RNS Number: 9388L

Drax Group plc

(“Drax” or the “Group”; Symbol:DRX)

Highlights

- Strong system support and generation performance during first three months of 2024

- Full year 2024 expectations for Adj. EBITDA(1) in line with analysts’ consensus estimates(2)

- New balance sheet facilities further extending maturity profile

- £408 million(3) of term-loans with three to five year maturities

- €350 million five-year (2029) bond

- Repayment of 2025 bonds

- Notice of redemption of $500 million 2025 bond issued

- Tender process for repurchase of €250 million 2025 bond commenced

- Final dividend of 13.9 pence per share, subject to shareholder approval at today’s AGM

- Total dividend for 2023 of 23.1 pence per share (2022: 21.0 pence per share)

Drax Group CEO, Will Gardiner said:

Drax Group CEO, Will Gardiner

“We continue to deliver a strong system support and generation performance, providing dispatchable, renewable power for millions of homes and businesses.

“We are excited about the opportunity to deliver BECCS at Drax Power Station, the country’s largest source of 24/7 renewable power by output. With a bridging mechanism and the right support from Government, our BECCS plans could help the UK meet its net zero targets and continue to support the country’s long-term energy security, while creating thousands of new jobs across the region.

“BECCS can also help deliver the global energy transition and, through our new global BECCS business, we are continuing to develop options for projects in North America. These could provide long-term, large-scale carbon removals and attractive opportunities for growth as part of a potential trillion-dollar global carbon removals market.”

Biomass Generation

Drax Power Station, the UK’s largest source of 24/7 renewable power by output – supported by its integrated global biomass supply chain – is performing well, supporting UK energy security with flexible and reliable renewable power generation and a wide range of system support services.

As the demand for power and flexibility grows, Drax believes the size, flexibility and location of the asset make it an integral long-term part of the UK energy transition.

Flexible Generation and Energy Solutions

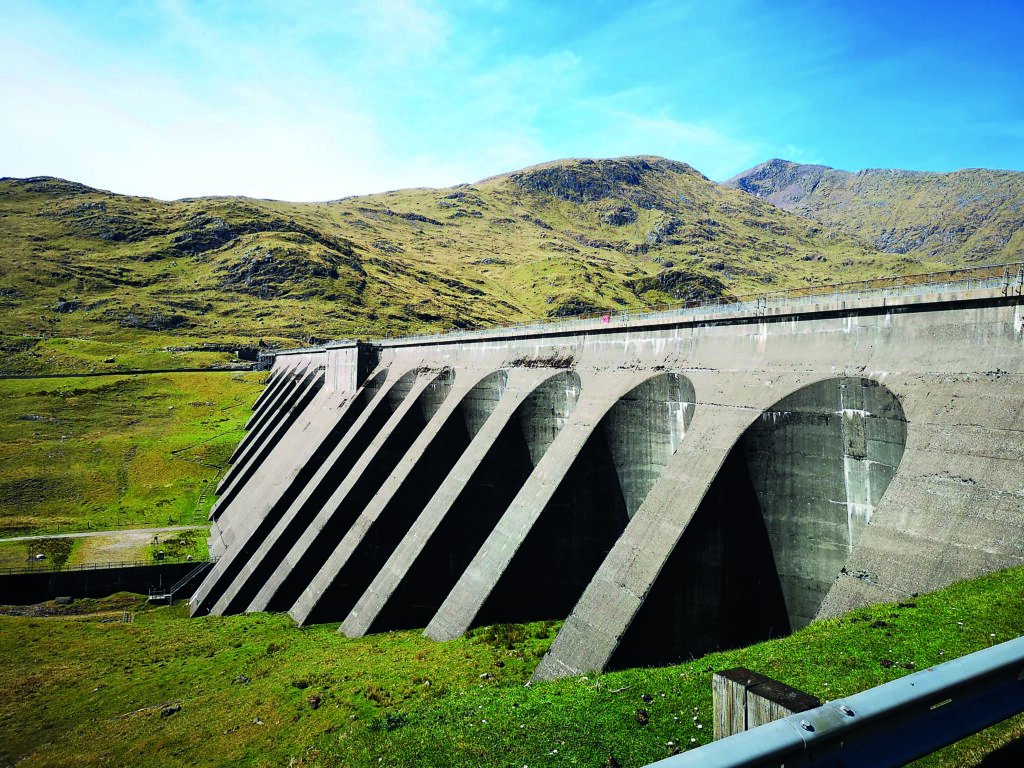

The Group’s pumped storage and hydro business is performing well, providing flexible and renewable power generation and a wide range of system support services.

Drax believes that the retirement of dispatchable thermal assets and increased reliance on intermittent renewables in the UK system, as well as a long-term increase in demand, will drive a growing need for dispatchable power and system support services, creating long-term enduring earnings opportunities for these assets.

Construction of three new Open Cycle Gas Turbines with combined capacity of c.900MW continues, with commissioning expected to take place from September 2024.

Generation contracted power sales

As at 22 April, Drax had over £2.9 billion of contracted forward power sales between 2024 and 2026 on its ROC, pumped storage and hydro generation assets – 23.3TWh(4) at an average price of £125.4/MWh(5). Both 2024 and 2025 are effectively fully hedged.

The Group has a further 3.4TWh of CfD generation contracted for 2024 and 2025.

| Contracted power sales as at 22 April 2024 | 2024 | 2025 | 2026 |

|---|---|---|---|

| Net ROC, hydro and gas (TWh)(4) | 10.4 | 9.9 | 3 |

| - Average achieved £ per MWh(5) | 153.1 | 108.4 | 84.8 |

| CfD (TWh) | 3.2 | 0.2 | - |

Pellet Production

The Group’s pellet production business has started the year well. The market remains challenging but, as a vertically integrated producer, user, buyer, and seller of biomass, Drax operates a differentiated model from its peers and sees the current global biomass market as representing a favourable balance of risks and opportunities for the Group.

Drax is positive on the outlook for biomass demand and expects this to grow, as sustainable woody biomass is increasingly used for BECCS, as well as for next-generation sustainable aviation fuels (SAF) and the Group continues to develop a pipeline of sales opportunities in these new markets.

Full Year Expectations

Drax continues to expect 2024 full year Adjusted EBITDA to be in line with analysts’ consensus estimates, subject to continued good operational performance.

Balance Sheet

Between February and April 2024, the Group completed c.£408 million of new term-loan facilities, which includes an optional uncommitted extension of £25 million.

These combined facilities have two tranches maturing in 2027(3) and 2029(3) and a margin referenced over SONIA (Sterling Overnight Index Average) for sterling loans and over EURIBOR (Euro Interbank Offered Rate) for euro loans.

In April 2024, the Group priced a new €350 million five-year (BBB-/BB+) bond issue with a rate of 5.875%.

Taken together these facilities provide proceeds of over £700 million, extending the Group’s maturity profile beyond 2027. The proceeds will be used for the repayment of 2025 maturities. As such, the Group has launched a tender offer process for its €250 million 2025 bond and also announced the full redemption of its $500 million 2025 bond, both of which are expected to complete in May 2024.

Ofgem

In May 2023, Ofgem announced the opening of an investigation into Drax Power Limited’s annual biomass profiling reporting under the Renewables Obligation scheme. In its opening statement, Ofgem confirmed that it had not established any non-compliance that would affect the issuance of ROCs. Drax awaits the conclusion of this investigation.

Bridging Mechanism and UK BECCS

In January 2024, the UK Government launched a consultation on a bridging mechanism to support large-scale biomass generators transitioning from their existing renewable schemes to BECCS. The consultation concluded in February 2024 and Drax awaits the Government’s response, which is expected shortly.

Over recent months Drax has continued to formally engage with the UK Government regarding a bridging mechanism and UK BECCS, and the outcome of the consultation is expected to be another stage in this process.

BECCS – Global

The Group is continuing to participate in the growing market for Carbon Dioxide Removals (CDRs), with incremental CDR sales at prices of up to $350/t. The certificates would be deliverable in 2030, in line with the Group’s plans for a first new-build BECCS plant in the US South.

BECCS Done Well

In 2022, Drax invited Jonathon Porritt, environmental campaigner and co-founder of Forum for the Future, to convene a High Level Panel (the Panel) to conduct an independent inquiry into BECCS, with Forum for the Future acting as Secretariat.

The Panel outlined 30 conditions that would demonstrate that BECCS from woody biomass can be “done well”, helping to deliver positive outcomes for nature, climate and people.

In July 2023 Drax published its initial response to the Panel’s recommendations and in April 2024 Drax published a second and final response. Further details are available via the link below.

‘BECCS Done Well’: Final response and commitments from Drax

Other

Drax will report its half year results on 26 July 2024.

Notes:

- Earnings before interest, tax, depreciation, amortisation, excluding the impact of exceptional items and certain remeasurements. Adjusted EBITDA includes the Electricity Generator Levy (EGL).

- As of 22 April 2024, analyst consensus for 2024 Adj. EBITDA (incl. EGL) was £968 million, with a range of £881 – 1,097 million. The details of this company collected consensus are displayed on the Group’s website.

https://www.drax.com/investors/consensus/

- 2027 term-loan: €135 million and £145 million, 2029 term-loan: €50 million and £80 million, with an optional uncommitted extension of £25 million.

- Includes 3.5TWh of structured power sales in 2025 and 2026 (forward gas sales as a proxy for forward power), transacted for the purpose of accessing additional liquidity for forward sales from RO units and highly correlated to forward power prices.

- Presented net of cost of closing out gas positions at maturity and replacing with forward power sales.

Enquiries:

Drax Investor Relations: Mark Strafford

mark.strafford@drax.com

+44 (0) 7730 763 949

Media:

Drax External Communications: Andy Low

andy.low@drax.com

+44 (0) 7841 068 415

Website: www.Drax.com

Forward Looking Statements

This announcement may contain certain statements, expectations, statistics, projections and other information that are, or may be, forward-looking. The accuracy and completeness of all such statements, including, without limitation, statements regarding the future financial position, strategy, projected costs, plans, beliefs, and objectives for the management of future operations of Drax Group plc (“Drax”) and its subsidiaries (the “Group”), are not warranted or guaranteed. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on circumstances that may occur in the future. Although Drax believes that the statements, expectations, statistics and projections and other information reflected in such statements are reasonable, they reflect Drax’s current view and no assurance can be given that they will prove to be correct. Such events and statements involve risks and uncertainties. Actual results and outcomes may differ materially from those expressed or implied by those forward-looking statements. There are a number of factors, many of which are beyond the control of the Group, which could cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements. These include, but are not limited to, factors such as: future revenues being lower than expected; increasing competitive pressures in the industry; uncertainty as to future investment and support achieved in enabling the realisation of strategic aims and objectives; and/or general economic conditions or conditions affecting the relevant industry, both domestically and internationally, being less favourable than expected, including the impact of prevailing economic and political uncertainty, the impact of strikes, the impact of adverse weather conditions or events such as wildfires. We do not intend to publicly update or revise these projections or other forward-looking statements to reflect events or circumstances after the date hereof, and we do not assume any responsibility for doing so.

END