View the Drax Group plc annual report and accounts

Q. Do you think performance got better or worse in 2016?

A. Financially, EBITDA was in line with our guidance, although below 2015. This principally reflects very challenging commodity markets and the removal of the Climate Change Levy exemption.

We were able to partly offset the impact of these factors with a focus on flexible system support, in the prompt and balancing markets, ancillary services and improving retail profitability, all of which are important parts of our strategy to develop broader, non-commodity exposed earnings.

Operationally, 2016 was another good year across our business, but particularly

in generation where the team completed a significant outage programme and on the regulatory front the European Commission’s approval of the CfD meant we could complete the final stages of the upgrade to our third biomass unit.

Q. What were the most significant changes for the Group in 2016?

A. The most important change was the new Group strategy, which gives us all a very clear direction for the future and will see Drax become a broader business across our markets – pellet supply, generation and retail. The acquisition of Opus Energy will strengthen our retail offer, and our plans to build four rapid response gas power stations will plug the gaps at times of system stress.

The new Group strategy is underpinned by new people and IT strategies which are crucial to its successful delivery.

Haven Power has also seen significant change with the arrival of CEO Jonathan Kini. He, along with his team have been working to ensure we are well placed to continue growing and to boost our retail offer with the recent acquisition of Opus.

Q. How do you think 2017 will be different to 2016?

A. The focus will be on continuing to deliver good performance right across the Group, but there will also be changes as we work closely with the Opus team to ensure we create the best possible retail offer for the UK’s SMEs. Drax Power will be progressing the OCGT gas projects, and it will be an exciting year for Drax Biomass as they look to secure acquisitions of pellet mills and opportunities to export compressed word pellets to other markets. Everyone across the Group will see further evidence of the new strategy roll-out, particularly in the form of the people and IT strategies.

Q How does diversifying into gas fit with your aim to replace coal with renewable generation at Drax?

A. It complements it perfectly. The European Commission’s approval of the CfD enabled us to complete the upgrade of half the power station to run on compressed wood pellets in place of coal and in 2016, 65% of the electricity we generated at Drax was renewable.

The job is not yet done, and with the right conditions we will upgrade the remaining coal units. We can do this in just two to three years, when the conditions are right.

The planned gas power stations will not be run to produce baseload power, but as rapid response units to plug the gaps at times of system stress, for example when wind and solar fail to contribute what’s required. They will also be part of a solution that can accelerate the end of coal in the UK.

Q. Can you explain the acquisition of Opus? Wouldn’t it have made more sense to grow Haven?

A. We acquired Haven in 2009 when it was an SME focused business. Since then the business has grown significantly by principally focusing on the I&C market to provide a route to market for around half the electricity Drax Power produces, although it retains a relatively small SME presence.

Opus – like Haven – is a challenger business and brings with it 265,000 customer metered sites, largely SMEs. Opus also supplies gas, which for the first time will see us having the ability to provide a dual fuel offer, something that is vital for many SMEs.

Opus gives us immediate scale in the SME market and we think the complementary nature of the Haven and Opus models can provide a compelling challenger retail proposition for our customers.

Q. Have you got the right team and systems in place to ensure that Opus will join the group with minimal disruption?

A. Yes, Jonathan Kini, who leads our retail business has a great depth of experience in SME markets and integration. He has strengthened his team to ensure we have the expertise required to make this a very successful transition as Opus becomes a member of the Drax family.

However, I’m in no way complacent about the challenges, that’s why we developed a plan to embed Opus covering everything from IT to communications. It’s vital we get this right and that our new colleagues become part of delivering our new Group strategy and share in our values. Clearly I also want both Haven and Opus customers to continue experiencing high levels of service along with the benefits of a more comprehensive retail offer.

Q. How is Drax Power different to when you joined?

A. In many ways Drax is now a very different place to what it was when I joined Drax more than ten years ago. The fact that in 2016 65% of our output was renewable is something I’m very proud of, and right across the power station you can actually see the difference that using compressed wood pellets has made: huge storage domes, specially designed train wagons, and a visitor centre and guides explaining the latest chapter in the Drax story.

Essentially today the power station operates as two power stations: a reliable, flexible, renewable generator producing electricity for businesses and homes and a fossil fuel generator providing system support and security of supply.

Q. You have highlighted the role that Drax coal units can play in system support and ancillary services – what is this and why is it important?

A. Increasing levels of intermittent renewables and inflexible nuclear present the grid with a challenge, and for Drax, opportunities.

When the grid needs capacity our coal units have the flexibility to turn on and off, and ramp up and down responding to demand as weather and time of day determine the availability of wind and solar. It is already common place for Drax to “two-shift” the coal units; using them to provide flexible, responsive power, rather than baseload.

But it’s not just about generation – a well-functioning grid needs other services too. 2017 will see Drax seeking further opportunities to provide the electricity grid with this increasingly important system support.

Q. Did the result of the UK’s EU referendum have any impact on the business?

A. Our business model is largely unaffected by the decision to leave the EU. We will continue to generate and sell power in the UK. We purchase a significant amount of the fuel we require in foreign currency and our long-term hedging strategy – five years ahead – has protected us against any negative impacts of exchange rate fluctuations for the medium-term.

Q. Has the change in the UK Government resulted in any different signals being sent out to the renewables sector?

A. I think that still remains to be seen. We have to look at the huge changes that have happened in Government since the EU referendum as a potential opportunity for us as we continue to make the case for investment in further biomass upgrades.

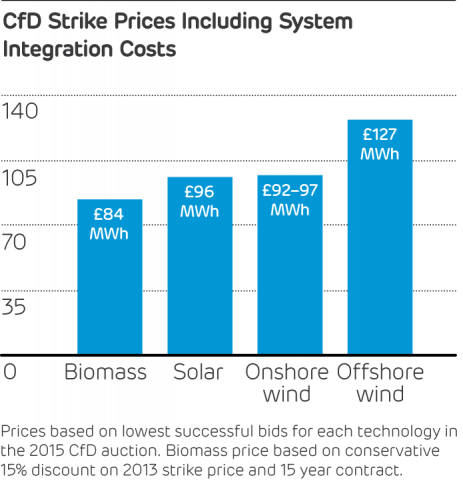

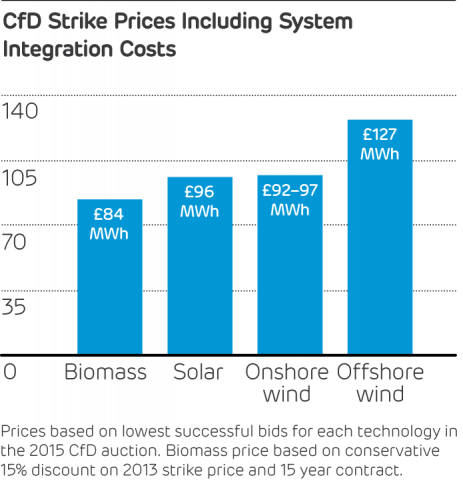

What is clear is that the focus is still very much on affordable energy. In 2016, Imperial College London and the economic consultancy NERA published new research that we commissioned. It showed that when whole system costs are factored in biomass is the cheapest large scale renewable technology. If Government applied this method of support to future CfD auctions, consumers could benefit by up to £2.2 billion.

As we take forward our new strategy we will also be clearly communicating our plans for rapid response gas power stations and how the system support they will provide contributes to decarbonising the UK’s energy system.

Q. What are the latest plans to convert the remaining generating units that run on coal?

A. We have now delivered on our original strategy to upgrade three generating units to run on compressed wood pellets. However, we would like to do more, and have consistently said that with the right conditions we stand ready to convert further units.

The transformation we’ve been through has meant we’ve learnt a huge amount over the last few years, and there’s no doubt that for future upgrades we can carry them out quicker and more cost-effectively.

Q. Why do you think questions around the sustainability of biomass continue to be raised?

A. I think many companies involved in the sourcing and supply of sustainable products will face questions in this area. What we will do is continue to be open and honest about all aspects of how our business operates including sustainability. Much of that evidence can be seen in this annual report, from our own stringent sustainability policy, to how we comply with the UK Government’s sustainability legislation criteria.

However, we are never complacent and for example each new pellet supplier to Drax is fully and independently audited before a contract is signed and our existing suppliers are audited at least once every three years.

Q. Which other business roles do you have outside of Drax and how do they help the Group

A. I’m a non-executive director at the Eaton Corporation and also the Court of the Bank of England. I think it’s important to have roles outside the business, as long as they allow you to get the balance right and these do. So, clearly they should in no way be a distraction from the “day job”, but worth an investment of time that allows you to see how others operate and whether there are lessons that we can learn or best practice that we can adopt.

Q. What’s the feeling around the Board table?

A. I’d say it’s one of excitement at the opportunities our new Group strategy and acquisitions present for the future. While there’s obviously satisfaction that we’ve delivered on what we initially set out to do – upgrade three generating units to run on compressed wood pellets, there is certainly no feeling of “job done”.

In the months ahead the Board will rightly want to see clear and positive progress as we work to boost our retail offer through Opus Energy and develop our plans to build four rapid response gas power stations.

View the Drax Group plc annual report and accounts

“I was a student in the Process Operations Technology programme at Southwest Mississippi Community College and Drax came to the school to recruit new grads. They were introducing a new technology I’d never heard of and it sparked my interest.

“I was a student in the Process Operations Technology programme at Southwest Mississippi Community College and Drax came to the school to recruit new grads. They were introducing a new technology I’d never heard of and it sparked my interest. “I’ve always wanted to work in renewable energy and I studied life cycle analysis during my degree. I started looking for jobs in renewable energy, and as the biggest generator of renewable energy in the UK, Drax was an obvious choice!

“I’ve always wanted to work in renewable energy and I studied life cycle analysis during my degree. I started looking for jobs in renewable energy, and as the biggest generator of renewable energy in the UK, Drax was an obvious choice! “I’ve always enjoyed building and fixing things. Given that my father and both grandfathers were in engineering – one of them even working at Drax

“I’ve always enjoyed building and fixing things. Given that my father and both grandfathers were in engineering – one of them even working at Drax