| Six months ended 30 June | H1 2019 | H1 2018 (restated) |

|---|---|---|

| Key financial performance measures | ||

| Adjusted EBITDA (£ million) | 138 | 102 |

| Net cash from operating activities (£ million) | 197 | 112 |

| Net debt (£ million) | 924 | 366 |

| Interim dividends (pence per share) | 6.4 | 5.6 |

| Adjusted basic earnings per share (pence) | 2 | 1.6 |

| Total financial performance measures | ||

| Operating profit (£ million) | 34 | 12 |

| Profit / (loss) before tax (£ million) | 4 | -11 |

| Basic earnings / (loss) per share (pence) | 1 | -1 |

Financial highlights

- Group Adjusted EBITDA up 35% to £138 million (H1 2018: £102 million)

- Includes £36 million from acquired Hydro and Gas assets

- Excludes £34 million of capacity payments (H1 2018: £6 million recognised) – expect Capacity Market to be re-established in 2019

- Sustainable and growing dividend

- Interim dividend up 12.5% to £25 million (6.4 pence per share) (H1 2018: £22 million, 5.6 pence per share)

- Expected 2019 full year dividend up 12.5% to £63 million (15.9 pence per share) (2018: £56 million)

- Good progress with refinancing of acquisition bridge facility, continue to expect completion during 2019

- On track to deliver 2x net debt / Adjusted EBITDA by year end, assuming reinstatement of the Capacity Market

Operational highlights

- Integration of acquired Hydro and Gas assets progressing well

- Strong system support performance – 92% increase in value from flexibility(5) – £69 million (H1 2018: £36 million)

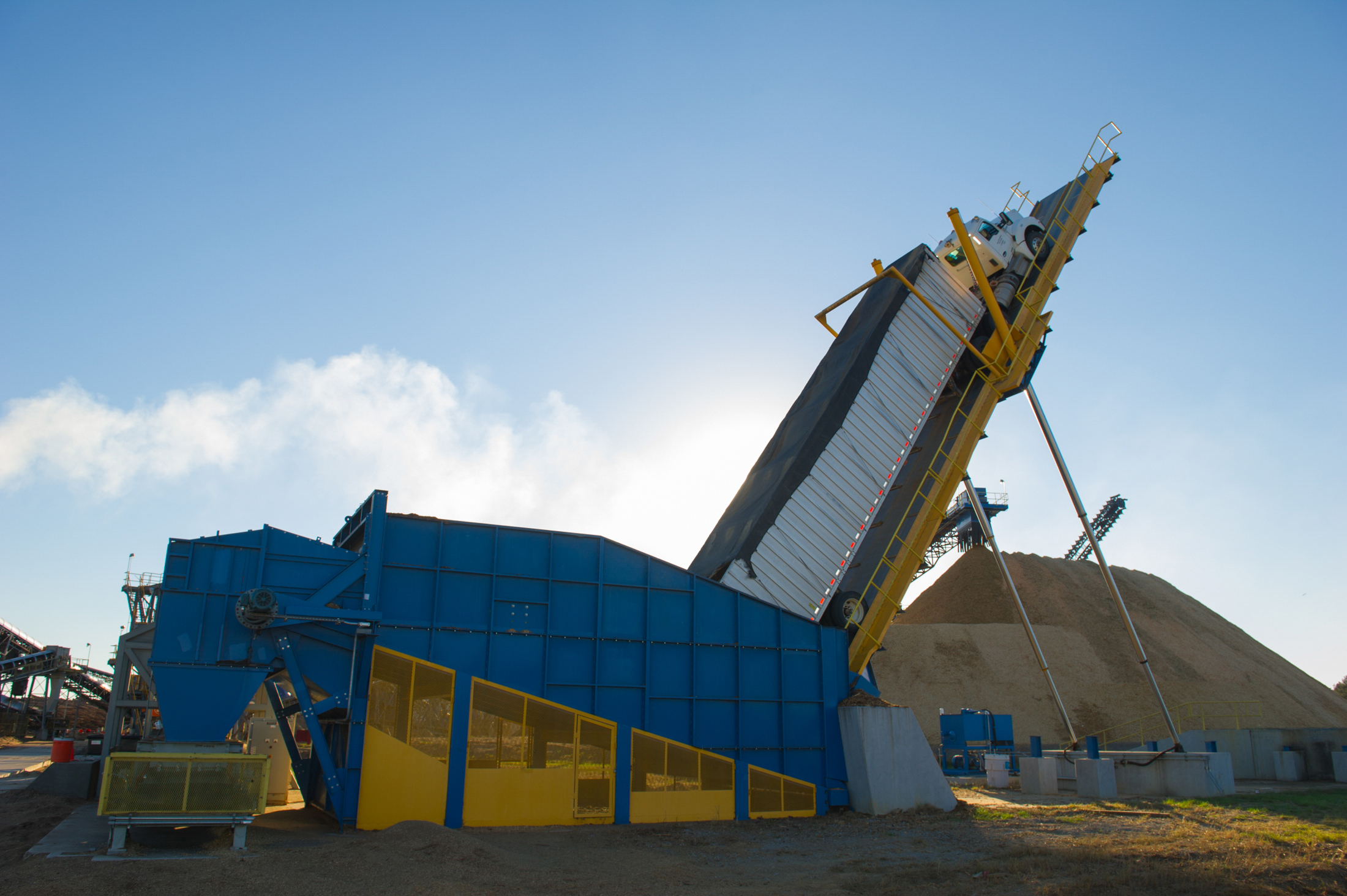

- Progress with biomass cost reduction – LaSalle sawmill co-location and rail spur operational

- 52% reduction in reported carbon emissions – 128tCO2/GWh (H1 2018: 265tCO2/GWh)

Progress with strategic initiatives

- Planned expansion of biomass self-supply – 0.35Mt of new capacity and lower cost biomass

- Development of options for BECCS(6) – potential for large-scale carbon negative generation at Drax Power Station

- Planning approval for third OCGT(7) received, expect fourth OCGT and coal-to-gas CCGT(8) approval in 2019

Outlook

- Full year EBITDA and net debt expectations unchanged; remain subject to re-establishment of Capacity Market

- Generation – strong contracted position and system support services, higher H2 biomass generation

- Pellet Production – growth in H2 pellet volumes, focus on cost reduction and improved quality

- Customers (formerly B2B Energy Supply) – focus on increasing gross profit, reducing bad debt and cost to serve

- Attractive investment options for growth: biomass capacity expansion, cost reduction and new gas generation

Will Gardiner, Chief Executive of Drax Group said:

“Drax Group has delivered strong profit and dividend growth in the first half of the year. Integration of our new Hydro and Gas generation assets is progressing well and the value the Group delivers from supporting the energy system has almost doubled. Drax is supporting British business with innovative new energy services and, despite challenging market conditions, our Customers business continues to grow. Our biomass cost reduction initiative and plans for expanded biomass self-supply are going well.

“Drax wholeheartedly supports the UK’s target of achieving net zero carbon emissions by 2050.”

“Reducing our greenhouse gas emissions by half in the past year underscores Drax’s commitment to this goal. With the right investment and regulatory framework we could go further and Drax could become the world’s first carbon negative power station – something the UK Committee on Climate Change recognises will be crucial.”

Operational review

Pellet Production – Focus on capacity expansion with good quality pellets at lowest cost

Adjusted EBITDA of £8 million (H1 2018: £10 million)

Adjusted EBITDA of £8 million (H1 2018: £10 million)

- Pellet production 0.65Mt (H1 2018: 0.66Mt) – weather-affected forestry activities and lower pellet production

- Good progress with cost reduction initiatives

- Initiatives for run rate savings of £10/MWh on 0.45Mt pa from LaSalle pellet plant

- Rail spur operational May 2019 – reduction in transport cost to Port of Baton Rouge

- Co-location agreement with Hunt Forest Products for low-cost sawmill residues, now operational

- Port of Baton Rouge rail agreement – increased rail capacity and lower costs for LaSalle and Morehouse

- Capacity expansion with run rate savings of £20/MWh on 0.35Mt

- £50 million investment in 0.35Mt capacity increase at LaSalle, Morehouse and Amite, commissioning 2020/21

- Pellet and hammermill upgrades to enable greater utilisation of low-cost sawmill residues and dry shavings

- Initiatives for run rate savings of £10/MWh on 0.45Mt pa from LaSalle pellet plant

Power Generation – Flexible, low-carbon and renewable generation

- Adjusted EBITDA of £148 million (H1 2018: £88 million)

- Contribution of Hydro and Gas assets following acquisition from ScottishPower – £36 million

- Strong system support performance – 92% increase in value from flexibility(5) – £69 million (H1 2018: £36 million)

- Suspension of Capacity Market – £34 million of H1 revenue not accrued (H1 2018: £6 million recognised)

- Biomass output (net sales) up 2% to 6.4TWh (H1 2018: 6.3TWh)

- ROC(9) generation reprofiled to reflect weather-affected US biomass supplies – optimise within ROC cap and utilise fourth biomass unit to produce expected higher levels of ROC generation in H2 2019

- Lower thermal output

- Coal – higher carbon costs, lower margins and reduced output – buy back opportunities for hedged sales

- Gas – Damhead Creek restricted hours ahead of inspection and Shoreham interim inspection brought forward

Customers – Continued growth in meters and margin per MWh, implementing structure to support long-term growth

Adjusted EBITDA of £9 million (H1 2018: £16 million)

Adjusted EBITDA of £9 million (H1 2018: £16 million)

- Increased operating costs associated with integration, restructuring and development of next generation system

- Weather-related reduction in energy consumption and increased focus on margin per MWh

- Continued growth in gross profit per MWh

- Growth in customer meters to 405,000 (H2 2018: 396,000)

- Improvement in bad debt £13 million (H1 2018: £18 million)

- Progressing with integration of Opus and Haven

- Focused on creation of scalable platform for growth, improved gross margin, reduction in bad debt and cost to serve

Group financial information

- Tax rate benefits from Patent Box claims – Corporation Tax rate of 10% on profits arising from the use of biomass innovation

- Capital investment of £60 million, full year expectations unchanged (£170 – £190 million)

- Includes 0.35Mt of new low-cost US pellet capacity (£10 million in 2019 and £40 million in 2020/21)

- Net debt of £924 million, including cash and cash equivalents of £244 million (31 December 2018: £289 million)

- Expect 2x net debt to Adjusted EBITDA by end of 2019 subject to re-establishment of Capacity Market

Notes:

- H1 2018 restated to reflect adoption of IFRIC guidance issued in respect of derivative contract accounting consistent with the approach taken in the 2018 Annual Report.

- Adjusted Results are stated after adjusting for exceptional items (including acquisition and restructuring costs, asset obsolescence charges and debt restructuring costs), and certain remeasurements.

- Earnings before interest, tax, depreciation, amortisation, excluding the impact of exceptional items and certain remeasurements.

- Borrowings less cash and cash equivalents (see note 12 to condensed consolidated interim financial statements).

- Balancing Market, Ancillary Services and lower-cost coals.

- BioEnergy Carbon Capture and Storage.

- Open Cycle Gas Turbine.

- Combined Cycle Gas Turbine.

- Renewable Obligation Certificate.

Read full Report | View investor presentation | Sign up or watch webcast | Read press release