Key takeaways:

- As the UK continues to expand its renewable capacity the cost of curtailing wind generation at times of low demand is increasing, adding £806 million to bills over the last two years.

- Curtailment costs arise from the grid paying to turn down generation due to energy balancing or system balancing issues.

- Long-duration storage, such as pumped storage hydro, offers a way to absorb excess wind power, reducing the cost of keeping the system balanced.

- Drax’s plans to expand Cruachan Power Station would increase the amount of excess power it can absorb from 400 MW to over one gigawatt, and rapidly deliver the same amount back to the grid when needed.

- New financial mechanisms, such as a cap and floor regime, are needed to enable investors to back capital-intensive, long-term projects that will save consumers and the grid millions.

Meeting big ambitions takes big actions. And there’re few ambitions as big, or as urgent, as achieving a net zero power sector by 2035.

This energy transition must mean more low carbon power sources and fewer fossil fuels. But delivering that future requires new ways of managing power, balancing the grid and a new generation of technologies, innovation, and thinking to make big projects a reality.

As the system evolves and more renewables, particularly wind, come online, the UK is forecast to need 10 times more energy storage to deliver power when wind-levels drop, as well as absorb excess electricity when supply outstrips demand, and to maintain grid stability. Pumped hydro storage offers a tried and tested solution, but with no new long-duration storage projects built for almost 40 years in the UK, the challenges of bringing long-term projects to fruition are less engineering than they are financial.

Drax’s plan to expand Cruachan Power Station to add as much as 600 megawatts (MW) of additional capacity will help support a renewable, more affordable, net zero electricity system. But government action is needed to unlock a new generation of projects that deliver electricity storage at scale.

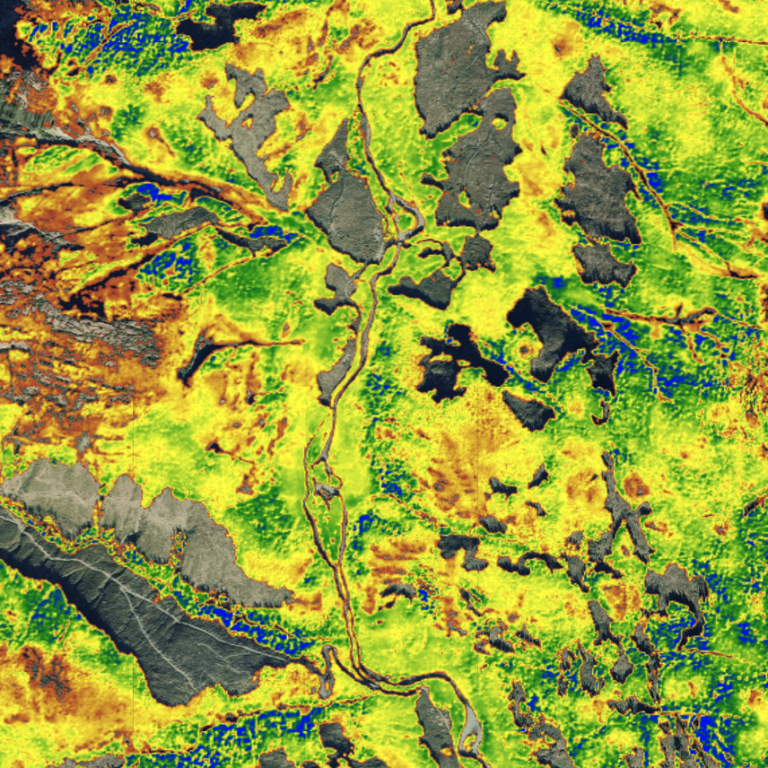

Reigning in excess wind power

Wind is the keystone power source in the UK’s renewable ambitions. Wind capacity increased from 5.4 GW in 2010 to 25.7 GW in 2021 – enough to provide renewable power for almost 20 million homes – and the government aims to increase this to 50 GW by 2030.

However, wind comes with challenges: the volume of electricity being generated must always match the level of demand. If there is a spike in electricity demand when there are low wind-levels, other technologies, such as electricity storage or carbon-emitting gas power, are required to make up the shortfall.

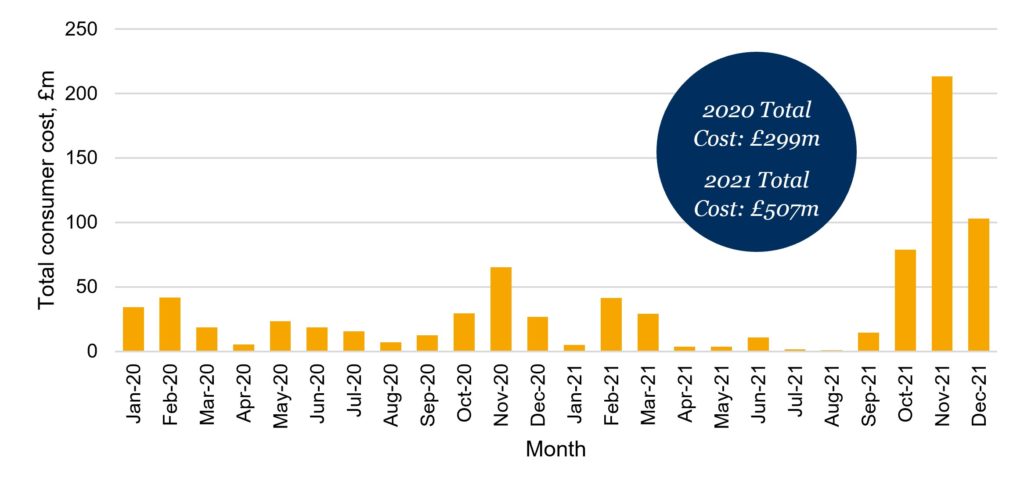

Conversely, if there is too much wind power being generated and not enough demand for electricity the grid often has to pay windfarms to stop generating. This is known as wind curtailment and it’s becoming more expensive, growing from £300 million during 2020 to more than £500 million in 2021.

An independent report by Lane Clark & Peacock (LCP), by Drax, found that over the last two years curtailing wind power added £806 million to energy bills in Britain.

There can also be a carbon cost to curtailing wind power. As more intermittent renewables come onto the system the grid can become more unstable and difficult to balance. In such an event the National Grid is required to turn to fossil fuel plants, like gas generation, that can deliver balancing and ancillary services like inertia, voltage control and reserve power that wind and solar can’t provide.

“It’s lose-lose for everyone,” says Richard Gow, Senior Government Policy Manager at Drax. “Consumers are paying money to turn off wind and to turn up gas generation because there’re not enough sources of ancillary services on the system or renewable power can’t be delivered to where it’s needed.”

“Curtailment costs have spiked this year because of gas prices, and while they might dip in the next two or three years, curtailment costs are only ever going to increase. If there’s wind power on the system without an increase in storage, the cost of managing the system is only going to go up and up.”

Source: the LCP’s ‘Renewable curtailment and the role of long duration storage’ report, click to view/download here.

The proposed Cruachan 2 expansion would help the grid avoid paying to turn off wind farms by increasing the amount it would be able to absorb from 400 MW to over 1,000 MW, and rapidly deliver the same amount of zero carbon power back to the grid should wind levels suddenly drop or the grid need urgent balancing.

Adding this kind of capability is a huge engineering project, involving huge new underground caverns, tunnels and waterways carved out of the rock below Ben Cruachan. However, the challenge in such a project lies less with the scale of the engineering than with its financeability.

From blueprints to real change

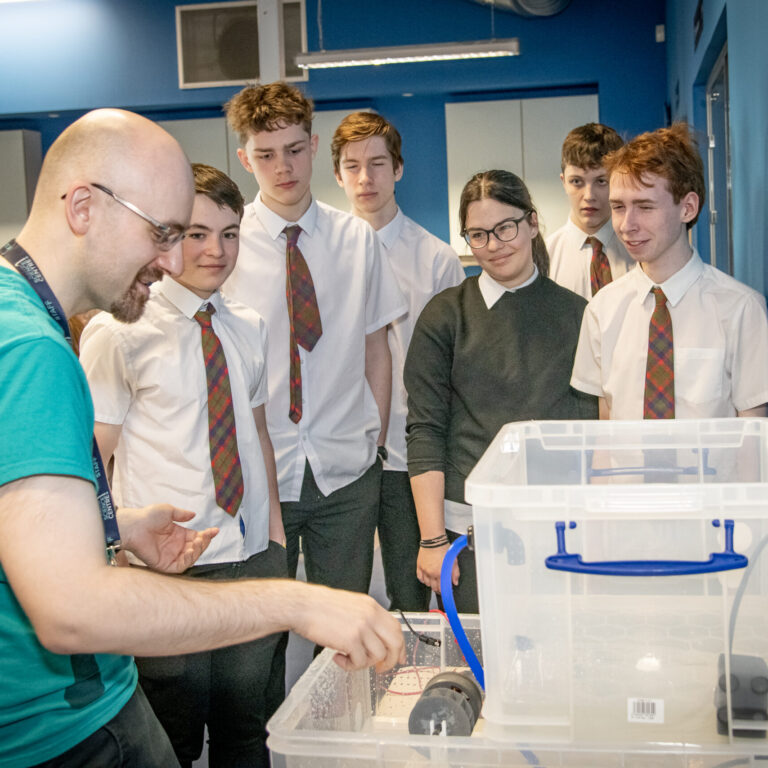

The original Cruachan Power Station’s six-year construction period began in 1959. The work of digging into the mountainside was carried out by a team of 1,300 men, known affectionately as the Tunnel Tigers, armed with hand drills and gelignite explosives in an era before modern health and safety practices.

Engineer working at Cruachan Power Station

Expanding Cruachan in the 21st century will be quite a different, and safer process, and one that’s practically, straightforward.

“There is no reason why we physically couldn’t build Cruachan 2,” says Gow. “Detailed engineering work has indicated that this is a very feasible project. There’s no technological reason or physical constraint that would prevent us. It has a large upfront cost, and requires drilling into a mountain, but the challenge is much more on the financial, particularly securing the investment, side of the project.”

Pumped storage hydro facilities today generate their revenues from three different markets: the capacity market, where they receive a flat rate per kilowatt they deliver to the grid; the wholesale and balancing market, where they buy power to store when it’s abundant and cheap and sell it back to the grid when it’s needed, more valuable and used to support the Electricity System Operator in matching supply and demand on a second-by-second basis; and through ancillary services contracts, dedicated to specific stability services.

These available markets present challenges for ambitious, capital-intensive projects designed to operate at scale. With the exception of the capacity market, revenues from these markets are often volatile and difficult to forecast, with no long-term contracts available.

Sourcing the investment needed to build projects on the scale of Cruachan 2 requires mechanisms to attract investors comfortable with long project development lead times that offer stable, low risk, rates of return in the long-term.

Cap and floor

An approach that can provide sufficient certainty to investors that income will cover the cost of debt and unlock finance for new projects is known as a ‘cap and floor’ regime.

With cap and floor, a facility’s revenues are subject to minimum and maximum levels. If revenues are below the ‘floor’ consumers would top-up revenues, while earnings above the ‘cap’ would be returned to consumers. This means investors can secure upfront funding safe in the knowledge of revenue certainty in the long term, whilst also offering protection to consumers.

Such an approach won’t attract investors looking to make a fast buck, but the vital role that it could play in the ongoing future of the UK energy system offers a long-term, stable return. At the same time, the system would save both the grid and energy consumers hundreds of millions of pounds.

The cap and floor system is also not unique, with a similar approach currently used for interconnectors, the sub-marine cables that physically connect the UK’s energy system to nearby countries allowing the UK to trade electricity with them. This means investors are already familiar with cap and floor structures, how they operate and what kind of returns they can expect.

“It’s not just pumped storage hydro that this could apply to,” explains Gow. “There are other, different large-scale, long-duration storage technologies that this could also apply to.”

“It would give us revenue certainty so that we can invest to support the system and reduce the cost of curtailment while ensuring consumers get value for their money.”

The Turbine Hall inside Cruachan Power Station

Cruachan was originally only made possible through the advocacy and actions of MP and wartime Secretary of State for Scotland Tom Johnston. Then it was needed to help absorb excess generation from the country’s new fleet of nuclear power stations and release this to meet short term spikes in demand. Today it’s renewable wind the system must adapt to.

For the UK to continue to meet an ever-changing energy system the government must be prepared to act and enable projects at scale, that bring long-term transformation for a net zero future.