Driven by our purpose

Chapter 1:

Welcome, 2020 highlights and market context

Welcome to Drax Group

Our purpose is to enable a zero carbon, lower cost energy future.

Our ambition is to become carbon negative by 2030. Being carbon negative means that we will be removing more carbon dioxide from the atmosphere than we produce throughout our direct business operations globally – creating a carbon negative company

Our strategic aims:

-

To build a long-term future for sustainable biomass

By expanding our sustainable bioenergy supply chain and reducing costs we are developing options for long-term biomass operations – renewable generation, negative carbon emissions, system support services and third party supply of biomass to international markets.

-

To be the leading provider of power system stability

Through a portfolio of flexible and renewable generation, and large industrial and commercial customer supply business, we will provide system support services to allow the power system to utilise intermittent renewable energy accelerating the UK’s decarbonisation en route to 2050.

-

To give our customers control of their energy

We provide our customers with renewable energy, and the opportunity to control and optimise energy use and cost, helping us support the energy system.

This webpage presents the Strategic Report section. View the full Drax Group plc Annual Report and Accounts PDF.

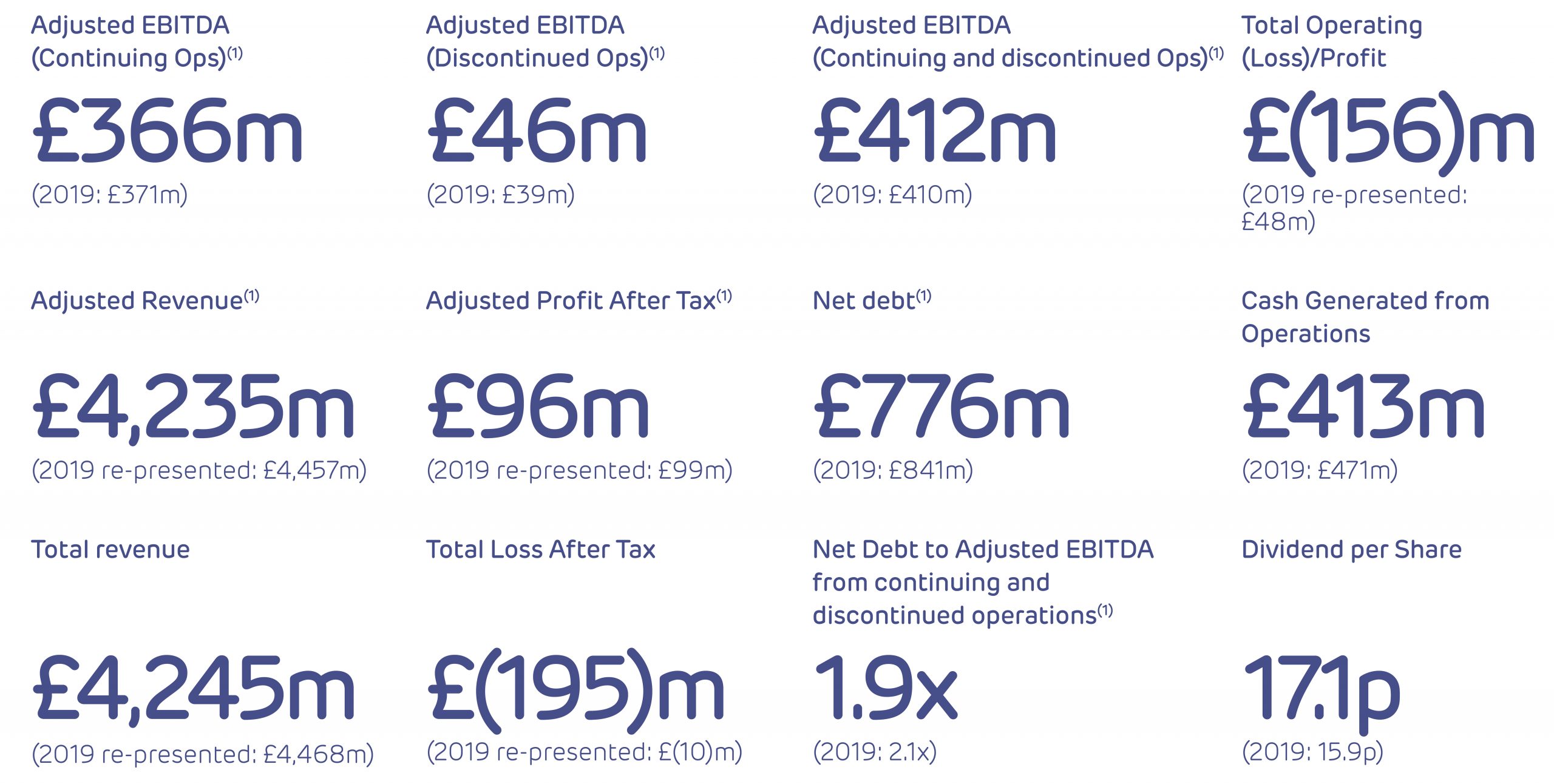

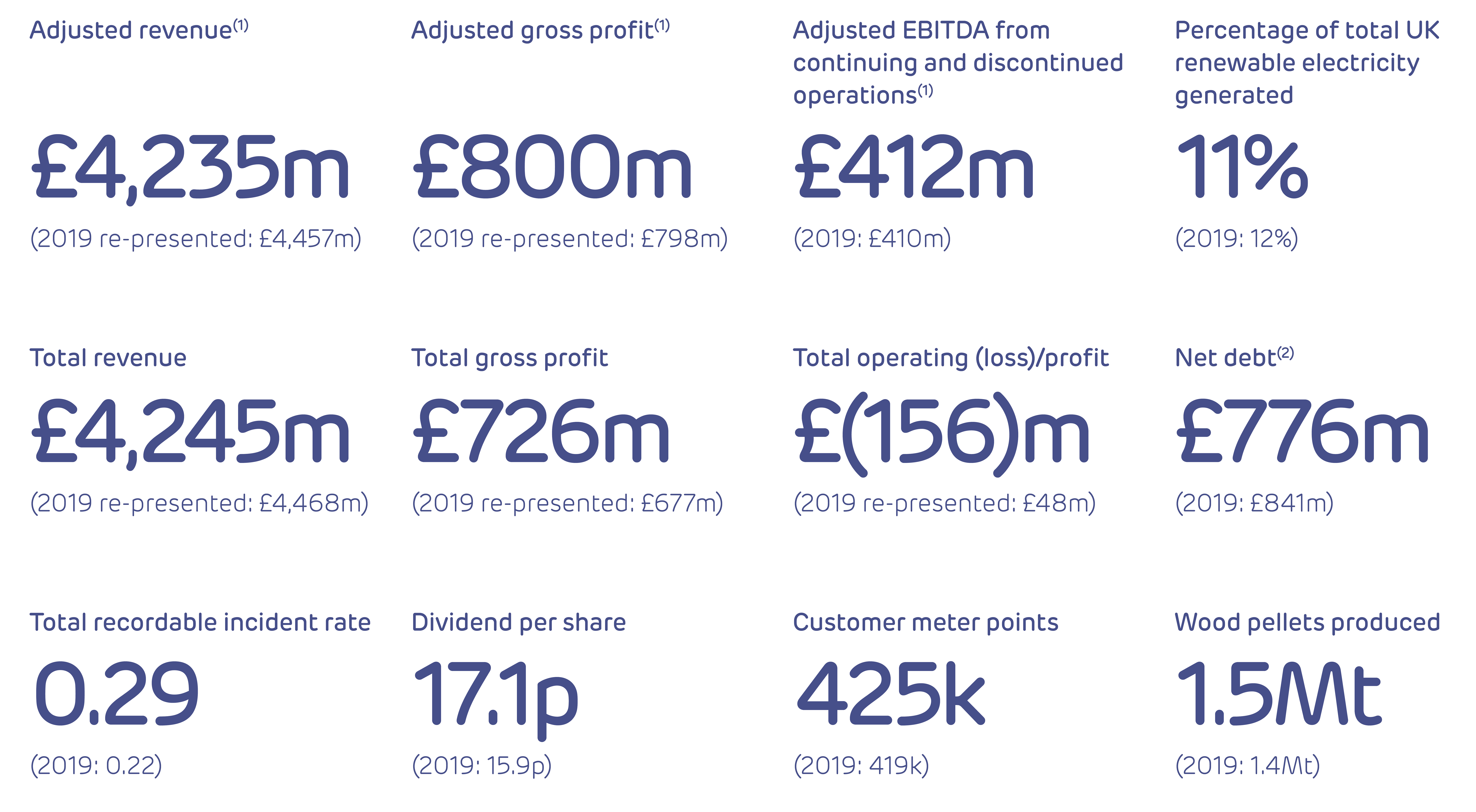

2020 highlights

(1) We calculate Adjusted financial performance measures, which are specific to Drax and exclude income statement volatility arising from derivative financial instruments and the impact of items we consider to be exceptional, to provide additional information about the Group’s performance. Adjusted financial performance measures are described more fully on page 153, with a reconciliation to their statutory equivalents in note 2.7 to the consolidated financial statements on page 170. Throughout this document we distinguish between Adjusted financial performance measures and Total financial performance measures, which are calculated in accordance with International Financial Reporting Standards (IFRS). On 15 December 2020, the Group announced the sale of its portfolio of CCGT assets to VPI Holdings in a deal worth up to £193 million (see page 21), which subsequently completed on 31 January 2021. As a result of this transaction, the results of the CCGT portfolio for 2019 and 2020 have been classified as discontinued operations in the consolidated financial statements. References to financial performance measures throughout this annual report refer to continuing operations, unless otherwise stated. Further details, and a full reconciliation of continuing, discontinued and total financial performance measures is included in note 5.5 to the consolidated financial statements.

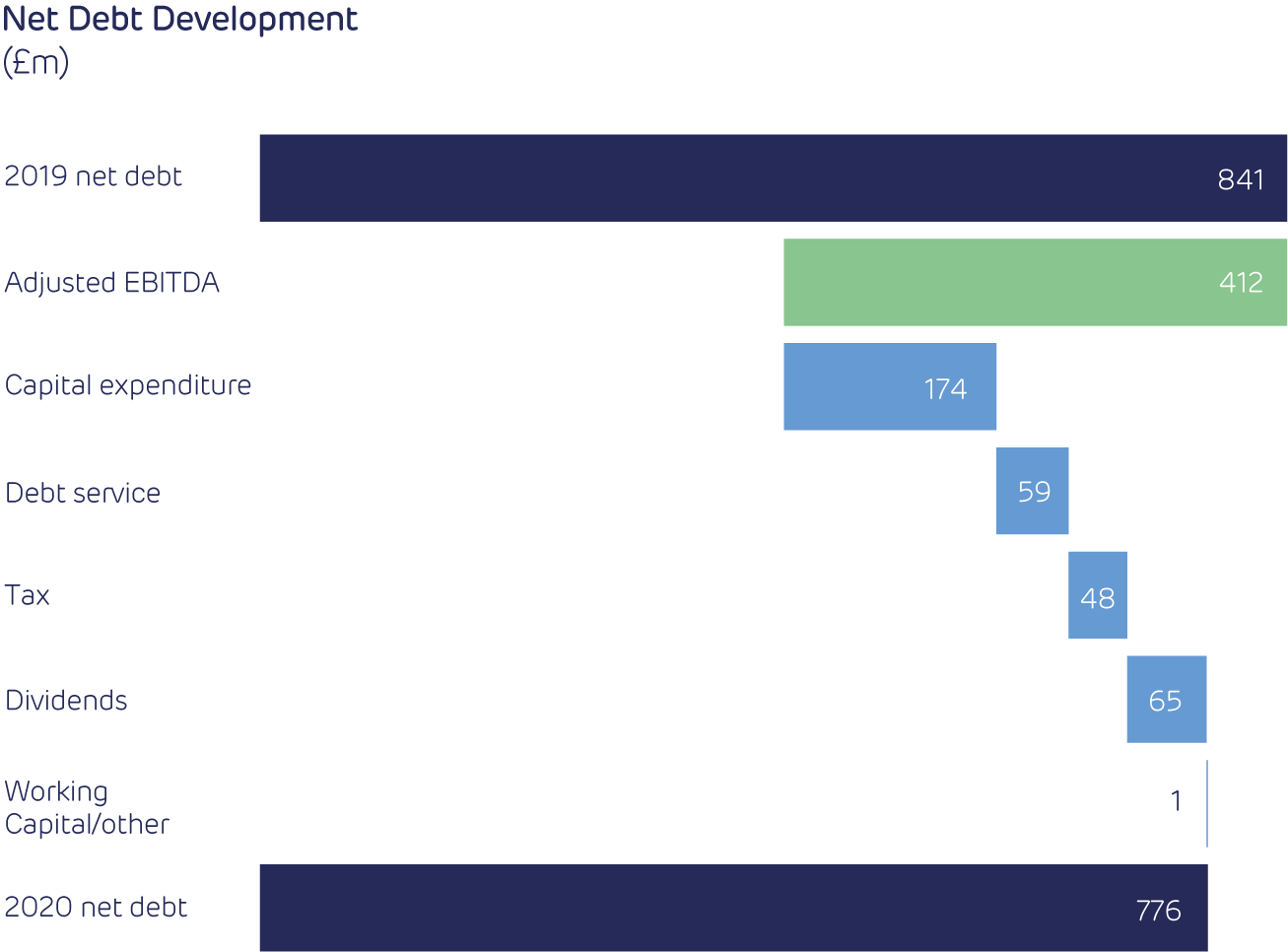

(2) We define net debt as borrowings less cash and cash equivalents. A reconciliation of net debt is provided on page 184. Borrowings is defined as per the Group’s balance sheet on page 156 and does not include lease liabilities, pension obligations or other financial liabilities.

Market context

Why is Drax important in the market?

Supporting the nation’s energy needs, tackling climate change and promoting the UK’s socio-economic growth and global leadership ambition through negative emissions

Decarbonisation, electrification, the role of negative carbon emissions and a green recovery from Covid-19

2020 was widely expected to be a transformative year: the UK would leave – and seek a new relationship with – the European Union; the re-elected UK Government under Boris Johnson would implement a new vision and manifesto, including the levelling up agenda and COP26; and US elections in November would offer two very different domestic and international visions. But very few predicted why 2020 would become such a watershed year. The worldwide pandemic (Covid-19) fundamentally changed the world, with short- and long-term socio-economic consequences and global impact on health.

One issue didn’t change, however. Climate change, and the focus on a green economy and renewable power. Rather than the global crisis pushing the green agenda into the long grass, the general public reconnected with the environment during lockdowns, and governments saw the economic benefits of pushing a green recovery with moreaffordable green technology.

Net zero

UK and Globally

The UK continued to position itself as a world leader in decarbonisation.

The Prime Minister’s 10-point plan and Energy White Paper included low- carbon technologies such as offshore wind and carbon capture and storage.

Despite COP26 being postponed by a year, several major economies announced, reaffirmed or accelerated their net zero commitments. The EU set a new 2030 target for emission reduction to complement its target of carbon neutrality by 2050. South Africa, Japan and South Korea announced net zero emissions by 2050. China announced a carbon emission peak before 2030, with carbonneutrality by 2060. Joe Biden pledged to re-join the Paris Climate Agreement, proposing to make US electricity production carbon-free by 2035 and meet net zero by 2050.

Bioenergy carbon capture and storage (BECCS)

The UK’s Climate Change Committee highlighted in December 2020 that 53 MtCO2 of BECCS would be needed to meet net zero. National Grid set out in its 2020 Future EnergyScenarios (FES) report that BECCS was needed in the power industry in every scenario to achieve net zero in 2050 and could help the UK achieve a carbon negative power system as early as 2030.

The UK Government reaffirmed its commitment to Carbon Capture Usage and Storage, safeguarding and building on its £800 million budget commitment in a minimum of two clusters. In that context, it announced a call for evidence on the role of Greenhouse Gas Removal technologies (GGRs) including BECCS. This will inform key strategic decisions around the development, deliverability and cost of different GGRs, as well as the Government’s role in addressing marketbarriers, supporting policies and frameworks.

Flexibility and Stability

Intermittent renewable technologies such as solar and wind grew in 2020, helping decarbonise the power sector. However, this growth increased challenges for the stability of the UK’s electricity grid, caused by generation outages and low wind levels. National Grid twice issued an “Electricity Margin Notice” – a warning that the margin between electricity supply and demand on the system had tightened to critical levels – for the first time since 2016. This underscored the need to increase flexible generation and technologies, such as Drax’s pumped storage and biomass, to keep the system stable and balanced.

Electrification

According to National Grid’s FES report, electricity demand could double between now and 2050. One of the key components of net zero will be the substantialincrease in the electrification of various sectors of the economy, such as heat and transportation. With wind and solar technologies likely to supply the bulk of this generation, flexible technologies will play a role in managing their integration and constraints. The FES report estimates that up to 20 GW of hydrogen power and up to40 GW of storage (such as that provided by pumped storage hydro) could be required to balance the grid in 2050.

Drax Impact

Drax already plays an active role in decarbonising the energy system and providing stability and flexibility. Our strategic focus for a net zero future remains increasing pumped storage and sustainable biomass self-supply, whilst progressing BECCS to be carbon negative by 2030. We are also continuing to focus on giving our customers control of their energy.

Covid-19 and the Green Bounce Back

Energy

Covid-19’s global economic impact also affected the UK power market. In 2020 alone, the average wholesale power price fell 44%, with average electricity demand down by 13%. the costs of balancing the system rose 51% to £293 million whilst the share of renewables increased from 28% to 38.4%, with biomass increasing 8.4%and fossil fuel decreasing by 17.4%.

Green Economic Recovery

It has become increasingly clear that a Covid-19 socio-economic recovery in the UK will focus on green technologies and industries, using private finance to fund immediate and future priorities such as green infrastructure. This could create tens of thousands of jobs around the country, such as offshore wind, carbon capture and storage, and hydrogen.

Drax Impact

Drax can be at the heart of the green economic recovery in the North. Scaling up BECCS at Drax could support thousands of jobs during construction at its peak and contribute significantly to the local economy, according to a report from Vivid Economics, commissioned by Drax. Delivering the Zero Carbon Humber project could create and support tens of thousandsof jobs locally and throughout the supply chain, according to the report.

Many businesses will be remembered for their actions during the Covid-19 pandemic. At Drax, we generated good returns for shareholders, with a sustainable and growing dividend and increased share price, whilst “keeping the lights on”, avoiding furloughing employees and supporting our employees, customers and communities.

Global situation

COP26

COP26 in Glasgow was postponed to 2021 but offers potential to be a major success for the UK both domestically and internationally. The UK Government will want to showcase innovative decarbonisation technologies ahead

of COP26. This will be an opportunity for Drax to continue to explain how it can be part of a diverse green energy mix to meet net zero with innovative advancements technologically (through BECCS, CCS and hydrogen) and financially through new green finance models.

Biomass Acceptability

In the US, EU and in the UK, policy makers have continued to regulate biomass in the context of global and domestic efforts to meet net zero.

In the EU, the European Commission’s Green New Deal proposed a new biodiversity strategy and re-opening key legislation such as the REDII and EU ETS. In the UK, the Government announced it would begin work on a new bioenergy strategy – to be published in 2022. In the US, the EPA has been actively considering the carbon credentials of biomass.

The UK Government’s BEIS attitudes survey shows that public support for biomass continues to rise.

EU Carbon Targets

With the EU’s increased net zero ambition and timetable, biomass is likely to play a key role in helping the EU to meet its ambitious targets. This increased ambition will have implications for carbon pricing and could result in higher carbon prices in the UKeven after Brexit. The

UK announced a UK Emissions Trading Scheme (ETS) to replace the EU-ETS from 1 January 2021. The EU is also examining the potential to introduce a carbon borderadjustment where non-EU countries will be required to account for an implied carbon price to import goods into the EU.

Drax Impact

Despite Covid-19 challenges, Drax’s global supply chain for pellets has remained resilient. As in 2020, Drax will continue to engage with UK, EU and US policymakers on the role of biomass, through the BEIS biomass strategy, revision of REDII and new US administration.

In 2021, Drax is positioning itself as one of the business leaders for COP26 and will look to support the UK Government in its efforts to make this a success.

Chapter 2:

Business Model

Climate change is the biggest challenge of our time. Drax’s purpose – to enable a zero carbon, lower cost energy future – puts us at the heart of addressing this global challenge.

Click to view/download graphic here.

Chapter 3:

ESG highlights

At Drax, we believe that achieving a positive economic, social and environmental impact is key to delivering long-term value creation.

Environment

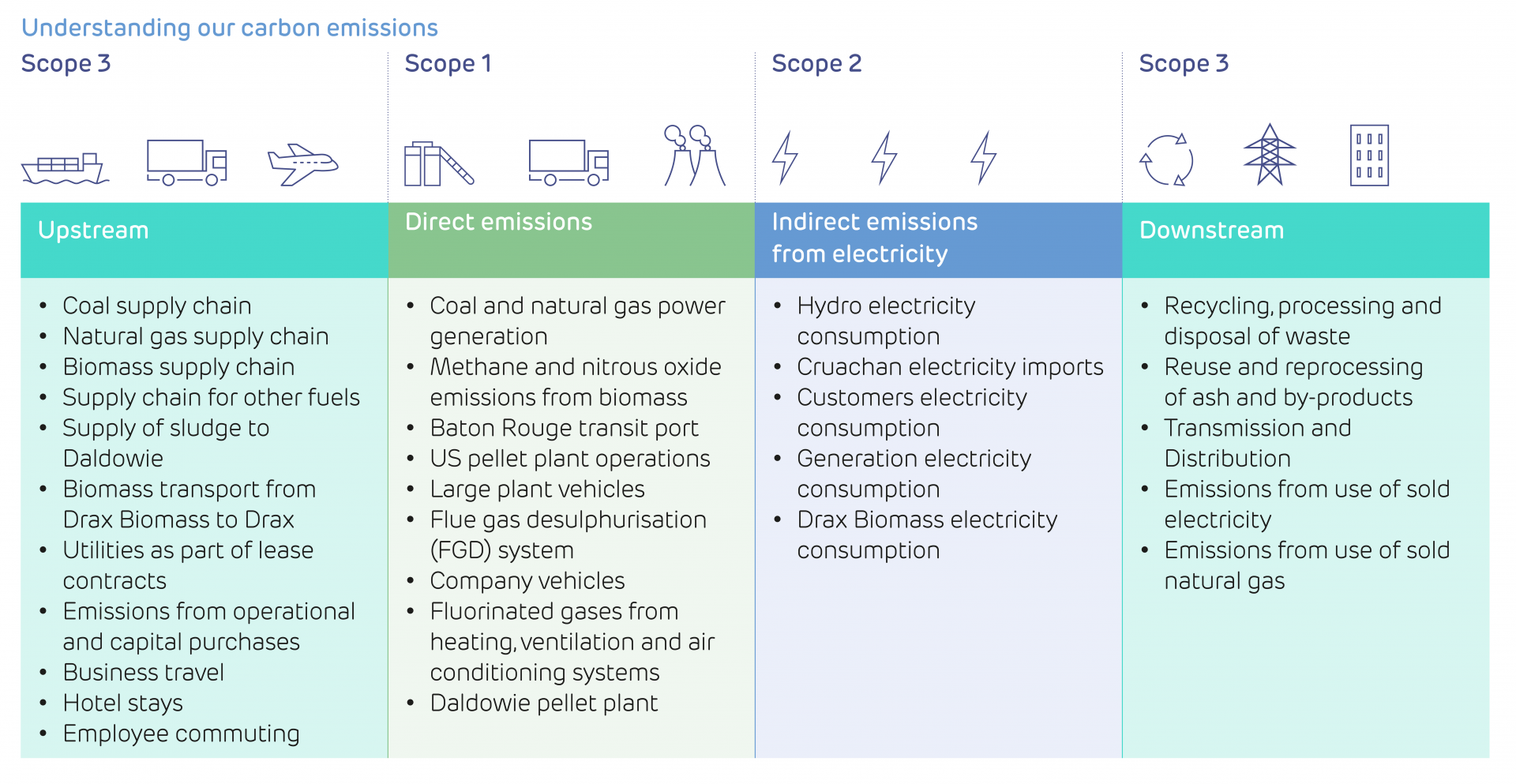

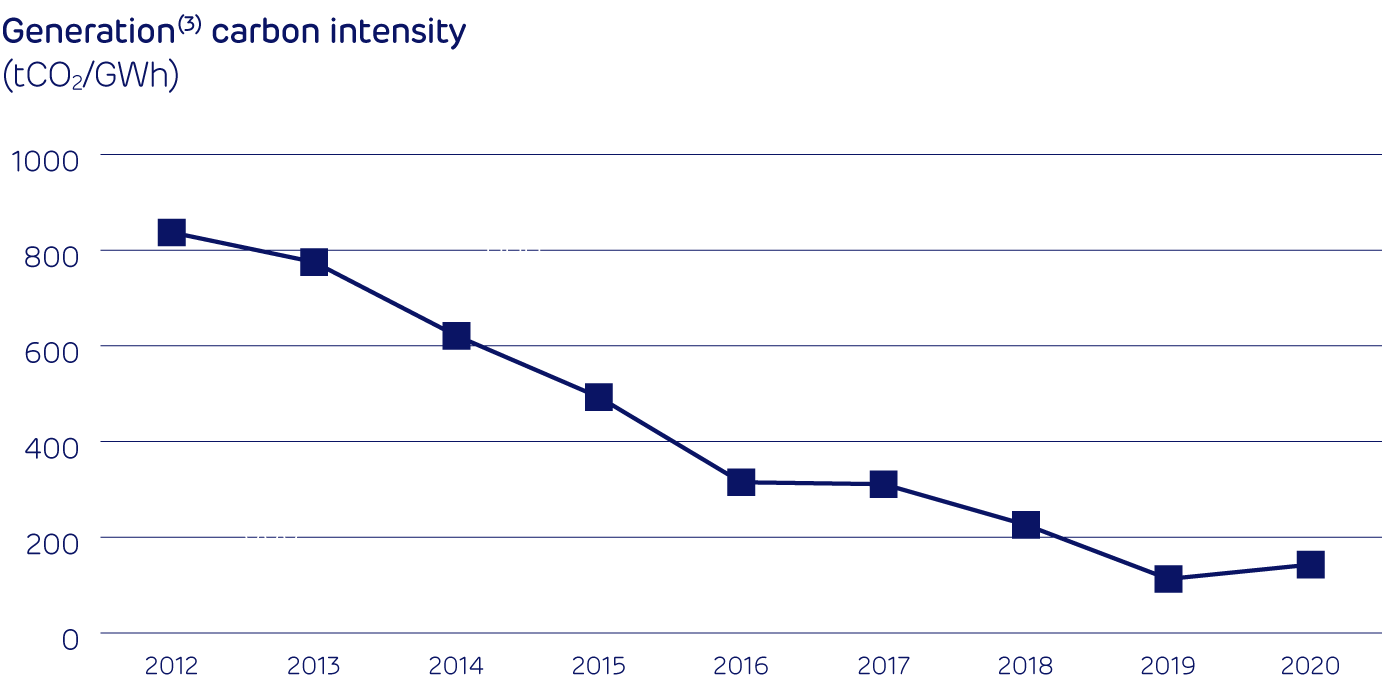

Since 2012, Drax has reduced its absolute scope 1 and 2 carbon emissions by more than 85%. Our ambition is to become a carbon negative company by 2030.

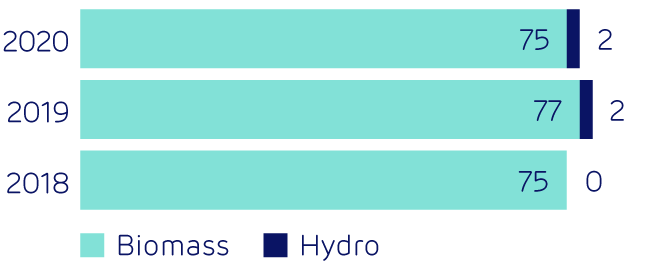

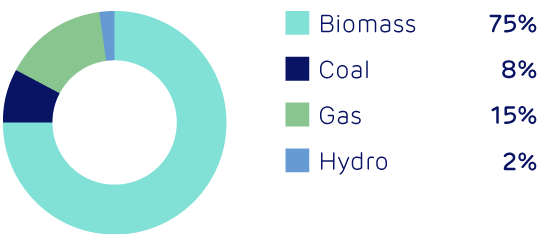

Renewable generation (%)

UK’s largest source of renewable electricity

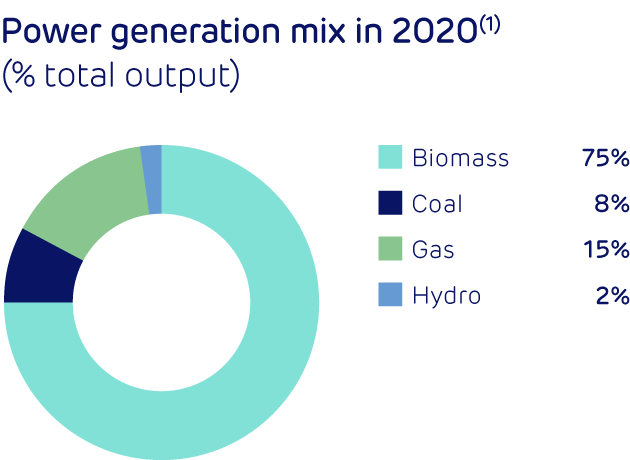

Power generation mix in 2020

(% total output)

Electricity supplied to customers from renewable sources (%)

UK’s largest supplier to business

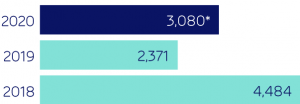

Group carbon intensity

(tCO2e/GWh)

Group carbon emissions, scope 1 & 2

(ktCO2e)

Social

Creating a safe, fair and inclusive place to work, and making a positive contribution in the communities where we operate.

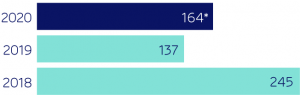

Total Recordable Incident Rate

(TRIR)

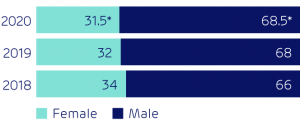

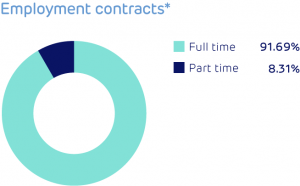

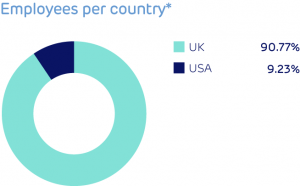

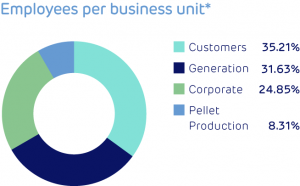

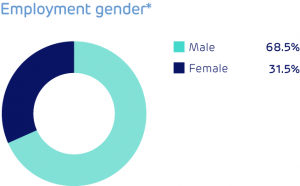

Gender diversity, total workforce

(%)

Governance

Clarity of purpose, a positive culture and strong governance enable us to deliver for our stakeholders. Remuneration is based on long-term performance and linked to Environmental, Social and Governance (ESG) metrics, including our performance in the CDP.

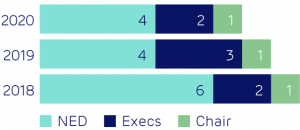

Board composition

Executive Directors/Non-Executive Directors (%)

Gender diversity (%)

* Limited external assurance using the assurance standard ISAE 3000 for 2020 data as indicated.

For assurance statement and basis of reporting see www.drax.com/sustainability

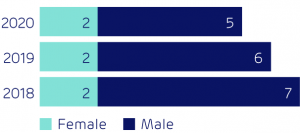

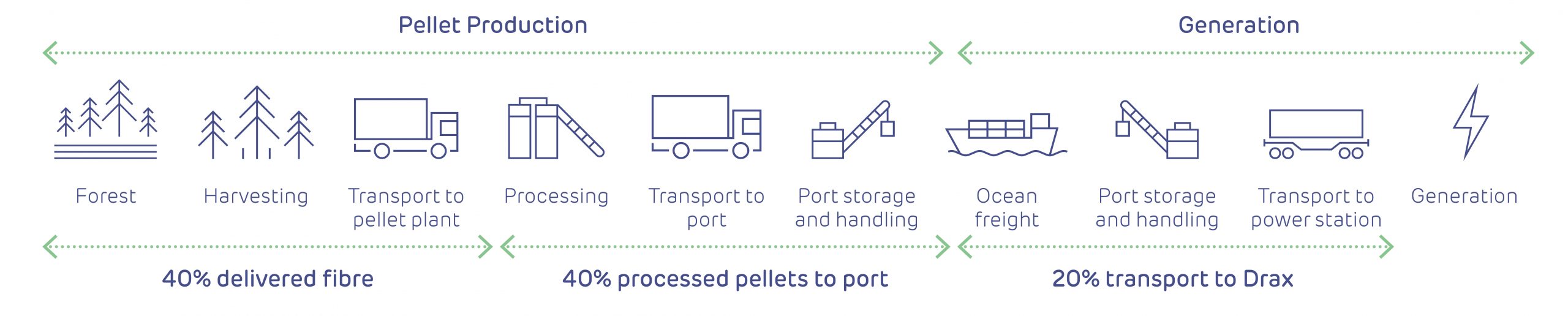

Biomass Sourcing

Sustainably sourced biomass is CO2 neutral under scientific principles established by the UN Intergovernmental Panel on Climate Change.

* Forestry residues includes branch tops and bark, thinnings and low-grade roundwood. For more information, see Sourcing Sustainable Biomass on page 53

** BECCS is bioenergy with carbon capture and storage, enabling the capture of CO2 resulting from generation, which is stored in an aquifer under the North Sea

100% sustainably sourced

• Wood pellets sourced from sustainably managed working forests and residues from forest industries

• Sustainability Policy and Responsible Sourcing Policy outline our requirements and commitments

• Supplier compliance evidenced by Sustainable Biomass Program (SBP) certification or third party audits

99% Woody biomass sourced by Drax in 2020 that was SBP compliant

(1) Limited external assurance by Bureau Veritas using the assurance standard ISAE 3000. For assurance statement see www.drax.com/sustainability

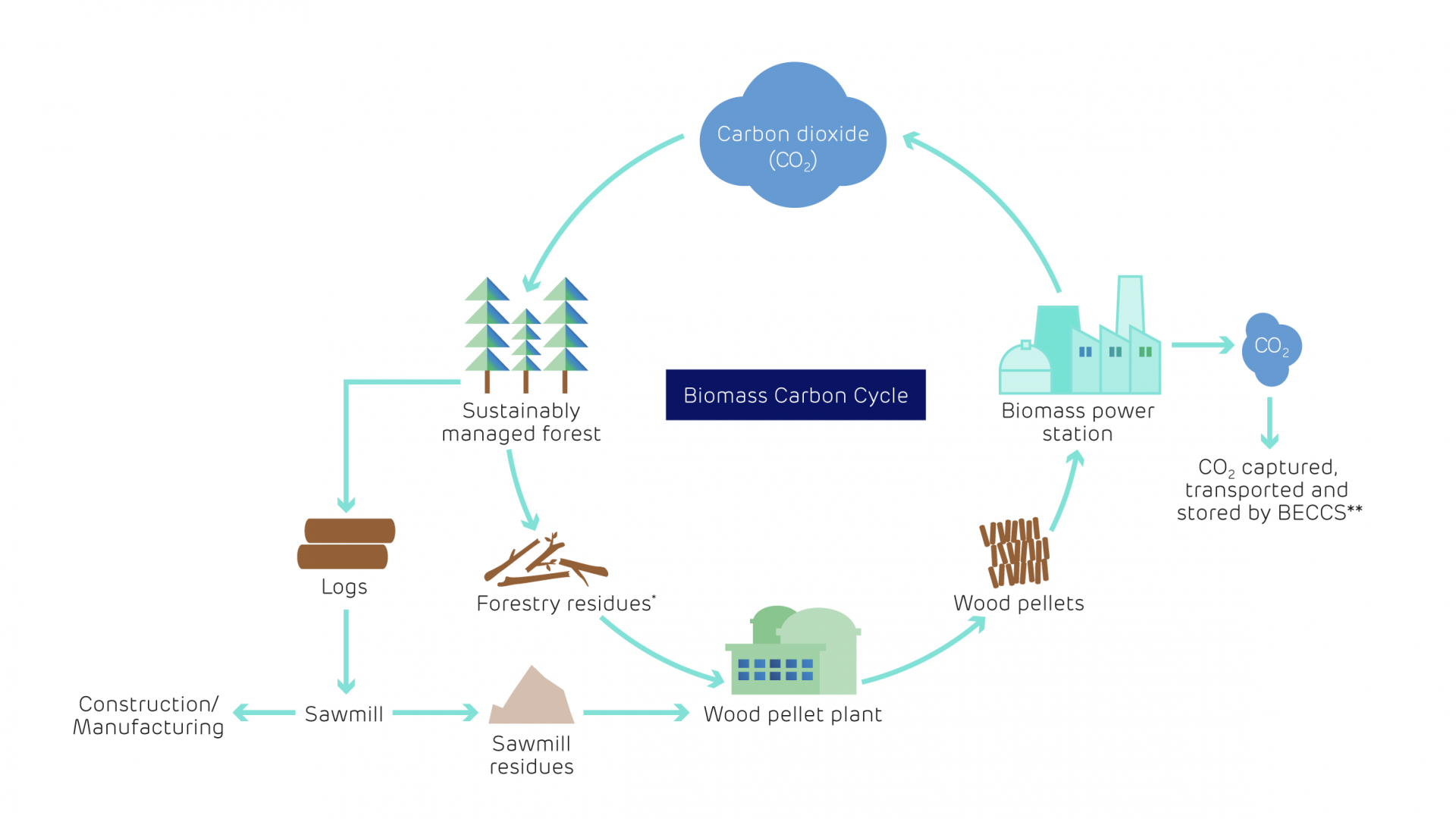

ESG rating performance

UN Sustainable Development Goals (SDGs)

We believe we can have the most impact in these areas:

Chapter 4:

Chair's Statement and Group CEO's review

Chair’s Statement

Managing Covid-19 impact Keeping colleagues safe remained paramount throughout the pandemic:

Managing Covid-19 impact Keeping colleagues safe remained paramount throughout the pandemic:

-

Focused on the health, safety and wellbeing of colleagues and those we work with

-

Continued to pay our sustainable and growing dividend

-

Supported customers, including help with debt and the freezing of payments

-

Supported our communities

-

No Covid-19 financial support from the Government, and no furloughing of employees

![]() Find out more on page 34 of the full report PDF.

Find out more on page 34 of the full report PDF.

How are we planning to become carbon negative by 2030?

With the right negative emissions framework from the UK Government, we aim to become a carbon negative company by 2030. We believe BECCS technology could have global application in the delivery of negative carbon emissions

Introduction

Drax Group’s purpose is to enable a zero carbon, lower cost energy future.

This informs our strategy of building a long-term future for sustainable biomass, becoming the leading provider of electricity system stability in the UK, and giving customerscontrol of their energy.

Since 2012, we have reduced Drax’s carbon emissions by over 85%, principally reflecting our long-term investment in sustainable biomass. During the year we made further progress, announcing in February 2020 an end to commercial coal generation effective in March 2021. In January 2021, we completed the sale of our gas generation portfolio, further reducing our carbon emissions. More recently, on 8 February 2021, we announced the proposed acquisition of Pinnacle Renewable Energy Inc., which is expected to position Drax as the world’s leading biomass generation and supply business, alongside the continued development of Drax’s ambition to become carbon negative by 2030.

The proposed acquisition is subject to shareholder approval and certain court and regulatory approvals.

There remains more we can do to reduce carbon emissions. With the right negative emissions framework from the UK Government, we aim to achieve our ambition to become a carbon negative company by 2030 using BECCS technology. We believe this technology could have global application in the delivery of negative carbon emissions.

Through these activities, we expect to play a major role in delivering the UK’s legally binding objective to achieve net zero carbon emissions by 2050 and support global efforts to reduce carbon emissions.

Operations, Covid-19 and supporting stakeholders

2020 witnessed the outbreak of Covid-19 with unprecedented global impact. For Drax, the safety and wellbeing of colleagues remained paramount. The Board held additional meetings, overseeing the Group’s response, understanding the impacton colleagues, customers, communities andother stakeholders.

As a strategic part of the UK’s critical national infrastructure, we recognise our responsibility to support the country’s response to Covid-19 and our stakeholders.We maintained high levels of power generation throughout 2020, and we did not seek any Covid-19 financial support from the UK Government, nor did we furlough any employees.

We provided extra support to our customers, particularly the small and medium-size enterprises (SMEs) that were adversely affected. We froze energy payments from care homes in communities local to Drax and offered debt support to customers. We supported our communities in the UK and US with charitable donations and provided over 850 free laptops to enable home learning for students in our communities.

Throughout the pandemic, we have continued to engage with shareholders to explain our expectations of the impact of Covid-19 on the Group and the Board has considered their feedback.

Operationally, our generation portfolio performed well. In 2020, the Group was the largest source of renewable electricity by output in the UK, providing 11% of the total from its biomass and hydro generation assets. We also provided the system support services and operational flexibility required to help maintain grid stability during the Covid-19 induced changes to power demand. Additionally, we completed two major outages on our gas and biomass assets, with the latter including a turbine upgrade which will help contribute to our strategy to reduce the cost of biomass.

Sustainable biomass has a long-term role to play in the UK and global energy markets, both as a flexible and sustainable source of renewable energy, and as a means of delivering negative carbon emissions. Key to securing this long-term role is reducing the cost of biomass and growing our supply chain. We believe these actions will deliver attractive returns to shareholders and enable a long-term future for sustainable biomass, which could include negative carbon emissions via BECCS.

Our Customers business, which supplies electricity and gas to businesses in the UK, experienced significant challenges associated with the impact of Covid-19. The SME market suffered most from this impact, with lower energy demand and, in some cases, an increase in business failures. Throughout the year, our teams have focused on supporting customers as well as working to deliver improvements. We continue to monitor the situation and assess the options for this part ofthe business.

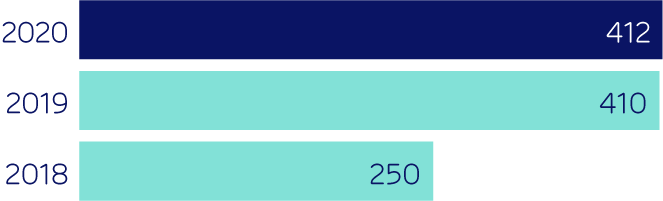

Results and dividend

Adjusted EBITDA in 2020, including both continuing and discontinued operations, was £412 million (see page 22 for further detail and a reconciliation to relevant IFRS measures). This was a small increase on 2019 (£410 million), despite the impact of Covid-19, which was principally associated with the performance of our Customers business. We believe this was a strong performance within the context of a challenging environment.

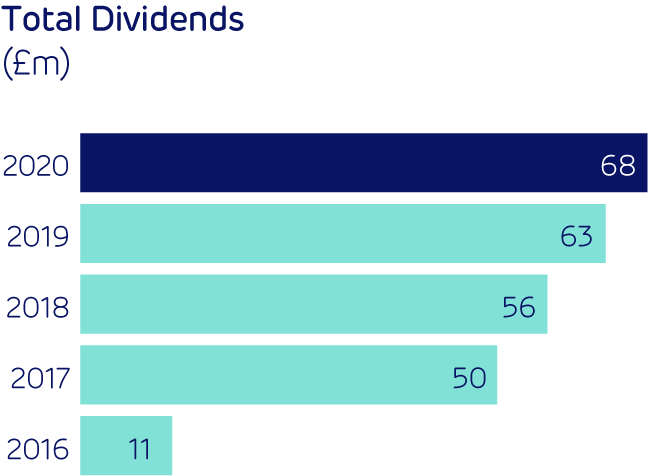

At the 2020 half year results, we confirmed an interim dividend of £27 million (6.8 pence per share). The Board proposes to pay a final dividend in respect of 2020 of £41 million, equivalent to 10.3 pence per share, making the full year 2020 dividend £68 million (17.1 pence per share) (2019: £63 million, 15.9 pence per share). This represents a 7.5% increase on 2019 and is consistent with our policy to pay a dividend which is sustainable and expected to grow as the strategy delivers stable earnings, strong cashflows and opportunities for growth.

In determining the continued appropriateness of the dividend, the Board considered a range of factors. These included trading performance, current liquidity, the outlook for the year in the context of Covid-19, as well as the steps being taken to support all stakeholders. The Board believes payment of the final dividend remains consistent with the Group’s commitment to all stakeholders.

The Group has a clear capital allocation policy which it applied throughout 2020. In determining the rate of growth in dividends from one year to the next, the Board will take account of cash flows, the less predictable cash flows from the Group’s commodity-linked revenue streams and future investment opportunities. The latter includes our stated intent to invest to expand the Group’s biomass supply chain andreduce the cost of biomass. If there is a build-up of capital, the Board will consider the most appropriate mechanism to return this to shareholders.

“During 2020 we supported stakeholders in response to Covid-19, and maintained high levels of power generation throughout the year”

Philip Cox, CBE Chair

People and values

The Board is committed to building a supportive, diverse and inclusive working environment where all colleagues feel they belong. To underpin this, in September we launched a new Diversity and Inclusion Policy and approach.

Listening to employees and ensuring a two-way dialogue is vital to understanding where we are doing well and where we can improve. In 2020, we asked employees for feedback on our values and their experience of working at Drax – which informed the evolution of our values – an important part of engagement as Drax continues to develop and change. Will Gardiner, our CEO, and I met regularly with the chairs of our workforce engagement forums. These meetings provided valuable ongoing insights and feedback for the Board in a period of significant change. This helped us to support the business in managing the transition to remote working and ensuring the safety and wellbeing of our workforce. On behalf of the Board, I would like to thank Will and the executive team for their leadership during this extraordinary year and all of our employees who have responded so well to the challenges presented in 2020.

Safety is a long-held and central commitment of our operational philosophy. While the number of incidents is low, we need to remain vigilant and work to reduce them. We are committed to the highest standards and have continued our efforts to strengthen our approach across the Group.

Sustainability is at the heart of what we do and we believe that achieving a positive economic, social and environmental impact helps us create long-term value. We remain committed to promoting the UN Global Compact principles on respect for human rights, labour rights, the environment and anti-corruption.

Board changes

In April 2020, Andy Koss stepped down from the Board after four years as an Executive Director and 15 years with the Group. I would like to thank Andy for his valuable contribution to the Group in this period.

Conclusion

In 2020 we delivered a strong financial and operational performance in the context of the very challenging environment caused by Covid-19, supported our stakeholders and continued to pay a sustainable and growing dividend in line with our policy.

At the same time, we continued to make progress with our strategic objectives. Our biomass strategy is clear; we believe it can deliver sustainable long-term value to our stakeholders as we realise our purpose of enabling a zero carbon, lower cost energy future and we remain focused on this objective.

Philip Cox CBE

Chair

Group CEO’s Review

How has Drax performed in 2020?

We have delivered a robust performance, supporting our employees, communities and customers and made good progress in delivering on our strategy

2020 highlights

-

Adjusted EBITDA of £412 million from continuing and discontinued operations(1)

-

Strong balance sheet and liquidity

-

Sustainable and growing dividend

-

Increase in biomass self-supply and reduction in cost

-

Strong system support performance

-

Sale of gas generation portfolio completed in January 2021 and expected end of commercial coal generation in March 2021

-

Proposed acquisition of Pinnacle Renewable Energy Inc.

(1) See page 22 for further detail and a reconciliation to relevant IFRS measures.

Drax Group’s purpose is to enable a zero carbon, lower cost energy future. To deliver that purpose, our strategy is to build a long-term future for sustainable biomass, become the leading provider of system stability in the UK and give customers control of their energy.

Our purpose also drives our commitment to the battle against climate change. Since 2012 we have reduced the Group’s carbon emissions by over 85%, we are the UK’s largest renewable energy generator by output and have an ambition to become a carbon negative company by 2030.

Operationally, 2020 was a successful year, as we delivered increases in pellet production and increased availability across our generation fleet, in spite of the challenges we faced due to the Covid-19 pandemic. Our colleagues have responded tremendously to those challenges, with operational staff on site at power stations and pellet plants working in a safemanner, while the rest of our colleagues have had to work from home. As a result, we have had a limited number of Covid-19 cases although, sadly, one colleague in the US died with the virus.

Strategically, 2020 was a pivotal year for the Group. In February 2020 we announced an end to commercial coal generation, effective in March 2021. In January 2021 we completed the sale of our gas generation portfolio, which was announced in December 2020. Following these actions we believe our carbon emissions will be amongst the lowest of any European energy company.

As we work towards our purpose we continue to develop our options for BECCS, which we believe can become a world leading, UK-ledand exportable solution for large-scale carbon negative power generation. Subject to the right negative emissions framework from the UK Government, we expect to be in a position to make further investment in the development of this option in 2021 and to advance our ambition to become acarbon negative company by 2030.

In February 2021, we were pleased to announce the proposed acquisition of Pinnacle Renewable Energy Inc. (Pinnacle) which we believe will position Drax as the world’s leading biomass generation and supply business, delivering against our strategy to increase our self-supply capability, reduce our biomass production cost and create a long-term future for sustainable biomass. Completion of the proposed acquisition is subject to shareholder consents and the satisfactionof certain conditions precedent.

As we advance our strategy, we expect to deliver higher quality earnings, reduce commodity exposure and create opportunities for growth aligned with the UK’s legally binding objective to become carbon neutral by 2050. This underpins our continued commitmentto a sustainable and growing dividend.

Summary of 2020

Adjusted EBITDA, a key financial KPI, of £412 million from continuing and discontinued operations represents a small increase on 2019 (£410 million), inclusive of an estimated £60 million impact associated with Covid-19, principally on our Customers business. We believe that this was a strong underlying performance which reflects increased pellet production, biomass cost reduction and renewable power generation,offsetting the impact of Covid-19 on the Customers business. The Total Operating loss for the year was £156 million, predominantly reflecting asset obsolescence charges and provisions for other costs following the announcement of the closure of coal generation at Drax Power Station.

Our balance sheet is strong with cash and total committed facilities of £682 million at 31 December 2020 and net debt of £776 million giving a ratio of 1.9x net debt to Adjusted EBITDA from continuing and discontinued operations for the full year, in line with our long-term target.

During the year we completed a series of financing activities that extend the maturity of our debt to 2030 and reduce the cost of our debt whilst retaining the link between carbon emissions and the level of interest paid via a new ESG-linked revolving credit facility (RCF).

In further recognition of the progress we have made on ESG performance, in December 2020 the CDP awarded Drax an A- rating for our CDP climate response (2019: C). Separately, we are now a TCFD Supporter and we reflect that framework in this report.

Safety remains a primary focus. Since March 2020 our operational colleagues, working at power stations or pellet plants, have had to work in new ways to protect against outbreaks of Covid-19 on site, while maintaining our contribution to the integrity of the UK power system. I am very pleased with everyone’s efforts in this area and that we did not have any outbreaks of Covid-19 at our sites in 2020.

In this context, the Total Recordable Incident Rate (TRIR), a key scorecard measure of safety, was 0.29 (2019: 0.22). This was not the level we expect. Although there were no major incidents, the number of minor reportable injuries did increase. We take any increase in the number of reportable incidents seriously and have implemented processes to improve risk assessment, alongside a campaign to raise awareness of good practice, ensuring the correct personal protective equipment is used.

Operational performance

In the US southeast, our Pellet Production operations reported Adjusted EBITDA of £52 million up 63% (2019: £32 million). This was a strong performance, reflecting increased levels of production, improved pellet quality and a continued focus on cost reduction.

Pellet production was 1.5 million tonnes (Mt), an increase of 7% (2019: 1.4Mt), which reflects a strong operational performance and good fibre availability compared to 2019 when heavy rainfall restricted commercial forestry activity.

Pellet quality, as measured by the level of fines (larger particle-sized dust) in each cargo improved in 2020. Lower levels of fines result in biomass that is easier and safer to handle throughout the supply chain. As such there are safety, operational and cost benefits in reducing the level of fines and we continue to work hard to deliver these improvements.

We remain focused on opportunities to deliver savings, across the supply chain, as part of our target to reduce the cost of biomass to £50/MWh on 5Mt by 2027.

As a part of this long-term goal we previously identified an intermediate programme of supply chain improvements, efficiencies and investments. We believe this will reduce the cost of biomass by $35/tonne (£13/ MWh) on our existing portfolio by 2022 compared to 2018 (programme commenced in 2019). In 2020 this programme, alongside increased output and other incremental operational improvements, resulted in an average production cost of $153/tonne (2019: $161/tonne), a 5% saving year-on-year.

We expect to deliver further savings, as a part of this programme, by expanding our existing sites (LaSalle, Morehouse and Amite) by 0.4Mt. At the end of 2020 we completed the first phase of these – 0.1Mt at Morehouse – with the remaining capacity of 0.3Mt expected to come on stream by 2022. Realising these programmes will expand total capacity to 1.9Mt, providing economies of scale and allowing greater utilisation of low-cost residues.

“In January 2020 we announced an end to commercial coal generation in March 2021 and in January 2021 we completed the sale of our gas generation portfolio. This will further reduce the Group’s carbon emissions and we will use the proceeds to continue developing our biomass supply chain strategy.”

Will Gardiner, CEO

In February 2020 we announced plans to further expand our existing infrastructure with the development of three new 40,000 tonne satellite plants. These sites will use lower cost sawmill residues and leverage our existing infrastructure in the US southeast to produce biomass at around 20% below the current cost of production. We believe this model could provide 0.5Mt per annum of additional lower-cost biomass and that these projects advance the Group’s plans to create a long-term future for sustainable biomass, offer returns significantly ahead of the Group’s cost of capital and attractive payback periods.

In Generation, the portfolio has performed strongly, with Adjusted EBITDA of £446 million from continuing and discontinued operations, an increase of 9% compared to 2019 (£408 million). The portfolio produced 6% of the UK’s electricity between October 2019 and September 2020 (the most recent period for which data is available) and 11% of the UK’s renewable electricity, making Drax the largest renewable generator by output in 2020.

This level of renewable generation is only possible thanks to a combination of portfolio availability and a resilient supply chain.

Portfolio availability (calculated based on the availability of each generation asset weighted by EBITDA contribution) was 91% (2019: 88%). Underlying this performance is a robust maintenance regime. During the year we completed major planned outages at Damhead Creek and Drax Power Station. The latter included the second in a series of high-pressure turbine upgrades across three biomass units which will deliver incremental thermal efficiency improvements and lower maintenance costs, reducing the cost of our biomass power generation. The final outage on the unit which operates under the contracts for difference (CfD) scheme is scheduled to take place in 2021.

The logistical challenges of these major works, in a Covid-19 operating environment, are significant. We delivered the outages with minimum delay thanks to the diligence, skill and hard work of our teams and contractors.

Our biomass supply chain performed well and to date there has been no material impact from Covid-19 or Brexit on our supply chain or those of our key suppliers.

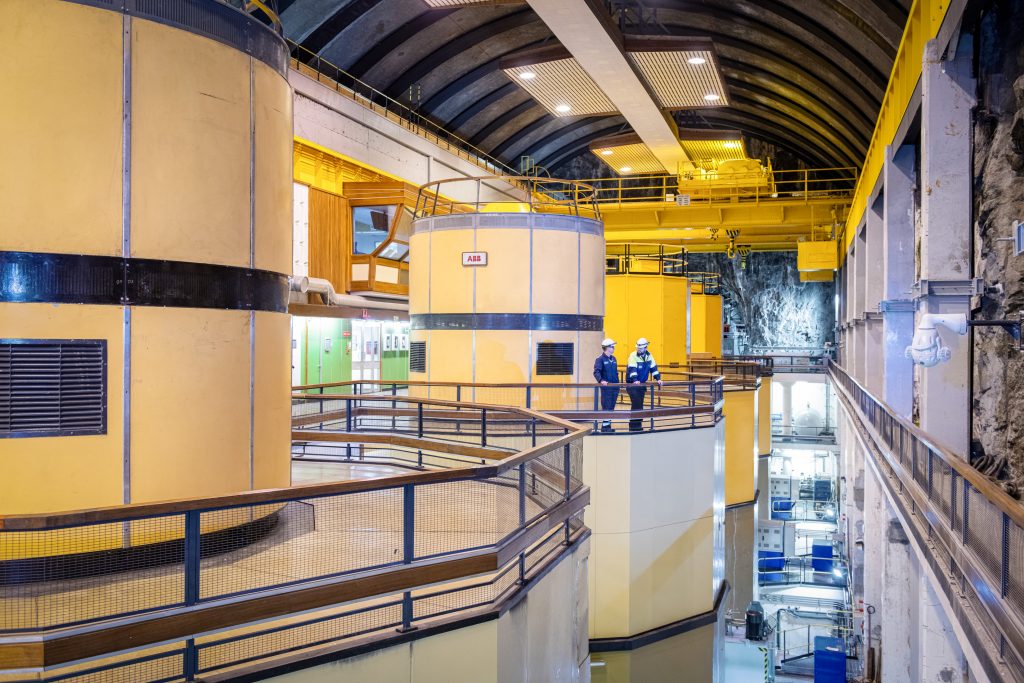

Our Scottish hydro operations – Cruachan Pumped Storage Power Station (Cruachan), and the Lanark and Galloway hydro schemes – have performed well. These assets provide renewable electricity, system support services, peak power generation and Capacity Market income. Taken together with the Daldowie energy from waste plant, Adjusted EBITDA was £73 million (2019: £71 million).

Engineers look out from beside a turbine within Cruachan Power Station in Scotland

System support services (Balancing Market, ancillary services and portfolio optimisation) are an important part of the Group’s strategy. They are also critical to the safe and reliable operation of the power system. Historically, baseload thermal power plants provided both electricity and a full range of system support services. As the UK power system decarbonises, intermittent renewable generation has progressively displaced these assets, creating new challenges in balancing the system.

Throughout 2020 our portfolio supported the system operator in managing the impact of Covid-19 on power demand. In the first half of 2020, a reduction in demand for electricity required flexible generators, like Drax, to turn-down and stabilise the system. In the second half of 2020, a combination of cold weather, lower wind speed and asset availability issues led to periods of increased demand. At these times, our flexible assets were able to increase output to help balance the system.

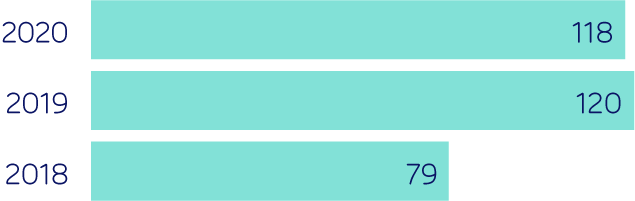

System Support Services and Optimisation – our measure of performance in the provision of these services was gross profit of £118 million, a small reduction on 2019 (£120 million), which included income from specific constraint contracts which were not expected to recur in 2020.

Cruachan, an important source of system support, was successful in a tender process to procure specific non-generation services – inertia and reactive power. The contract, which commenced in July 2020, is worth up to £5 million per year and is over a six-year period. This was the first tender of its kind and we expect the system operator to conduct further tenders over the coming years.

Merchant power prices remain an important part of the Group’s earnings, but by focusing on flexible and renewable generation, the importance of merchant power prices has reduced. We have a strong forward power sales position in place until 2022. Beyond this date, whilst an exposure exists, it is largely associated with the three biomass units which operate under the Renewable Obligation Certificate (ROC) scheme.

In January 2021, following the UK’s exit from the European Union, the UK introduced a new carbon emissions trading scheme to replace the existing European scheme to which the UK no longer has access. We believe that robust carbon pricing is essential for decarbonisation and an important component of long-term power prices. With a growing level of interconnection between the UK and continental Europe as well as growing ambition in terms of EU energy policy we believe that in the long-term UK carbon and power prices could trend towards European prices. We also believe that with greater demand for system support services, near-term power prices could become more volatile – driven by system support service requirements rather than commodity market fundamentals.

The end of commercial coal operations in March 2021, and final closure of the generating units in September 2022, is expected to result in annual cost savings of £30-35 million once complete. We believe that this will help to support the financial model for long-term biomass generation at Drax Power Station when the current renewable subsidy schemes end in March 2027. An employee consultation process was completed in 2020. Implementing the changes will result in the reduction of 206 roles and one-off costs of £34 million.

Our Customers business reported a loss at the Adjusted EBITDA level of £39 million (2019: £17 million profit). This reflects the significant reduction in demand caused by Covid-19, the cost associated with exiting hedged positions as market prices have fallen and the increased risk of business failure and bad debt – principally in the SME market, around 30% of monthly billing. Looking beyond the impact of Covid-19 we will continue to monitor the wider Customer portfolio to ensure alignment with the Group’s strategy.

Performance in Industrial and Commercial markets was stronger with the addition to the portfolio of long-dated power sales contracts to water utilities, providing revenue visibility over the next five years. Just as the Generation business provides system support services, so too can our Industrial and Commercial customer portfolio. Over time, we expect that this part of the Group, through efficiency and demand-side response, can contribute increasingly to the Group’s system support services alongside generation. We continue to believe this approach will support long-term growth.

The Customers business has a differentiated market position – selling purely renewable power while helping over 2,000 independent renewable generators access the market.

Innovation engineer inspecting CCUS incubation area BECCS pilot plant at Drax Power Station, 2019

“We believe our carbon emissions will be amongst the lowest of any European energy company”

Will Gardiner, CEO

Biomass domes at Drax Power Station

Biomass strategy

Biomass has an important role to play in global energy markets as a flexible and sustainable source of renewable energy, as well as offering the potential to deliver negative emissions via BECCS. We believe that the key to securing this long-term role is to reduce the unit cost of biomass and develop greater direct control of the supply chain.

The Group is targeting control of 5Mt of self-supply capacity by 2027 (currently 1.6Mt, plus 0.4Mt in development) and reduce the cost of biomass to £50/MWh by 2027. Through the delivery of these strategic objectives Drax aims to create a long-term future for sustainable biomass, including third-party supply, BECCS and merchant biomass generation

The proposed acquisition of Pinnacle accelerates the Group’s strategic objectives by adding 2.9Mt of biomass production capacity from 2022, being a combination of capacity available to Drax for self-supply and long-term third-party supply contacts to counterparties in Asia and Europe. In 2019, Pinnacle’s production costs were around 20% lower than our own.

We intend to deliver further savings through the optimisation of existing biomass operations, greater utilisation of forestry residues, such as sawmill residues and the use of other lower cost renewable feedstocks.

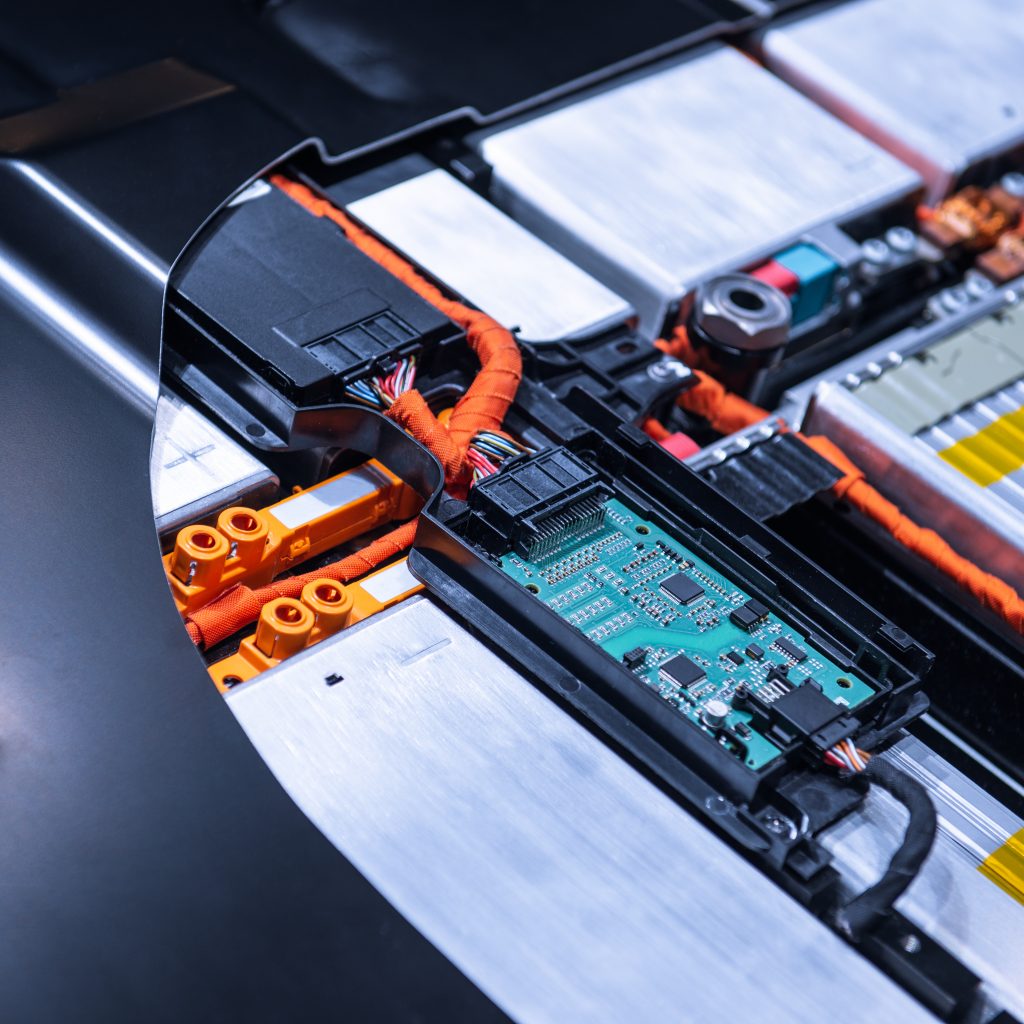

The UK’s Climate Change Committee (CCC) has set out what is required for the country to achieve its legally binding objective of being net zero by 2050. This includes an important role for BECCS to remove carbon from the atmosphere, creating negative emissions. BECCS is the only large-scale solution for negative emissions with renewable electricity and system support capabilities. Through combining BECCS with its existing biomass generation units at Drax Power Station, we believe we could remove millions of tonnes of carbon each year from 2027. In doing so Drax aims to become a carbon negative company by 2030.

The technology to deliver post-combustion BECCS exists and is proven at scale. In September 2020, Drax commenced a trial of one such technology provided by Mitsubishi Heavy Industries. In addition, we are developing innovative technology options, including C-Capture, a partnership with Leeds University, IP Group and BP, which has developed an organic solvent which could be used for BECCS.

Drax Power Station is in the Humber region, an area with the highest absolute level of carbon emissions in the UK, owing to the industry and manufacturing located there. This makes the region a natural site for large-scale carbon capture and storage for energy and industry. We continue to work in partnership with Equinor, National Grid and others as part of the Zero Carbon Humber campaign, which we believe can bring new investment, new jobs and world-leading and exportable negative emissions technologies to the UK.

We expect further clarity on the regulation and support for BECCS and the Humber cluster over the next two years and stand ready to develop this technology which is necessary in allowing the UK to deliver its target of a net zero economy by 2050.

We expect global demand for wood pellets to increase in the current decade, as other countries develop decarbonisation programmes that recognise the benefits of sustainable biomass for generation, opening up new sustainable markets. Whilst there is an abundance of unprocessed sustainable biomass material globally, there remains limited capacity to convert these materials into energy dense pellets, which have a low-carbon footprint and lower cost associated with transportation. The proposed acquisition of Pinnacle supports our biomass self-supply strategy which can be used as part of our options for merchant generator or BECCS, but equally it provides an immediate capability to serve the global market for biomass, underpinned by long-term off-take agreements.

Biomass sustainability

When sustainably sourced, biomass is renewable – and sustainably sourced biomass is an important part of UK and European renewable energy policy.

The legal framework and science which underpins this assessment is clear. Carbon emitted in the generation of renewable electricity is absorbed by and accounted for in the growth of forest stock. This is based on well-established principles set out by the Intergovernmental Panel on Climate Change, a UN body, which reconfirmed its long-standing position on sustainably sourced biomass in 2019. This interpretation is reflected in the European Union’s second Renewable Energy Directive (RED II) and Taxonomy rules, which mirror RED II.

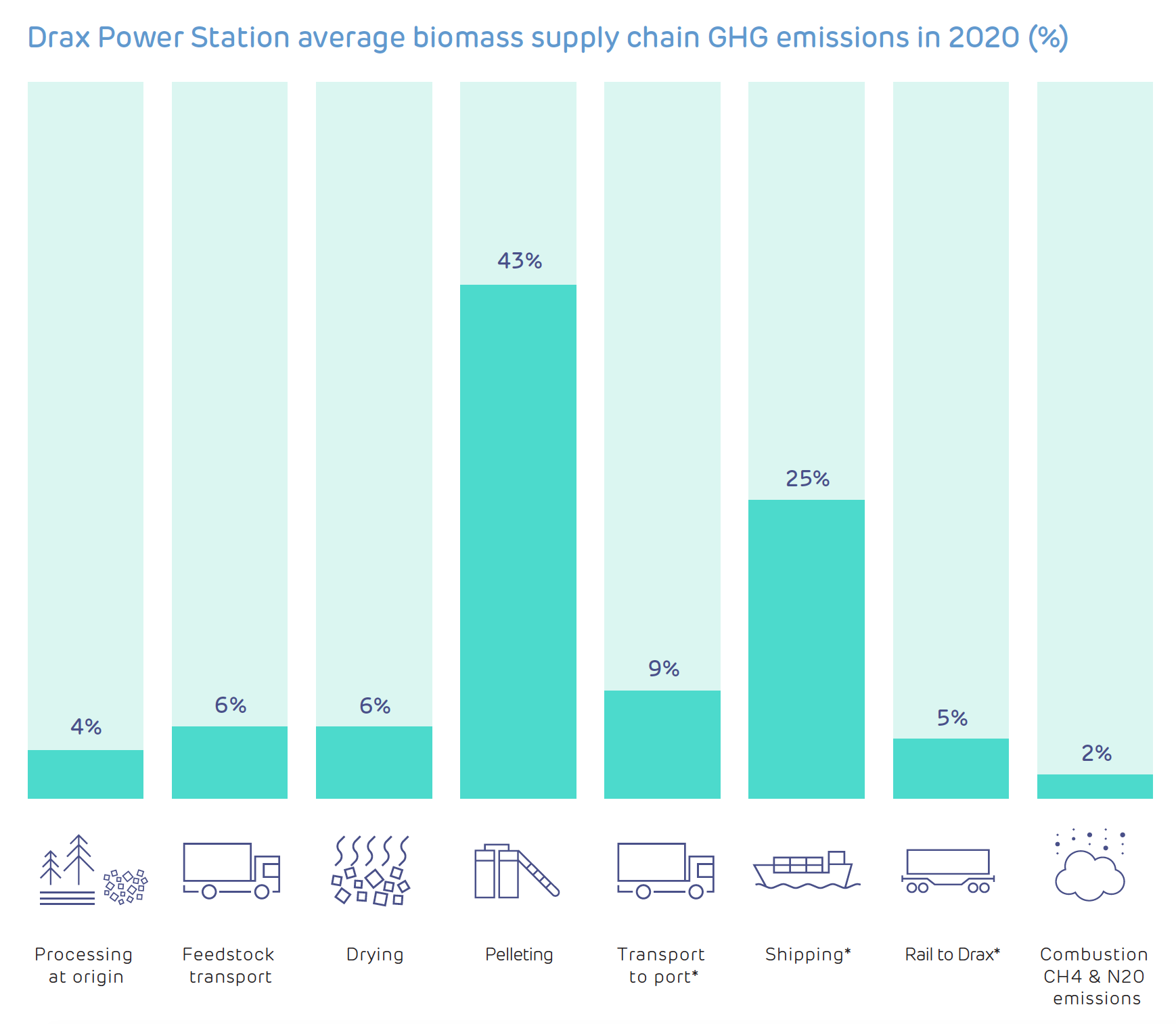

The Group provides full disclosure of the carbon emissions associated with our generation activities as part of our annual reporting. We also report the carbon emissions associated with our biomass supply chain, providing a greater level of disclosure than other forms of electricity generation that also have carbon emissions associated with their supply chains.

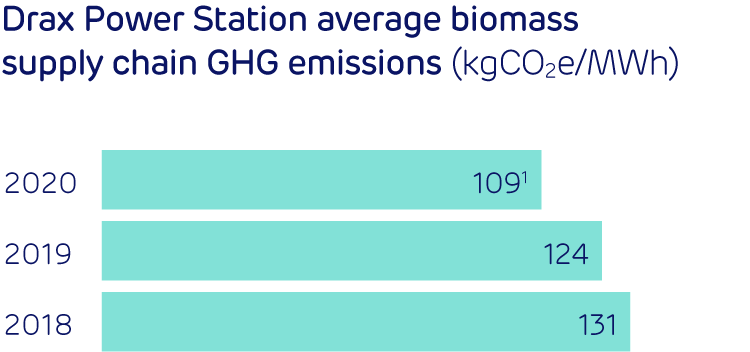

The Group’s biomass life cycle carbon emissions in 2020 were 109kg CO2e/MWh of electricity (2019: 124 kg CO2e/MWh), almost half the UK Government’s 200kg CO2e/MWh of electricity limit for biomass.

We maintain a rigorous and robust approach to biomass sustainability, ensuring the wood fibre used and pellets produced are fully compliant with the UK’s mandatory standards as well as those of the EU. We use low-cost sawmill residues and forest residues, which are a by-product of commercial forestry processes, and thinnings from growing forests, which help improve forest stocks and forest health. The carbon emissions from using sustainably sourced biomass to produce electricity are balanced by the absorption of carbon from growing forests.

In the US southeast, the source for most of our biomass, increased demand for wood fibre has directly contributed to increased growth and protection of forests. Inventories have increased by over 90% since 1950 as more carbon is stored year after year, despite harvests also increasing.

Our forestry commitments are based on the latest available science from Forest Research, the UK’s principal organisation for forest science. Our Responsible Sourcing Policy for Woody Biomass aims to ensure we only source biomass that makes a net positive contribution to climate change, protects and enhances biodiversity and has a positive social impact on local communities.

Our Policy goes beyond compliance, and our Independent Advisory Board on Sustainable Biomass (IAB), chaired by Sir John Beddington, provides guidance and independent oversight on the sourcing choices we make. The advice and scrutiny from the IAB means stakeholders can be assured that Drax will keep our policies under review and that the biomass we use follows the latest scientific research and best practice.

Other developments

In our Hydro business we are continuing to develop a long-term option for the expansion of Cruachan. Its location, ability to generate and absorb power from the grid, and full range of system support services makes it strategically important to the management of the UK power system and aligned with its future needs.

We are continuing to develop options for new gas generation, including four small open cycle gas turbine units at sites in Wales and eastern England. These flexible assets are intended to help meet peak demand and provide non-generation system support services. Any development remains subject to the Group’s decarbonisation plans and the right price in a future Capacity Market auction.

We have taken the decision not to pursue the option to develop a new combined cycle gas power station at Drax Power Station, and continue to assess options for the site.

People and values

Sustainability is at the heart of the Group and its culture. We believe that achieving a positive economic, social and environmental impact is key to delivering long-term value creation. Drax is a signatory to the UN Global Compact (UNGC) and we are committed to promoting the UNGC principles on respect for human rights, labour rights, the environment and anti-corruption.

The Board is committed to building a supportive, diverse and inclusive working environment where all colleagues feel they belong. This is underpinned by a new Diversity and Inclusion Policy and approach. We value the views of our employees and have incorporated their feedback in the development of our values. 2020 saw a significant improvement in the level of engagement which we measure as a KPI on the Group’s corporate scorecard – used for our 2020 cash bonus plan and determination of vesting under our 2018 LTIP due to vest in 2021.

The strong performance and positive response to Covid-19 across the Group is testament to the hard work, diligence and spirit of our employees. I am proud to have them as colleagues and I thank them for their efforts in this most challenging of years.

Outlook

Looking forward, our focus is on progressing our strategy: to build a long-term future for sustainable biomass; to be the leading provider of system stability in the UK and to give customers control of their energy. Through achieving these strategic objectives, we expect to deliver tangible financial benefits – long-term earnings growth, strong cash generation and attractive returns for our shareholders.

Our principal focus remains the expansion of our biomass supply chain and the reduction of cost to provide a long-term future for sustainable biomass. This includes our ambition to become a carbon negative company by 2030 underpinned by the development of BECCS, using technology already proven at scale to deliver negative carbon emissions. Through our expertise in biomass we are leading the way in developing this world class technology and response to climate change.

We are making good progress with the delivery of our strategy and will build on this as we continue to play an important role in our markets as well as realising our purpose of enabling a zero carbon, lower cost energy future for the UK.

Will Gardiner

CEO

Chapter 5:

Biomass Sustainability & Cost Reduction

There is widespread recognition among leading science-based organisations, such as the UN’s Intergovernmental Panel on Climate Change (IPCC) that sustainable biomass has an important role to play in meeting international climate targets

Sustainable biomass has three big benefits: it generates renewable electricity, supports forest growth and provides a route to negative emissions.

Biomass Sustainability

Sustainably sourced biomass for use in the generation of renewable electricity is an important and well-established part of UK and European renewable energy policy. In 2019 bioenergy was the leading form of renewable energy in Europe, providing twice the amount of energy of wind and solar combined. The status of biomass as a renewable material when sustainably sourced is based on well-established scientific principles reflected in the European Union’s second renewable energy directive and Taxonomy rules.

Sustainable biomass sourcing practices are at the heart of Drax’s activities and have underpinned our transformation from the UK’s largest coal-fired power station, to its fourth largest power generator operating a portfolio of flexible, renewable and low-carbon assets, with an ambition to become carbon negative by 2030. In addition, based on its utilisation of sustainably sourced biomass, Drax Power Station is also the UK’s largest source of renewable electricity by output.

We believe that sustainable practices are important to the activities of the Group in the UK and North America, are integral to good corporate governance and critical to the long-term sustainability of our business model.

Drax sources biomass from established, responsibly managed working forests primarily in the US, Canada and Europe. Commercial forests are generally managed for sawlogs, which are sold into the construction and manufacturing markets. Sawlogs command a financial premium which make them uneconomic for use in making renewable electricity from sustainably sourced biomass. However, the associated material and residues, such as sawmill residues and forest thinnings are of use in other lower cost markets such as biomass and fibre board. This process is fully compliant with UK and European legislation.

Drax is leading standards on biomass sustainability and we are committed to continuing to raise those standards, so that our sourcing policies evolve as the science develops. Our Responsible Sourcing Policy for Woody Biomass is in line with the recommended sourcing practices set out by Forest Research – the UK’s principal organisation for forestry and tree-related science. We have also set up an Independent Advisory Board (IAB) led by the UK government’s former Chief Scientific Adviser Sir John Beddington.

The IAB provides independent advice to Drax in all areas of its biomass sourcing. In 2020 the IAB reviewed our Responsible Sourcing Policy and confirmed that it reflects the recommendations made by Forest Research. We apply these standards to our own activities and those of our third-party suppliers.

We are committed to full transparency and provide an overview of our sourcing practices and publish reports for each area we source biomass material from. At the same time, we are taking action to reduce emissions across our supply chain, for example through investment in rail infrastructure and by partnering with organisations like the Smart Green Shipping Alliance.

Carbon accounting

Carbon accounting and reporting of sustainable biomass is an important area of disclosure. Sustainably sourced biomass is considered carbon neutral under UK and European legislation, underpinned by well-established principles set out by the Intergovernmental Panel on Climate Change, as carbon emitted in the generation of renewable electricity is consumed and accounted for in the growth of new forest stock.

Drax provides full disclosure of the biogenic carbon emissions associated with its generation activities. We also report the carbon emissions associated with our supply chain, providing a greater level of disclosure than any other form of electricity generation – wind, solar, gas, nuclear, which also have carbon emissions associated with their supply chains.

Forest growth

We are seeing the positive effects that sustainable sourcing practices are having on the carbon stored. For example, in the US southeast, where we source most of our biomass, increased demand for wood fibre has directly led to increased growth and protection of forests. Inventories have increased by over 90% since 1950 as more carbon is stored in these forests year after year, despite harvests also increasing.

Negative emissions

Our confidence in the contribution that sustainably sourced biomass can play in the UK’s transition to net zero is echoed by the UK’s Climate Change Committee (CCC). The CCC sees a critical role for BECCs in enabling the delivery of the UK’s net zero carbon by 2050.

Biomass cost reduction

Building a long-term future for sustainable biomass is a key strategic objective for Drax

The Group has identified three models through which it believes it can deliver a long-term future for sustainable biomass, all of which are underpinned by the delivery of its supply chain expansion and cost reduction plans.

Drax aims to expand its supply chain to 5Mt of self-supply capacity by 2027 (from 1.6Mt today, plus 0.4Mt in development) and reduce the cost of biomass to £50/MWh (from around £75/MWh in 2019). We expect to deliver these savings through the optimisation of existing biomass operations, greater utilisation of low-cost wood residues and an expansion of the types of sustainable low-cost biomass sourced across the Group’s expanded supply chain.

Drax believes that the additional capital and operating cost investment required to deliver this supply chain expansion is in the region of £600 million, which the Group expects to invest ahead of 2027.

This expansion and cost reduction plan gives rise to the three options (see page 17) which are not mutually exclusive. The delivery of one or more of these models by 2027 is expected to enable Drax to continue its biomass activities when the current UK renewable schemes for biomass generation end in 2027.

Expansion and optimisation of existing capacity

Drax currently uses around 7Mt of biomass for generation at Drax Power Station, 1.5Mt of which is self-supplied by our existing pellet production operations in the US Gulf.

We have also identified plans to expand our three existing production sites – LaSalle, Morehouse and Amite – by 0.4Mt over the next two years – an investment of £50 million, the first 0.1Mt of which has now been completed. This will expand total capacity to around 1.9Mt, provide economies of scale and allow even greater utilisation of lower cost residues, such as wood chips and sawmill residues.

Other projects include the co-location of a third-party sawmill at the LaSalle Plant to provide access to sawmill residues, lower transport costs and improved efficiency; a new rail spur connecting LaSalle to the local rail network, improving economies of scale in transport and fewer road miles; and a new chambering yard at the Port of Baton Rouge allowing greater rail throughput. These larger projects are accompanied by small projects to improve operational efficiency such as greater efficiency in the loading of road haulage.

In 2020, these initiatives and others contributed to a 5% year-on-year reduction in cost per tonne. The delivery of these projects, amongst other incremental improvements is expected to deliver $35 per tonne of savings on 1.9Mt by 2022.

In addition to improvements in the US, we have also invested to improve thermal efficiency at Drax Power Station. In 2020 we completed the second of three turbine upgrades which has improved thermal efficiency and alongside other improvements results in a reduction in fuel cost in the region of £1/MWh. The third outage is scheduled to take place in 2021.

Further expansion of self-supply capacity

In 2020 Drax approved the construction of three new 40,000 tonne satellite plants sited alongside existing sawmills in the US southeast at a cost of $40 million. These small sites are designed to utilise low-cost sawmill residues and leverage the Group’s existing infrastructure in the region. Drax believes that this approach could represent up to 0.5Mt of capacity and expects these plants to significantly reduce the cost of pellet production versus the 2018 benchmark and will be operational by 2022.

We will continue to assess opportunities to build or buy capacity to support this ambition – both in North America and other regions where we can demonstrate the right combination of sustainability, fibre availability, cost and infrastructure.

Exploring alternative fuels

Biomass residues from commercial forestry processes represent the majority of biomass used by Drax for generation. Over the last decade, as part of our work on biomass, we have screened hundreds of different types of materials, and we are now using this knowledge of chemistries and operational characteristics to inform the exploration of alternative fuels.

Examples of these materials include sugar cane residues (bagasse), nuts and agricultural residues. Drax believes that in time such materials could represent a significant volume of sustainable biomass material.

Trading and optimisation

An integral part of our strategy is to develop a biomass trading capability. This is an optimisation and risk management activity to support our aim to deliver lower-cost pellets, and non-proprietary trading, through which we aim to optimise internal and external supply and develop opportunities in other markets.

Drax has identified three opportunities for the long‑term use of sustainable biomass

![]()

Merchant biomass generation at Drax Power Station

Biomass has an important role to play in the UK as a flexible and reliable source of renewable energy, complementing increased utilisation of intermittent and inflexible generation across the UK power grid.

In March 2027, when the current renewable schemes end, Drax believes that through a combination of peak power generation, system support services, Capacity Market income and a low-cost operating model for Drax Power Station (including low-cost biomass), this site can continue to operate as a merchant renewable power station

Bioenergy carbon capture and storage (BECCS)

Bioenergy carbon capture and storage (BECCS)

The CCC has set out what is required for the country to achieve its legally binding objective of being net zero by 2050. This includes a significant role for BECCS to remove carbon from the atmosphere, creating negative emissions. BECCS is the only large-scale solution for negative emissions that also generates renewable electricity and can provide system support services. Through combining BECCS with our existing biomass generation units at Drax Power Station, we believe we could remove millions of tonnes of carbon each year from 2027. In doing so Drax aims to become a carbon negative company by 2030.

The technology to deliver post-combustion BECCS exists and is proven at scale. In September 2020, Drax commenced a trial of one such technology provided by Mitsubishi Heavy Industries. In addition, Drax is developing innovative technology options, including C-Capture, a partnership between Leeds University, Drax, IP Group and BP, which has developed an organic solvent which could be used for BECCS.

Third party biomass supply

Third party biomass supply

Drax expects global demand for sustainable wood pellets to increase in the current decade, as other countries develop decarbonisation programmes which incorporate the benefits of sustainable biomass for generation. Whilst there is an abundance of unprocessed sustainable biomass material globally, there remains limited capacity to convert these fibres to energy dense pellets, which have a low-carbon footprint and lower cost associated with transportation. As a result, Drax expects the global market for biomass to remain under supplied.

Drax is therefore exploring options to service biomass demand in other markets – such as Europe, North America and Asia alongside the UK. Establishing a presence in these markets could offer the potential for long-term offtake agreements, providing diversified revenues from other biomass markets.

Key performance indicators

Finance

Group adjusted EBITDA from continuing and discontinued operations(1) (£m)*

Why we measure this

This is our principal financial performance metric, combining the underlying earnings performance of each business to give a Group outcome

£412m

Average net debt(1) (£m)*

Why we measure this

This is a key measure of our liquidity (borrowings less cash) and our ability to manage our current obligations. Our long-term target is net debt to EBITDA of around 2x

£849m

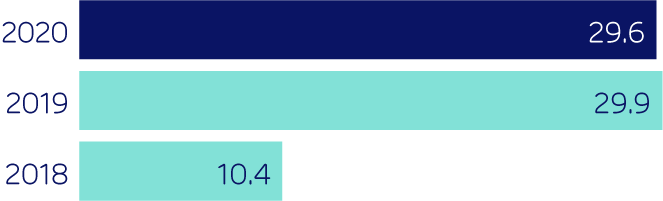

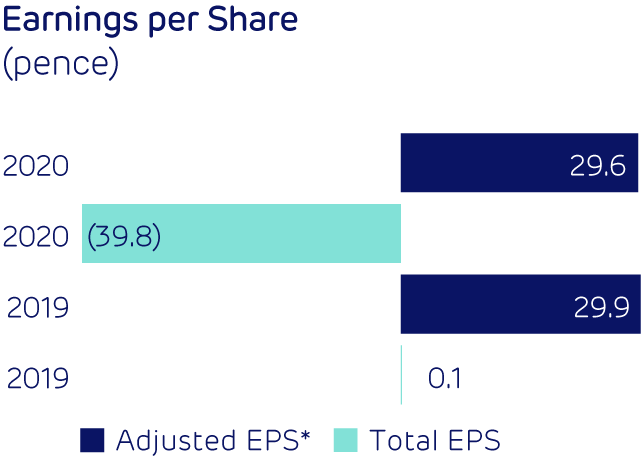

Adjusted Earnings Per Share(2) (EPS)*

Why we measure this

This is an important measure of our profitability – showing our adjusted earnings (adjusted net profit from continuing and discontinued operations after tax) on a per-share basis

29.6p

Dividend

Why we measure this

This is a primary measure of our value creation for shareholders. We aim to pay a sustainable and growing dividend

17.1p

*The definition and calculation of Alternative Performance Measures (those that are defined by Drax and not IFRS) is set out on page 153 of the report PDF

Sustainability

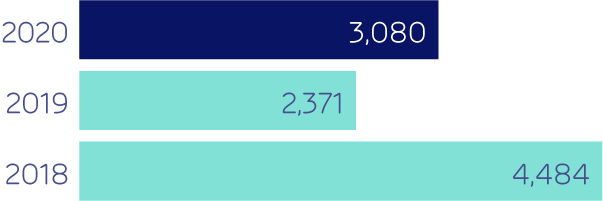

Group carbon emissions, scope 1 & 2 (ktCO2e)

Why we measure this

We are focused on reducing carbon emissions – as measured by scope 1 and 2 – which enables us to track progress towards our carbon negative ambition

3,080 ktCO2e

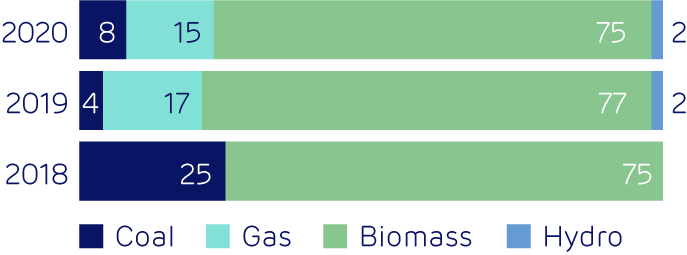

Power generation mix (% total output)

Why we measure this

This is a measure of the different generation sources we use, allowing us to track our progress as we seek to enable a zero carbon energy future

CDP Climate score (1)

Why we measure this

This is an internationally recognised disclosure system and a benchmark for our environmental performance

(1) These measures are contained in the Group Scorecard. and form the basis for the calculation of outcomes for annual bonus and 50% of PSP awards. For more information see pages 125 and 126.

(2) EPS forms the basis for the calculation of outcomes for 50% of LTIP awards. For more information see page 115 of the report PDF.

Safety

Total Recordable Incident Rate(1) (TRIR)

Why we measure this

Good safety management is a core principle and is critical to safe and efficient operations. TRIR is an industry standard measure of the number of incident over hours worked

0.29

Pellet Production

Pellets produced (Mt)

Why we measure this

This measures a key part of our strategy – to increase our pellet production capacity and output

1.5Mt

Cost of production(1) (GJ)

Why we measure this

This measures a key part of our strategy – to reduce the cost of biomass produced

$8.61/GJ

Power generation

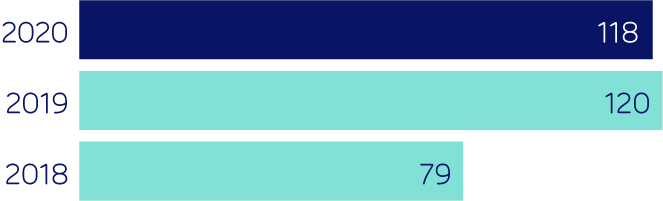

Value from system support (£m)

Why we measure this

This measures our generation performance in the provision of non-generation system support services – balancing mechanism, ancillary services and portfolio optimisation

£118m

Commercial availability (%)

Why we measure this

This is an important measure of the amount of time our assets are available to operate, either to generate electricity or provide system support services

91%

Customers

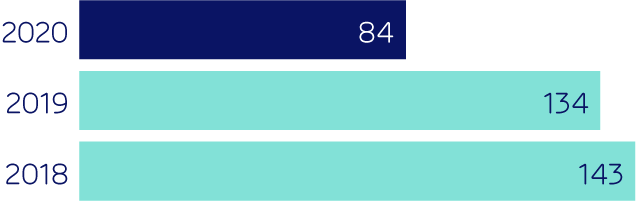

Gross margin(1) (£m)

Why we measure this

This is a key measure of the financial performance of our Customers business – average margin earned

£84m

Chapter 6:

Financial review

How did Drax’s financial performance respond to the challenges of 2020?

Performance has been robust throughout the year, and despite the challenges of Covid-19, Adjusted EBITDA from continuing and discontinued operations was £412 million

2020 highlights

- Robust financial performance – delivering Adjusted EBITDA from continuing and discontinued operations of £412 million, ahead of 2019 despite impact of Covid-19

- Sale of CCGT assets concluded on 31 January 2021 for total consideration, before customary adjustments, of up to £193 million

- Ratio of Net debt to Adjusted EBITDA from continuing and discontinued operations of 1.9x at 31 December 2020

- Asset obsolescence charges of £239 million includes coal closure (£226 million) and decision not to proceed with Drax CCGT (£13 million)

- Provision for one-off coal closure costs of £34 million

- Total operating loss of £156 million includes asset obsolescence charges, one-off coal closure costs plus net derivative remeasurements

- Cash generated from operations of £413 million, compared to £471 million in 2019

- Strong liquidity – with total cash and committed facilities of £682 million at 31 December 2020

- 7.5% increase in dividend to £68 million

The sale of Drax Generation Enterprise Ltd (which contained the Group’s CCGT portfolio) to VPI Generation Limited was announced on 15 December 2020 and completed on 31 January 2021 (see page 27 for further details). The income, expenditure and cash flows of the disposed operations for both the current and previous year have been presented as discontinued operations, and the assets and liabilities of the disposed operations as at 31 December 2020 have been presented as held for sale in the Group’s consolidated financial statements. Amounts presented in this financial review are for continuing operations unless otherwise stated. Reconciliations between continuing, discontinued and total amounts for each period are shown in note 5.5 to the consolidated financial statements on page 195. Comparatives for 2019 have been re-presented to reflect the income and expenditure for the disposed operations as discontinued. Tables in this financial review may not add down/across due to rounding.

Introduction

The Group’s financial performance in 2020 has been robust, delivering Adjusted EBITDA from continuing and discontinued operations of £412 million, which represents a small increase compared to the previous year despite an estimated impact of approximately £60 million as a result of the Covid-19 pandemic, most notably affecting our Customers business (2019 Adjusted EBITDA from continuing and discontinued operations: £410 million).

Strong availability and output from our biomass generation units at Drax Power Station underpinned this result. In addition, we saw value from system support services captured across our flexible generation portfolio and the continuing delivery of our cost reduction targets for biomass pellet production.

We estimate the total financial impact of Covid-19 to be approximately £60 million. In our Customers business, we witnessed a reduction in demand and an increased risk of business failure affecting our customers. This is reflected in costs incurred to exit our previously hedged positions and an increase in the provision for bad debt. In the Generation business, we saw a reduction in ROC recycle values and incurred increased outage costs, but largely offset this by delivering improved returns from flexible generation. We were also able to capture benefits from our substantial derivatives portfolio during a volatile period in markets.

(1) Alternative performance measures (income statement values described as “Adjusted”, plus net debt and net debt to Adjusted EBITDA calculations) are used throughout this financial review. All alternative performance measures are described in full on page 153 and reconciled to corresponding IFRS values on page 170.

Following the Board’s decision to close our remaining coal-fired generation operations, which was announced in February 2020, we recognised asset obsolescence charges in respect of the associated fixed assets of £226 million during the year. In addition, following an employee consultation process, we have booked provisions in respect of redundancy, pension costs, and other closure costs totalling £34 million. Other closure costs include a provision for work to ensure the safety of the site following the closure of the coal units and a small inventory write down for coal we no longer expect to burn prior to closure. All costs associated with the closure of the coal units have been treated as exceptional items in the income statement.

The Total operating loss for the year – which includes depreciation, amortisation and the effect of exceptional items and certain derivative remeasurements – was £156 million (2019 re-presented: profit of £48 million). The year-on-year reduction principally reflects £239 million of asset obsolescence charges plus the £34 million of coal closure costs described above, The asset obsolescence charges are comprised of £226 million related to the coal units and a further £13 million in respect of the option to develop a new combined cycle gas turbine at Drax Power Station, which is no longer expected to proceed. These one-off costs, the majority of which are non-cash, have been partially offset by a reduction in losses arising on the remeasurement of derivative contracts, from £121 million in 2019 to £70 million in 2020, as a result of sterling strengthening during the year.

On 15 December 2020, we announced the sale of our CCGT portfolio to VPI Generation Limited for a cash consideration of up to £193 million, subject to customary working capital adjustments. This included £29 million of contingent consideration associated with the option to develop a new CCGT at Damhead Creek. The transaction subsequently completed on 31 January 2021. The CCGTs have performed well since being acquired in December 2018, delivering £46 million of Adjusted EBITDA in 2020 (2019: £39 million). However, they do not form part of the Group’s core flexible and renewable generation strategy. The results of the CCGTs have been classified as discontinued operations in the consolidated financial statements.

We continued to strengthen our balance sheet and capital structure during 2020. In August we agreed a new infrastructure term loan facility agreement with committed funds in both sterling (£45 million) and euro (€126.5 million), with an option to increase by up to a further £75 million. In November €31.5 million was drawn under this agreement and a further £53 million was committed under the option which was subsequently drawn in December. These commitments have competitive effective interest rates inside the Group’s current average cost of debt. Also in November we issued a new €250 million euro-denominated bond at 2.625% which achieved a rate of 3.24% when swapped back to sterling, a record low cost for a Drax public market issuance. At the same time, we redeemed the existing £350 million sterling bond and the £125 million ESG facility, resulting in an improved maturity profile and lower all-in cost of our debt portfolio. We also refinanced our Revolving Credit Facility, extending its final maturity date from 2022 out to 2025 and converted it into a £300 million facility with ESG credentials. This delivers further enhancements to liquidity. Overall, net cash payments in respect of debt reduced our borrowings by £176 million (2019: increased borrowings by £636 million, linked to acquisitions).

We continue to generate strong net operating cash inflows. Net cash from operating activities was £306 million in 2020 (2019: £413 million). The reduction when compared to the prior year principally reflects a net cash outflow from rebased derivative contracts of £27 million, as the benefit of cash accelerated from such activity unwound over the course of the year (2019: net cash inflow of £104 million). In addition, 2020 saw the introduction of the new tax payment regime for large companies, accelerating tax payments in the year of transition. Cash capital expenditure in the year was £174 million (2019: £171 million).

The Group’s liquidity position remains strong and provides a solid platform from which we can continue to execute our strategy. At 31 December 2020, we held cash of £290 million (2019: £404 million) and total cash and total committed facilities of £682 million (2019: £615 million).

We remain fully committed to payment of a sustainable and growing dividend. The Board will recommend at the forthcoming Annual General Meeting a final dividend that takes total dividends for the financial year to £68 million, or 17.1 pence per share, an increase of £5 million or 1.2 pence per share when compared to 2019.

Financial Performance

Adjusted EBITDA

Group Adjusted EBITDA from continuing and discontinued operations of £412 million was slightly ahead of the prior year (2019: £410 million) despite the impact of Covid-19. This represents a robust performance in what has been a challenging year. Excluding the contribution from the CCGT portfolio classified as discontinued in the consolidated financial statements, Adjusted EBITDA from continuing operations was £366 million (2019: £371 million).

Our Generation business contributed Adjusted EBITDA from continuing and discontinued operations of £446 million (2019: £408 million), an increase of 9% or £38 million compared to the previous year. This result was underpinned by a 5% increase in total output from biomass in 2020, to 14.1TWh compared to 13.4TWh in 2019. This was supported by availability of 91% (2019: 88%). Our strong generation hedge book also provided protection against volatility in commodity markets resulting from Covid-19.

Despite this performance, Generation has been affected by the pandemic. ROC recycle values fell during 2020 and the cost of performing outage work at our sites increased as a result of implementing social distancing measures to enable this work to be carried out safely. These factors were offset by strong performance in the short-term and balancing markets plus some value captured from within the derivatives portfolio attributable to market volatility during the Covid-19 pandemic.

Our pumped storage and hydro assets in Scotland continued to perform well. Cruachan pumped storage power station contributed significantly to overall gross margin from system support activity of £118 million. This reduced slightly from £120 million in 2019, due to specific constraint contract income and benefits associated with closing out positions as our coal generation forecasts reduced, neither of which were expected to recur in 2020. This reflects the benefit of generating plant that is flexible and can turn up and down at short notice to meet demand.

Reconciliation of Adjusted EBITDA to Total Operating Loss

The CCGT portfolio performed strongly, particularly in the final quarter of the year as cold weather and low wind led to opportunities in the balancing market. Total output from the CCGTs was 2.8TWh (2019: 2.9TWh) with an EBITDA contribution of £46 million (2019: £39 million). On 15 December 2020, we announced the sale of the CCGT portfolio to VPI Generation Limited for total cash consideration of up to £193 million, including £29 million of consideration contingent on the development of a new CCGT at the Damhead Creek site. The sale subsequently completed on 31 January 2021. Initial cash consideration received on 1 February was £188 million, including £24 million in respect of adjustments for working capital.