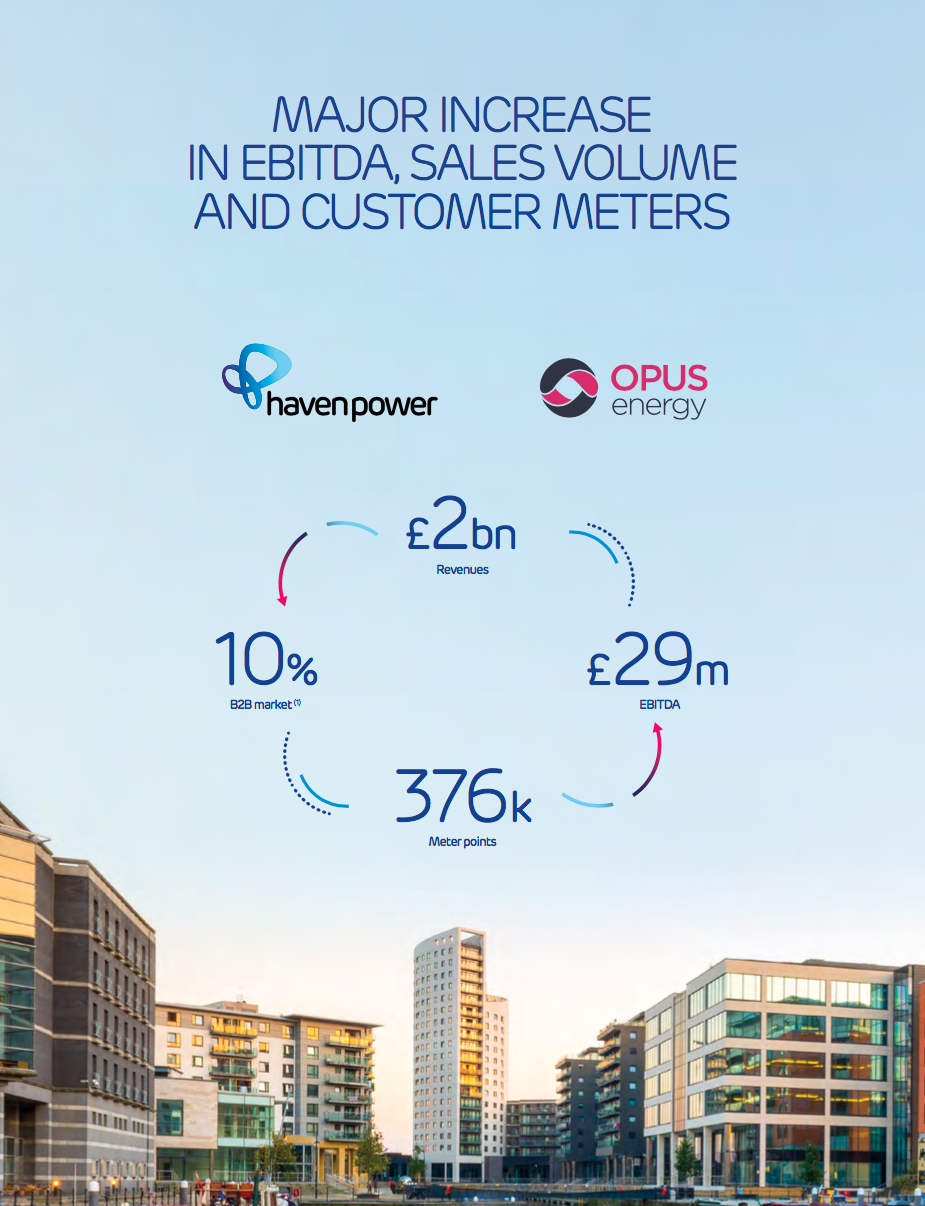

In B2B Energy Supply, we completed the acquisition of Opus Energy, a supplier of electricity and gas to corporates and small businesses. The transaction completed in February 2017 and Opus Energy has continued to operate successfully within the Group, achieving its targets and making an immediate and significant contribution to profitability. Alongside this good performance we have also implemented the operational steps necessary to realise further operational benefits of the acquisition, and we now source all of Opus’ power and gas internally.

Haven Power delivered a strong performance with the sale of large volumes of electricity to industrial customers. Through our customer focus and efficiencies, margins have improved and the business generated a positive EBITDA for the first time.

Together, our B2B Energy Supply business now has over 375,000 customer meters, making it the fifth largest B2B power supplier in the UK.

We are delivering innovative low-carbon power solutions, with 46% of our energy sold from renewable sources. As the power system transforms, we will be working closely with our customers to help them adapt to a world of more decentralised and decarbonised power. We see this as a significant opportunity for the Group in the medium to long term.

In October 2017 we completed the sale of Billington Bioenergy (BBE) to Aggregated Micro Power Holding (AMPH). Consideration for the transaction was £2.3 million, comprised of £1.6 million of shares in AMPH and £0.7 million of cash.

The sale of BBE is aligned with our strategy to focus on B2B energy supply. However, through our shareholding in AMPH, we will retain an interest in the UK heating market, whilst gaining exposure to the development of small-scale distributed energy assets.

We continue to operate in a changing environment. The full impact of the UK’s decision to leave the EU is still unknown.

The immediate impact on the Group was a weakening of Sterling and an associated increase in the cost of biomass, which is generally denominated in other currencies. Through our utilisation of medium-term foreign exchange hedges the Group protected the cash impact of this weakness. In 2017, Sterling has generally strengthened, and we have been able to extend our hedged position out to 2022 at rates close to those that we saw before Brexit.

In terms of UK energy policy, the Government’s main focus has been on what it sees as unfair treatment of domestic consumers on legacy standard variable tariff (SVT) contracts. SVT are not a common feature of the B2B market. At the microbusiness end of this market, which is closer in size to domestic, most of our customers are on fixed price products and are active in renewing contracts.

The UK Government’s response to its consultation on the cessation of coal generation by 2025 has confirmed an end to non-compliant coal generation by October 2025.

We believe our assets, projects and ability to support our customers’ electricity management will support the Government’s ambition to maintain reliability when coal generation ceases.

Running a resilient, reliable grid is not simply about meeting the power demand on the system; there are also system support services which are essential to its effective operation. As the grid decentralises and becomes dependent on smaller, distributed generation, the number of plants able to provide these services is reducing. Biomass generation, our proposed OCGTs and our repowering project would allow us to meet these needs, but this will not come for free. A reliable, flexible, low-carbon energy system will require the right long-term incentives.

In November 2017, the Government confirmed that the UK will maintain a total carbon price (the combined UK Carbon Price Support – CPS – and the European Union Emissions Trading Scheme – EU ETS) at around the current level. CPS has been the single most effective instrument in reducing the level of carbon emissions in generation and we continue to support the pricing of carbon, a view echoed in a report prepared for the UK Government by the leading academic Professor Dieter Helm.

Against this backdrop we continue to make an important contribution to the UK economy. According to a study published by Oxford Economics in 2016, Drax’s total economic impact – including our supply chain and the wages our employees and suppliers’ employees spend in the wider consumer-economy was £1.7 billion, supporting 18,500 jobs across the UK.

The health, safety and wellbeing of our employees and contractors is vital to the Group, with safety at the centre of our operational philosophy. We also recognise the growing need to support the wellbeing of our employees and their mental health.

During the year we continued to use Total Recordable Injury Rate (TRIR) as our primary KPI in this area. Performance was positive, at 0.27, but we expect this to improve in the coming year.

The incident at our biomass rail unloading facilities in December did not lead to physical injuries but was nonetheless a significant event and caused disruption into 2018.

We consequently launched an incident investigation to ensure our personal and process safety management procedures are robust.

To promote greater awareness around wellbeing we have embedded this in our new people strategy and expect to focus more energy and resources on this important area during 2018.

Strong corporate governance is at the heart of the Group – acting responsibly, doing the right thing and being transparent. As the Group grows the range of sustainability issues we face is widening and recognising the importance of strong corporate governance, we have published a comprehensive overview of our sustainability progress in 2017 on our website. This also highlights future priorities to broaden our approach to sustainability and improved reporting of environment, social and governance (ESG) performance. We have also completed the process which allows us to participate in the UN Global Compact (UNGC) – an international framework which will guide our approach in the areas of human rights, labour, environment and anti-corruption.

During 2017 we published our first statement on the prevention of slavery and human trafficking in compliance with the UK Modern Slavery Act. We have added modern slavery awareness to our programme of regular training for contract managers and reviewed our counterparty due diligence processes.

We have continued to maintain our rigorous and robust approach to biomass sustainability, ensuring the wood pellets we use are sustainable, low-carbon and fully compliant with the UK’s mandatory sustainability standards for biomass. The biomass we use to generate electricity provides a 64% carbon emissions saving against gas, inclusive of supply chain emissions. Our biomass lifecycle carbon emissions are 36g CO2 / MJ, less than half the UK Government’s 79g CO2 / MJ limit.

Our people are a key asset of the business. Through 2017 we developed a new people strategy. The strategy focuses on driving performance and developing talent to deliver the Group’s objectives. We have established Group-wide practices, including a career development and behaviour framework focused on performance and personal development.

A key part of our strategy is to identify opportunities to improve existing operations and create options for long-term growth. To that end we have established a dedicated Research and Innovation (R&I) team led by the Drax engineers who delivered our world-first biomass generation and supply chain solution.

We are actively looking at ways to improve the efficiency of our operations, notably in our biomass supply chain.

Biomass is our largest single cost and as such we are focused on greater supply chain efficiency and the extraction of value from a wide range of low-value residue materials.

In B2B Energy Supply we are using our engineering expertise to help offer our customers value-adding services and products which will improve efficiency and allow them to optimise their energy consumption.

In the following sections we review the performance of our businesses during the year.

Our pellets provide a sustainable, low-carbon fuel source – one that can be safely and efficiently delivered through our global supply chain and used by Drax’s Power Generation business to make renewable electricity for the UK. Our manufacturing operations also promote forest health by incentivising local landowners to actively manage and reinvest in their forests.

Safety remains our primary concern and we have delivered year-on-year reduction in the level of recordable incidents.

Output at our Amite and Morehouse pellet plants increased significantly, although was below our target for the year.

We have remained focused on opportunities to improve efficiencies and capture cost savings as part of our drive to produce good quality pellets at the lowest possible cost. We still have more work to do in this area to optimise quality and cost, as our performance was below target for the year.

As part of our plans to optimise and improve operations we added 150k tonnes capacity at our existing plants, bringing total installed capacity to 1.1 million tonnes and increasing the amount of lower cost sawmill residues we are able to process and used in our pellets.

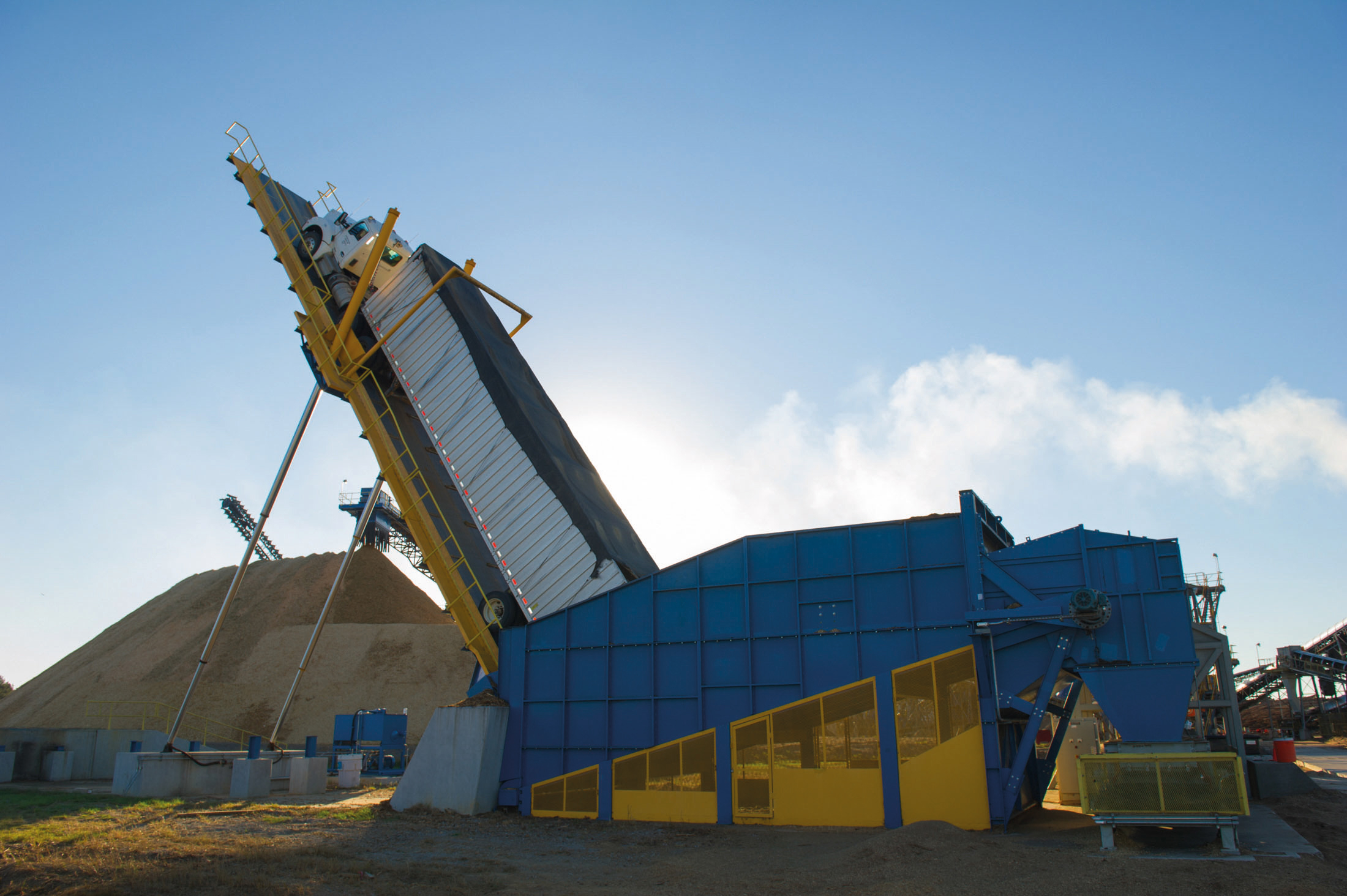

By-products of higher value wood industries, such as sawdust from sawmills, offer a low-cost source of residues for use in our pellet production process and during 2017 we added an additional 150k tonnes of capacity at our pellet plants to allow us to use more of this material. By investing in giant hydraulic platforms known as ‘truck dumps’, operators at Amite and Morehouse can unload a 50-foot truck carrying either sawdust or wood chips and weighing 60 tonnes in less than two minutes, increasing processing capacity, reducing the cost of processing and increasing the use of lower cost residues.

Find out more: www.drax.com/truckdumps and www.drax.com/sustainability/sourcing

At our Baton Rouge port facility greater volumes of production from our facilities drove higher levels of throughput with 17 vessels loaded and dispatched during the year (2016: 11 vessels).

In April, in line with our strategy to increase self-supply, we acquired a 450k tonne wood pellet plant – LaSalle Bioenergy (LaSalle). Commissioning of the plant began in November 2017 and we expect to increase production through 2018. LaSalle is within a 200-mile radius of our existing facilities. By leveraging the locational benefits of these assets we aim to deliver further operational and financial efficiencies.

The location of our operations allows us to leverage benefits of multiple assets and locations for operational efficiencies

All sites within 200-mile radius

Operational efficiencies

Shared logistics to Baton Rouge

Complementary fibre sourcing

Find out more: www.draxbiomass.com

There was a significant improvement in 2017, with EBITDA of £5.5 million (2016: £6.3 million negative EBITDA), driven by increasing volumes of wood pellets produced and sold to the Power Generation business. Sales of pellets in the year ending 31 December 2017 totalled £136 million, an increase of 84% over 2016.

Gross margin increased, reflecting higher production volumes. Raw fibre procurement, transportation and processing comprised the majority of cost of sales and as such this remains an important area of focus and an opportunity for the business. Through incremental investment in plant enhancements we expect to see further benefits from efficiencies and greater utilisation of lower cost residues.

Total operating costs have increased, reflecting an increase in operations at Amite, Morehouse and the Port of Baton Rouge, alongside the addition of LaSalle.

We acquired LaSalle for $35 million and have invested an additional $27 million as part of a programme to return the unit to service.

| 2017 £m | 2016 £m |

|

|---|---|---|

| Revenue | 135.7 | 73.6 |

| Cost of sales | (96.7) | (55.5) |

| Gross profit | 39.0 | 18.1 |

| Operating costs | (33.5) | (24.4) |

| EBITDA | 5.5 | (6.3) |

| Area | KPI | Unit of measure | 2017 | 2016 |

|---|---|---|---|---|

| Operations | Fines at disport | % | 9.6 | 7.6 |

| Operations | Output | ,000 tonnes | 822 | 607 |

| Financial | Variable cost/tonne | $/tonne | 77 | 82 |

Through 2018 we expect to continue to deliver growth in EBITDA from our existing assets. Our focus is on the commissioning of LaSalle alongside opportunities for optimisation and efficiencies in our processes, to deliver good quality pellets at the lowest cost.

We remain alert to market opportunities to develop further capacity as part of our self-supply strategy.

Drax Power Station remains the largest power station in the UK (almost twice the size of the next largest). During the year the station met 6% of the UK’s electricity needs, whilst providing 15% of its renewable electricity, alongside important system support services.

With an increase in intermittent renewables and a reduction in the responsive thermal generation historically provided by coal, the system of the future will require capacity which is reliable, flexible and able to respond quickly to changes in system demand and provide system support services. These long-term needs inform our biomass generation and the development of options for investment in gas – Open Cycle Gas Turbines (OCGTs) and coal-to-gas repowering.

We are developing options for four new OCGT gas power stations, two of which already have planning permission and could be on the system in the early 2020s, subject to being awarded a capacity agreement.

A high-tech new control room at Drax Power Station will allow engineers to have real time remote control of our OCGT assets via a fibre-optic cable network. Able to fire up from cold and produce power in minutes rather than hours, our OCGTs will help maintain system security as intermittent renewable sources of power increase and older thermal plants close.

Investment case

Find out more: www.drax.com/about-us/#our-projects

In October the Government published its Clean Growth Plan, setting out its plans for delivery of its legally binding target to reduce 2050 carbon emissions by 80% versus 1990 levels across electricity generation, heating and transport. This reinforces the Drax proposition – flexible, reliable, low-carbon electricity.

In November the Government updated its intentions regarding the future trajectory of UK Carbon Price Support (CPS), indicating that the total cost of carbon tax in the UK (the total of CPS and the EU Emissions Trading Scheme) would continue at around the current level (the tax is currently set at £18/tonne) whilst coal remains on the system.

We believe that CPS has been the single most effective instrument in reducing carbon emissions from generation and that having an appropriate price for carbon emissions is the right way to provide a market signal to further reduce emissions in support of the UK’s long-term decarbonisation targets.

The UK Government has now confirmed an end to non-compliant coal generation by 2025. We support this move subject to an appropriate alternative technology being in place. With this in mind we have continued to develop options for our remaining coal assets to convert to biomass or gas, to provide the reliable, flexible capacity which we believe will be required to manage the increasingly volatile energy system of the future.

Most recently with confirmation of Government support for further biomass generation at Drax Power Station we plan to continue our work to develop a low-cost solution for a fourth biomass unit, accelerating the removal of coal-fired generation from the UK electricity system, whilst supporting security of supply.

2017 saw the first full year of operation of our biomass unit under the Contract for Difference (CfD) mechanism, which provides index-linked revenues for renewable electricity out to 2027.

Our other biomass units are supported by the Renewable Obligation Certificate (ROC) mechanism which, similar to the CfD, is also index-linked to 2027. This acts as a premium above the price of power we sell from these units. We sell power forward to the extent there is liquidity in the power markets which, combined with our fuel hedging strategy, provides long-term earnings and revenue visibility.

Lower gas prices, higher carbon costs and the continued penetration of intermittent renewables have kept wholesale electricity prices subdued.

With increasing levels of intermittent renewables we are continuing to see opportunities to extract value from flexibility – short-term power and balancing market activity, the provision of Ancillary Services and the value achieved from out-of-specification fuels. To capture value in this market we continue to focus resource on optimising availability and flexibility of both coal and biomass units. This whole process requires a high level of teamwork between the operational and commercial teams across the Group to capture and protect value.

Over the period 2017 to 2022 we expect to earn £90 million from a series of one-year capacity market contracts for our coal units, demonstrating that they still have a role to play. The first of these contracts commenced in October 2017, adding £3 million to EBITDA.

Lastly, we continue to source attractively priced fuel cargoes – out-of-specification coals and distressed cargoes, which help keep costs down for the business and consumers. We do this for both coal and biomass. This is a good example of how our commercial and operational teams work together to identify opportunities to create value for the business, as these fuels typically require more complex handling processes.

You can follow the market and see prices at electricinsights.co.uk

Options for Drax Power Station to operate into the late 2030s and beyond moved up a gear in 2017 with the development of an option to repower two coal units to gas. Drax gave notice of the nationally significant infrastructure project to the Planning Inspectorate in September 2017. One of the units could be eligible for the capacity market auction planned for December 2019.

Local community consultations began in November 2017 and continued in February 2018 on options including up to 3.6GW of new gas generation capacity, a gas pipeline and 200MW of battery storage in line with Government plans to end non-compliant coal generation by 2025 and Drax Group’s strategy of playing a vital role in the future energy system.

Find out more: repower.drax.com

Overall, we delivered a good performance during 2017 and maintained a strong safety performance.

We completed a major planned outage on the unit supported by the CfD contract. This unit provides stable and reliable baseload renewable electricity to the network and long-term earnings visibility for the Group. The safe and efficient completion of these complex works is a credit to those involved and reflects our continued focus on opportunities for improvement and efficiencies.

The entire organisation has responded to a number of challenging unplanned events. Most notably, in December we experienced a fire on a section of conveyor at our biomass rail unloading facility and consequently an unplanned outage from late December 2017 to mid-January 2018. Following investigation and recommissioning, the facility has returned to service with enhanced operating procedures. Although this issue did not relate to the operation of the biomass-generating units, the resulting restriction on fuel deliveries by rail required the optimisation of generation across our biomass units, resulting in lower EBITDA and full year biomass availability than our target for the year.

Financial performance has significantly improved, with EBITDA of £238 million (2016: £174 million), principally due to the CfD mechanism.

Value from flexibility was below our target for the year, principally reflecting a lower level of Ancillary Service payments versus 2016.

Our operational performance drives the results. The financial impact of the unplanned outage on the rail unloading facility was mitigated by optimisation of our available biomass and the use of additional generation capacity retained for self-insurance purposes. However, this incident is a reminder of the need to invest appropriately to maintain a high level of operational availability and flexibility.

At the operating cost level, we have reduced costs reflecting the efficient single outage and our focus on the implementation of lean management techniques.

| 2017 £m | 2016 £m |

|

|---|---|---|

| Revenue | 2,719.6 | 2,490.9 |

| Cost of power purchases | (891.2) | (904.4) |

| Grid charges | (62.9) | (69.4) |

| Fuel and other costs | (1,367.1) | (1,180.1) |

| Cost of sales | (2,321.2) | (2,153.9) |

| Gross profit | 398.4 | 337.0 |

| Operating costs | (160.9) | (163.2) |

| EBITDA | 237.5 | 173.8 |

| Area | KPI | Unit of measure | 2017 | 2016 |

|---|---|---|---|---|

| Operations | Biomass unit technical availability | % | Below target | Below target |

| Operations | Value from flexibility | £m | 88 | N/A |

We aim to optimise returns from our core assets, through reliable, flexible, low-carbon energy solutions which provide a long-term solution to the UK’s energy needs. Alongside this, value in the generation market will be created from an ability to execute agile decisions and capture value from volatile short-term power markets.

We will also continue to explore opportunities for lower carbon generation, to exploit our strengths and create opportunities for the long term. To that end we will continue to develop options for gas and pursue efficiencies through our biomass supply chain.

Our B2B Energy Supply business – comprised of Opus Energy and Haven Power – is the fifth largest B2B power supplier in the UK. As the power system transforms, we will be working closely with our customers to help them adapt to a world of more decentralised and decarbonised power. The key factors influencing our business are regulation, competition and our operational performance.

The UK Government’s main focus has been on what it sees as unfair treatment of domestic consumers on legacy standard variable tariff (SVT) contracts. The Government will take forward legislation which will provide the regulator Ofgem with the authority to cap these domestic tariffs. SVTs are not a feature of our business. Our focus remains on the B2B market. At the microbusiness end of the market, which is closer in proximity to domestic, most of our customers are on fixed price products and are actively rather than passively renewing their power supply contracts.

The B2B market remains competitive with 65 different suppliers across the market. Our Haven Power and Opus Energy businesses offer customer-centric power, gas and services. We offer simplicity and flexibility across our products and actively engage with customers to help them manage their energy requirements and reduce carbon emissions.

90% of the electricity that Opus Energy supplied last year came from clean, renewable sources, at no extra cost to their predominantly small and medium-sized business customers. For those customers who want it, 100% renewable energy contracts are also available.

This was exactly what All Saints Church in Ascot was looking for to power their business.

Assistant Church Warden, Chris Gunton, commented:

“We wanted to move to a greener energy supplier, without paying a premium, so approached an energy broker for guidance. They advised us that Opus Energy were a reliable company with a good reputation, and when we asked for a quote they were the most competitive.”

It was a similar story for the Salisbury Museum, in Wiltshire. Nicola Kilgour-Croft, Finance Manager, said:

“We were looking for an energy supplier that offered great value, combined with the right length of contract and good ethics. Opus Energy ticked all these boxes for us.”

Alongside supplying customers, Opus Energy has Power Purchase Agreements with over 2,300 independent UK renewable energy generators. These could be anything from a single wind turbine owned by a village community, to Europe’s greenest zoo, Hamerton Zoo Park.

Commented Andrew Swales, Director of Hamerton Zoo:

“Working with Opus Energy has given us competitive prices, considerably better documentation and a highly efficient service. We’d happily recommend them.”

We have remained focused on delivering an excellent standard of customer service, which is central to our proposition.

February 2017 saw the completion of the acquisition of Opus Energy, which has made good progress integrating into the Group supported by a dedicated team, who have been working on systems, people and commercial projects to ensure our processes work effectively together.

In March we completed the purchase of a new office facility in Northampton, enabling the consolidation of four Opus Energy offices into one and the centralisation of the operational teams.

Sales volumes at Opus Energy were lower than target, reflecting our focus on margin which has remained strong and customer renewal rates were towards the high end of expectation. This reflects the continued commitment to a strong level of customer service and in recognition of this Opus Energy was awarded Utility Provider to Small Businesses of the Year 2017 at the British Business Awards.

At Haven Power we have continued to focus on value-adding flexible products and services particularly to Industrial & Commercial customers whose needs extend beyond commodity supply.

This is demonstrated through our ability to help customers manage and optimise their power consumption profiles through collaboration with our carefully selected partners. Through better systems and services, customer targeting and a keener focus on cost to serve we are driving efficiencies and improved margin at Haven Power.

Following the acquisition of Opus Energy the major Enterprise Resource Platform (ERP) system upgrade was re-planned which has led to a revised timeline from Q2 2018 onwards.

We continue to actively manage credit risk by assessing the financial strength of customers and applying rigorous credit management processes, with a strong focus continuing to be placed on billing and cash collection.

Health and safety remains an area of focus for the business and we continue to target a reduction in the level of recordable incidents.

Financial performance has significantly improved, with EBITDA of £29 million in line with our guidance (2016: £4 million negative). This was principally due to the acquisition of Opus Energy, which added 10 months of EBITDA, but also improved financial performance from Haven Power, which was ahead of plan.

Third Party Costs (TPCs) include grid charges, the cost of meeting our obligations under the Renewable Obligation (RO) and small-scale Feed-in-Tariff schemes. Grid charges include distribution, transmission and system balancing costs. TPCs have continued to increase and now account for 50% of revenue.

Total operating costs have risen with the acquisition of Opus Energy. We remain confident that over time the benefits of common platforms and knowledge sharing will lead to efficiencies.

| 2017 £m | 2016 £m |

|

|---|---|---|

| Revenue | 1,999.0 | 1,326.4 |

| Cost of power purchases | (883.7) | (688.9) |

| Grid charges | (435.8) | (310.4) |

| Other retail costs | (562.1) | (303.6) |

| Cost of sales | (1,881.6) | (1,302.9) |

| Gross profit | 117.4 | 23.5 |

| Operating costs | (88.0) | (27.8) |

| EBITDA | 29.4 | (4.3) |

| Area | KPI | Unit of measure | 2017 | 2016 |

|---|---|---|---|---|

| Operations | Implementation of new ERP (Haven Power) | Date | Q2 2018 | N/A |

| Operations | Sales volume (Opus Energy) | TWh | 5.7 | N/A |

| Operations | Renewal rate (Opus Energy) | % | Above Target | N/A |

In 2018 we will focus on Opus Energy on-boarding, systems development and the roll out of smart meters.

We continue to see opportunities for EBITDA growth in the B2B markets, which we will deliver through our customer-focused supply proposition.

Our focus in 2018 remains on the delivery of our strategy and long-term ambitions for earnings growth, underpinned by safety, sustainability, operational excellence and expertise in our markets. We also recognise that being the most efficient operator in each of our markets is a key factor in our success.

Our objective in Pellet Production remains the commissioning of LaSalle, the production of good quality pellets at the lowest cost, cross-supply chain optimisation and identifying attractive options to increase self-supply.

Our biomass proposition is strong – reliable, flexible, low-carbon renewable electricity and system support which, combined with an effective fuel hedging strategy, will provide long-term earnings visibility. We remain focused on ways to increase supply chain efficiency and make biomass competitive beyond 2027. As part of this we remain focused on the optimisation of our assets in the US Gulf and reduction in pellet cost. To support this focus we are moving our US headquarters from Atlanta to Monroe, Louisiana, which benefits from a much closer proximity to these assets.

In Power Generation, we continue to explore ways to optimise our existing operations, whilst meeting the needs of the changing UK electricity system.

We remain supportive of the UK Government’s decarbonisation targets and will continue our work to deliver four OCGTs and a low-cost biomass unit conversion utilising existing infrastructure at Drax Power Station, alongside developing the option to repowering the remaining coal units to gas.

In B2B Energy Supply, we will continue to grow our B2B offering, with significant opportunities to grow market share. At the same time, we will invest in supporting infrastructure to ensure we can continue to grow, offer market-leading digital propositions and smart metering services.

Pellet Production

Power Generation

B2B Energy Supply

We have made good progress on the delivery of our strategy and will continue to build on this as we progress our targets for 2025, whilst playing an important role in our markets and helping to change the way energy is generated, supplied and used.

View the Drax Group plc annual report and accounts

A. Financially, EBITDA was in line with our guidance, although below 2015. This principally reflects very challenging commodity markets and the removal of the Climate Change Levy exemption.

We were able to partly offset the impact of these factors with a focus on flexible system support, in the prompt and balancing markets, ancillary services and improving retail profitability, all of which are important parts of our strategy to develop broader, non-commodity exposed earnings.

Operationally, 2016 was another good year across our business, but particularly

in generation where the team completed a significant outage programme and on the regulatory front the European Commission’s approval of the CfD meant we could complete the final stages of the upgrade to our third biomass unit.

A. The most important change was the new Group strategy, which gives us all a very clear direction for the future and will see Drax become a broader business across our markets – pellet supply, generation and retail. The acquisition of Opus Energy will strengthen our retail offer, and our plans to build four rapid response gas power stations will plug the gaps at times of system stress.

The new Group strategy is underpinned by new people and IT strategies which are crucial to its successful delivery.

Haven Power has also seen significant change with the arrival of CEO Jonathan Kini. He, along with his team have been working to ensure we are well placed to continue growing and to boost our retail offer with the recent acquisition of Opus.

A. The focus will be on continuing to deliver good performance right across the Group, but there will also be changes as we work closely with the Opus team to ensure we create the best possible retail offer for the UK’s SMEs. Drax Power will be progressing the OCGT gas projects, and it will be an exciting year for Drax Biomass as they look to secure acquisitions of pellet mills and opportunities to export compressed word pellets to other markets. Everyone across the Group will see further evidence of the new strategy roll-out, particularly in the form of the people and IT strategies.

A. It complements it perfectly. The European Commission’s approval of the CfD enabled us to complete the upgrade of half the power station to run on compressed wood pellets in place of coal and in 2016, 65% of the electricity we generated at Drax was renewable.

The job is not yet done, and with the right conditions we will upgrade the remaining coal units. We can do this in just two to three years, when the conditions are right.

The planned gas power stations will not be run to produce baseload power, but as rapid response units to plug the gaps at times of system stress, for example when wind and solar fail to contribute what’s required. They will also be part of a solution that can accelerate the end of coal in the UK.

A. We acquired Haven in 2009 when it was an SME focused business. Since then the business has grown significantly by principally focusing on the I&C market to provide a route to market for around half the electricity Drax Power produces, although it retains a relatively small SME presence.

Opus – like Haven – is a challenger business and brings with it 265,000 customer metered sites, largely SMEs. Opus also supplies gas, which for the first time will see us having the ability to provide a dual fuel offer, something that is vital for many SMEs.

Opus gives us immediate scale in the SME market and we think the complementary nature of the Haven and Opus models can provide a compelling challenger retail proposition for our customers.

A. Yes, Jonathan Kini, who leads our retail business has a great depth of experience in SME markets and integration. He has strengthened his team to ensure we have the expertise required to make this a very successful transition as Opus becomes a member of the Drax family.

However, I’m in no way complacent about the challenges, that’s why we developed a plan to embed Opus covering everything from IT to communications. It’s vital we get this right and that our new colleagues become part of delivering our new Group strategy and share in our values. Clearly I also want both Haven and Opus customers to continue experiencing high levels of service along with the benefits of a more comprehensive retail offer.

A. In many ways Drax is now a very different place to what it was when I joined Drax more than ten years ago. The fact that in 2016 65% of our output was renewable is something I’m very proud of, and right across the power station you can actually see the difference that using compressed wood pellets has made: huge storage domes, specially designed train wagons, and a visitor centre and guides explaining the latest chapter in the Drax story.

Essentially today the power station operates as two power stations: a reliable, flexible, renewable generator producing electricity for businesses and homes and a fossil fuel generator providing system support and security of supply.

A. Increasing levels of intermittent renewables and inflexible nuclear present the grid with a challenge, and for Drax, opportunities.

When the grid needs capacity our coal units have the flexibility to turn on and off, and ramp up and down responding to demand as weather and time of day determine the availability of wind and solar. It is already common place for Drax to “two-shift” the coal units; using them to provide flexible, responsive power, rather than baseload.

But it’s not just about generation – a well-functioning grid needs other services too. 2017 will see Drax seeking further opportunities to provide the electricity grid with this increasingly important system support.

A. Our business model is largely unaffected by the decision to leave the EU. We will continue to generate and sell power in the UK. We purchase a significant amount of the fuel we require in foreign currency and our long-term hedging strategy – five years ahead – has protected us against any negative impacts of exchange rate fluctuations for the medium-term.

A. I think that still remains to be seen. We have to look at the huge changes that have happened in Government since the EU referendum as a potential opportunity for us as we continue to make the case for investment in further biomass upgrades.

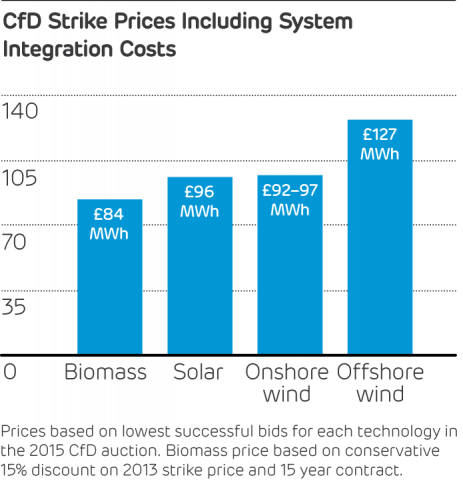

What is clear is that the focus is still very much on affordable energy. In 2016, Imperial College London and the economic consultancy NERA published new research that we commissioned. It showed that when whole system costs are factored in biomass is the cheapest large scale renewable technology. If Government applied this method of support to future CfD auctions, consumers could benefit by up to £2.2 billion.

As we take forward our new strategy we will also be clearly communicating our plans for rapid response gas power stations and how the system support they will provide contributes to decarbonising the UK’s energy system.

A. We have now delivered on our original strategy to upgrade three generating units to run on compressed wood pellets. However, we would like to do more, and have consistently said that with the right conditions we stand ready to convert further units.

The transformation we’ve been through has meant we’ve learnt a huge amount over the last few years, and there’s no doubt that for future upgrades we can carry them out quicker and more cost-effectively.

A. I think many companies involved in the sourcing and supply of sustainable products will face questions in this area. What we will do is continue to be open and honest about all aspects of how our business operates including sustainability. Much of that evidence can be seen in this annual report, from our own stringent sustainability policy, to how we comply with the UK Government’s sustainability legislation criteria.

However, we are never complacent and for example each new pellet supplier to Drax is fully and independently audited before a contract is signed and our existing suppliers are audited at least once every three years.

A. I’m a non-executive director at the Eaton Corporation and also the Court of the Bank of England. I think it’s important to have roles outside the business, as long as they allow you to get the balance right and these do. So, clearly they should in no way be a distraction from the “day job”, but worth an investment of time that allows you to see how others operate and whether there are lessons that we can learn or best practice that we can adopt.

A. I’d say it’s one of excitement at the opportunities our new Group strategy and acquisitions present for the future. While there’s obviously satisfaction that we’ve delivered on what we initially set out to do – upgrade three generating units to run on compressed wood pellets, there is certainly no feeling of “job done”.

In the months ahead the Board will rightly want to see clear and positive progress as we work to boost our retail offer through Opus Energy and develop our plans to build four rapid response gas power stations.