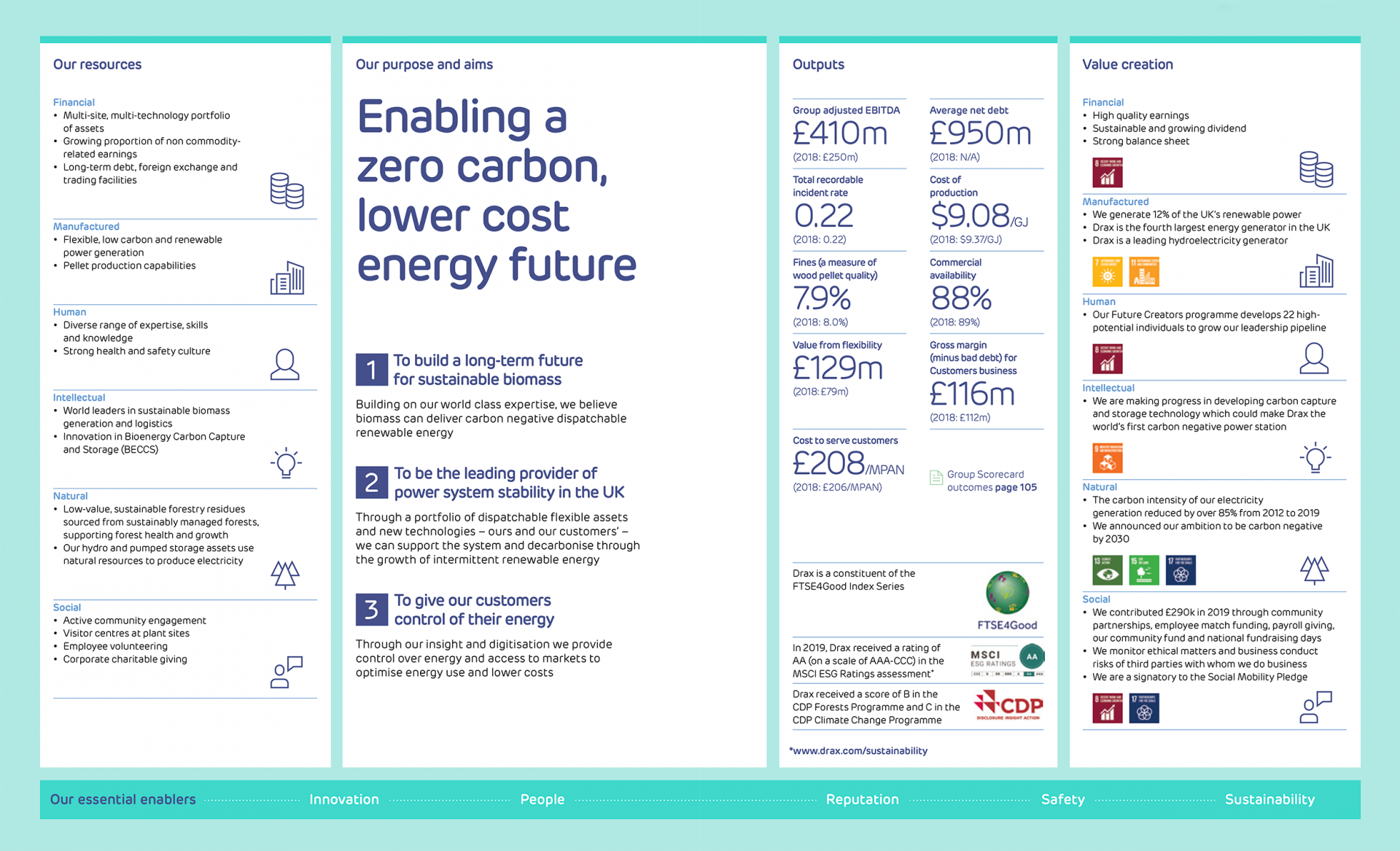

Enabling a zero carbon, lower cost energy future

Chapter 1:

Welcome, 2019 highlights and activities at a glance

Welcome to Drax Group

Our purpose is to enable a zero carbon, lower cost energy future.

Our ambition is to become carbon negative by 2030. Being carbon negative means that we will be removing more carbon dioxide from the atmosphere than we produce throughout our operations – creating a negative carbon footprint for the company.

Our strategic aims are:

-

To build a long-term future for biomass

Building on our world class expertise, we believe biomass can deliver carbon negative dispatchable renewable energy.

-

To be the leading provider of power system stability

Through a portfolio of dispatchable flexible assets and new technologies – ours and our customers’ – we will support the system and decarbonise through the growth of intermittent renewable energy.

-

To give our customers control of their energy

Through the provision of insight and digitisation we provide control over energy and access to markets to optimise energy use and lower costs.

This webpage presents the Strategic Report section. View the full Drax Group plc Annual Report and Accounts PDF.

2019 Highlights

1) We calculate Adjusted financial performance measures, which are specific to Drax and exclude income statement volatility arising from derivative financial instruments and the impact of exceptional items, to provide additional information about the Group’s performance. Adjusted financial performance measures are described more fully on page 131 of the full PDF report, with a reconciliation to their statutory equivalents in note 2.7 to the consolidated financial statements on page 149 of the full PDF report. Throughout this document we distinguish between Adjusted financial performance measures and Total financial performance measures, which are calculated in accordance with International Financial Reporting Standards (IFRS).

Our core activities at a glance

We operate an integrated value chain across three principal areas of activity: sustainable wood pellet production; flexible, low carbon and renewable energy generation; and energy sales and services to business customers.

PELLET PRODUCTION

A leading producer of wood pellets from sustainable low-value commercial forestry residues

Our pellets provide a sustainable, low carbon fuel source. This can be safely and efficiently delivered through our global supply chain and used by Drax’s Generation business to make flexible, renewable electricity for the UK. Our manufacturing operations also promote forest health by incentivising local landowners to actively manage and reinvest in their forests.

Our assets:

- 2 x 525 kt pellet plants

- 1 x 450 kt pellet plant

- 350 kt planned expansion of existing facilities, under construction

- 2.4 Mt export facility at Baton Rouge port

Pellets produced

1,407kt

Sales of pellets

£229m

GENERATION

GENERATION

A portfolio of flexible, low carbon and renewable UK power generation

Our multi-site, multi-technology generation portfolio provides power and system support services to the electricity grid. This portfolio provides long-term earnings stability and opportunities to optimise returns from the transition to a low carbon economy.

Our assets:

- Renewable biomass – 2.6GW

- Hydro – 0.6GW

- Thermal:

- Gas – 2.0GW

- Coal – 1.3GW

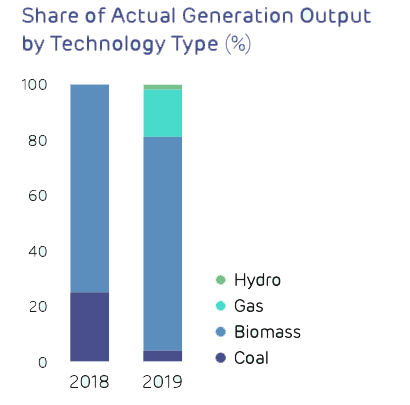

Generation

17.3TWh

Renewables

79%

CUSTOMERS

A leading supplier of renewable energy solutions to industrial and business customers

Our B2B Energy Supply business – comprised of Opus Energy and Haven Power – is the third largest B2B power supplier in the UK and the largest supplier of renewable energy to British businesses.

We are giving our customers control of their energy, which in turn supports the stability of the energy system.

Our assets:

- Opus Energy

- Haven Power

Customer meters

419k

Electricity and gas sales

18.9 TW

Chapter 2:

Business Model

Chapter 3:

Chair's Statement and Group CEO's review

Chair’s Statement

Investment Case

-

Critical to decarbonisation of the UK’s energy system and a major source of flexible, low carbon and renewable power from a nationwide portfolio of generation technologies

-

Underlying growth in the core business and attractive investment opportunities

-

Increasing earnings visibility, reducing commodity exposure

-

Strong financial position and clear capital allocation plan

“We continue to advance our purpose of enabling a zero carbon, lower cost energy future.”

Philip Cox, CBE Chair

Introduction

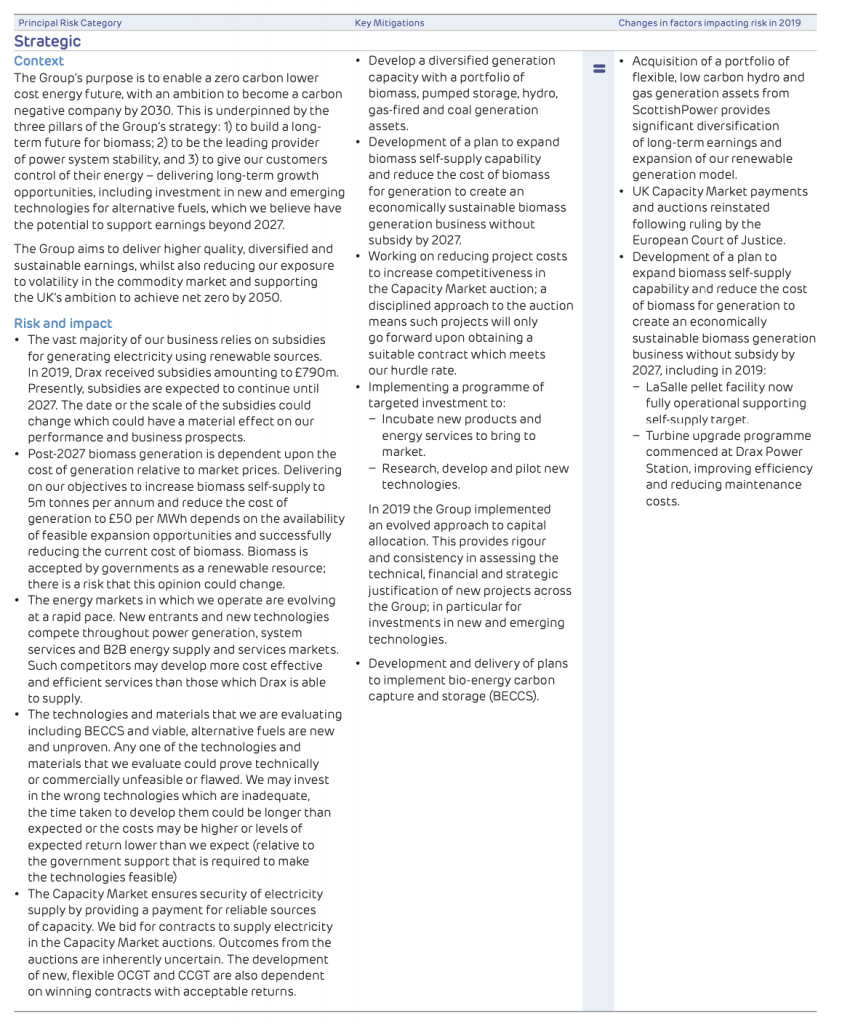

Drax Group’s purpose is to enable a zero carbon, lower cost energy future.

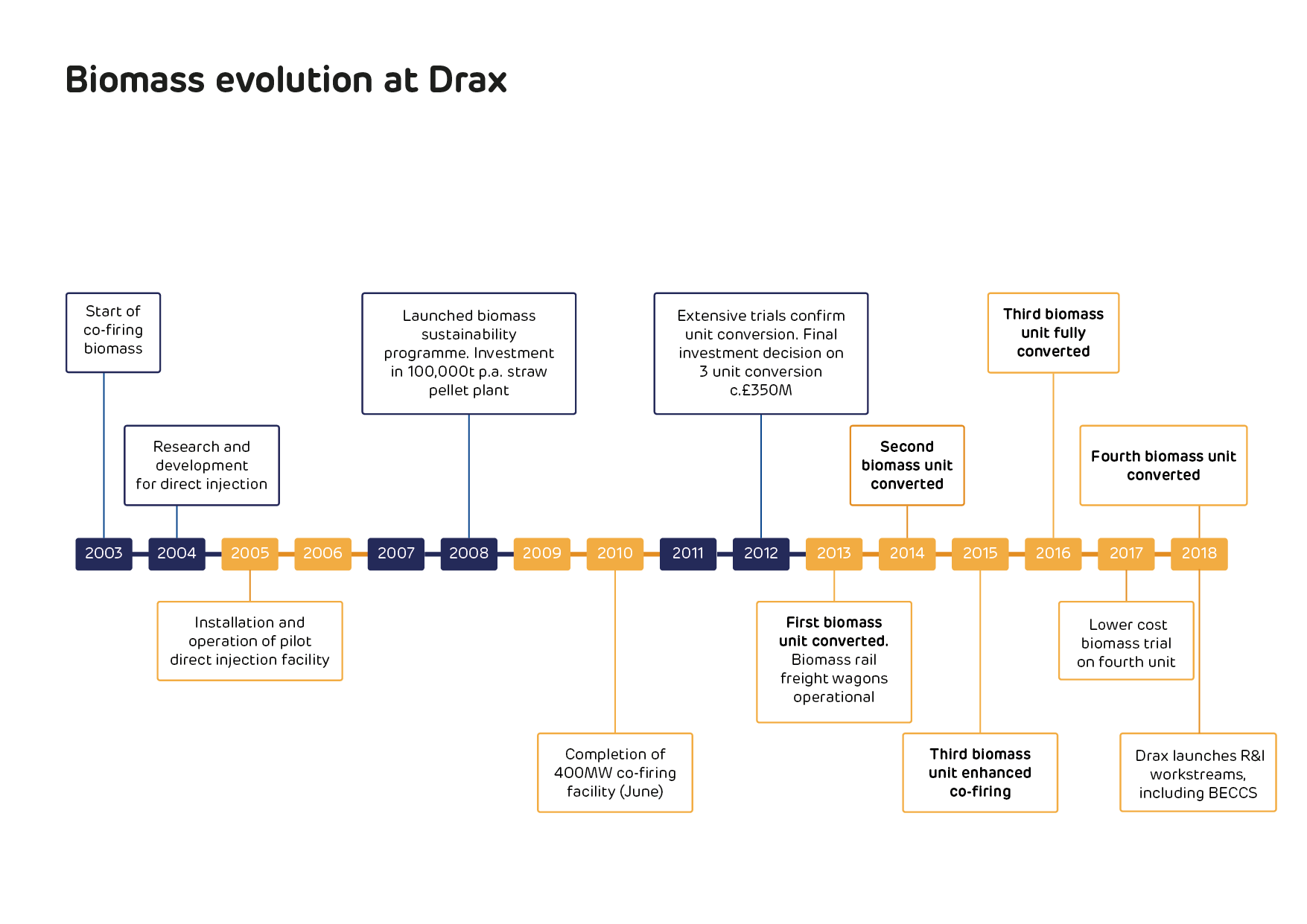

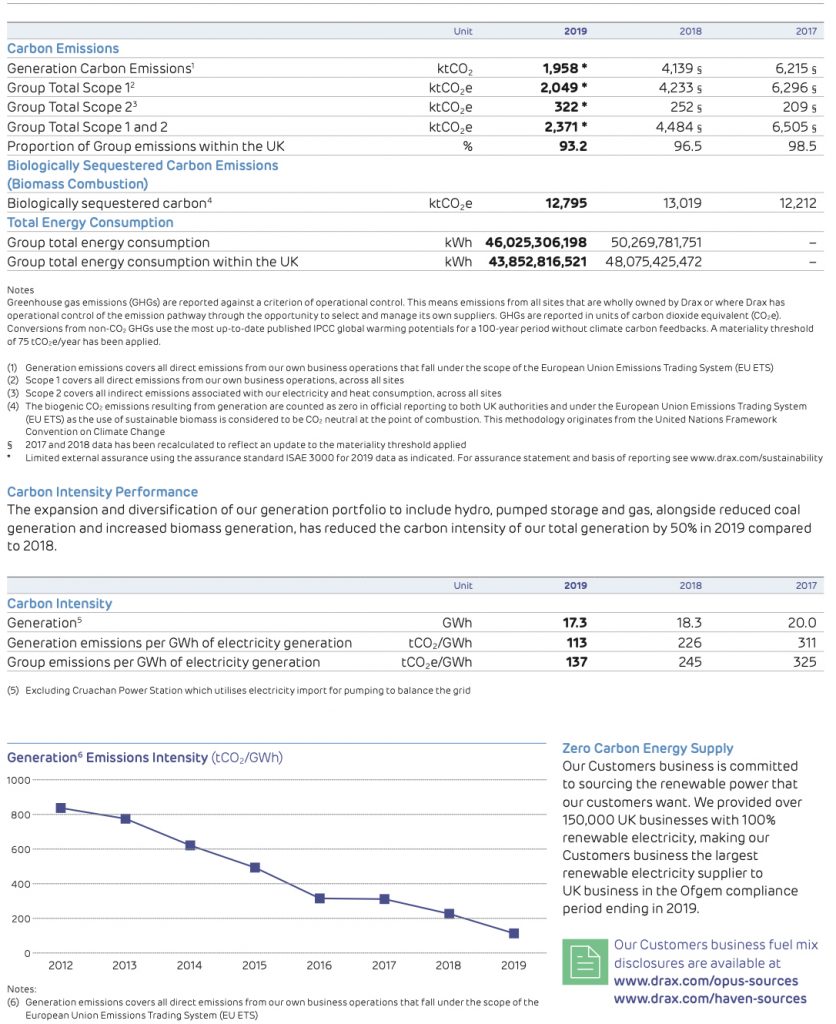

Since 2012 Drax has reduced its reported carbon emissions by over 85%. In December, we took a step further and announced an ambition to become carbon negative by 2030. With the right support and negative emissions framework from the UK Government, we believe we can realise this ambition.

Through these activities we expect to play a major role in delivering the UK’s legally binding objective to become carbon neutral by 2050.

The Group’s purpose informs our strategy through which we aim to build a long- term future for sustainable biomass, become the leading provider of system stability in the UK and give customers control of their energy.

In 2019 we continued to make good progress in delivering this strategy. In doing so we are delivering higher quality earnings, reducing commodity exposure and creating opportunities for growth aligned with the UK’s carbon neutral agenda.

Biomass has a long-term role to play in the UK and global energy markets as a flexible and sustainable source of renewable energy, as well as a means to deliver negative emissions. Key to securing this long-term role is reducing the cost of biomass. We aim to increase biomass self-supply to five million tonnes by 2027, which we believe will drive significant cost reduction and attractive returns to shareholders. We have made good progress in 2019 and will continue to implement measures to reduce costs and develop expansion opportunities in 2020.

The Group is working with a range of partner organisations to outline a plan for the decarbonisation of the Humber area. This is an industrial area in the northeast of England with one of the highest levels of CO2 emissions, making it a natural and cost-effective location for the deployment of carbon capture and storage, using Bioenergy with Carbon Capture and Storage (BECCS) at Drax Power Station. Through these initiatives we hope to deliver long-term benefits to a wide range of stakeholders and support the UK’s transition to net zero.

This is one example of how our engagement with stakeholders is an enabler to the delivery of our strategy. On pages 24 to 29 of the of the full PDF report, we provide further detail on our stakeholders and how members of the Board, including Non-Executive Directors, have participated in discussions and sought to understand views in order to inform decision making.

Drax Power Station is the UK’s largest single source of renewable electricity, providing 11% of the total. During 2019 the Generation business managed a programme of major planned outages. The business also optimised biomass operations to reflect weather-related biomass supply chain constraints. Over the same period coal generation has reduced, reflecting challenging market conditions. Following a comprehensive review of operations and discussions with National Grid, Ofgem and the UK Government, the Board of Drax has determined to end commercial coal generation at Drax Power Station. Drax will shortly commence a consultation process with employees and trade unions with a view to ending coal operations in September 2022. Under these proposals, commercial generation from coal will end in March 2021 but the two coal units will remain available to meet Capacity Market obligations until September 2022.

Dam and reservoir, Cruachan Power Station

In December 2018 we completed the acquisition of a portfolio of hydro and gas generation assets from ScottishPower, making Drax the fourth largest electricity generator in the UK and a leading provider of system support services. During 2019 we successfully integrated these assets into our generation portfolio. The assets have performed strongly, with returns significantly ahead of the Group’s cost of capital.

Following weather-restricted production in the first quarter of 2019, our US Pellet Production business produced at full capacity. Our focus remains on the production of good quality and low-cost biomass. Although pellet quality improved in 2019, it was below the level we expect and we are focused on delivering further improvements during 2020.

In our Customers business, which supplies electricity and gas to business customers, we made progress reducing cost, increased the margin per MWh and installed more smart meters year-on-year. However, in a challenging market financial performance was below the level we expect and we have more work to do to realise the opportunities we continue to see in this area. During 2019 we consolidated the management team at Haven Power and Opus Energy into a single integrated team. We expect this new structure to improve operational efficiency.

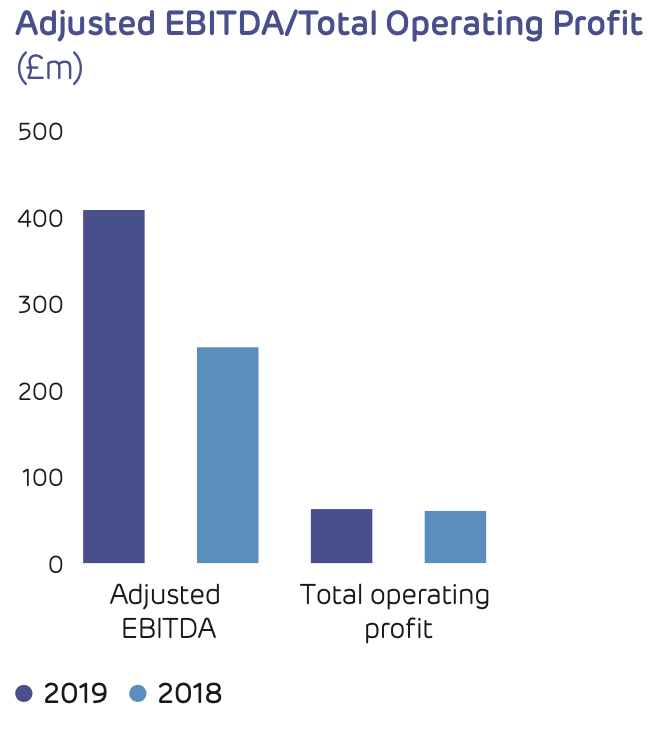

Results and dividend

Adjusted EBITDA in 2019 of £410 million grew by 64% compared to 2018 (£250 million). This reflects high levels of performance from the hydro and gas generation businesses, as well as continued growth in our Pellet Production business.

At the 2019 half year results we confirmed an interim dividend of £25 million (6.4 pence per share). The Board proposes to pay a final dividend in respect of 2019 of £38 million, equivalent to 9.5 pence per share, making the full year 2019 dividend £63 million (15.9 pence per share) (2018: £56 million, 14.1 pence per share). This represents a 13% increase on 2018 and is consistent with our policy to pay a dividend which is sustainable and expected to grow as the strategy delivers stable earnings, strong cash flows and opportunities for growth.

The Group has a clear capital allocation policy which it has applied throughout 2019. In determining the rate of growth in dividends from one year to the next the Board will take account of contracted cash flows, the less predictable cash flows from the Group’s commodity based business and future investment opportunities. If there is a build-up of capital, the Board will consider the most appropriate mechanism to return this to shareholders.

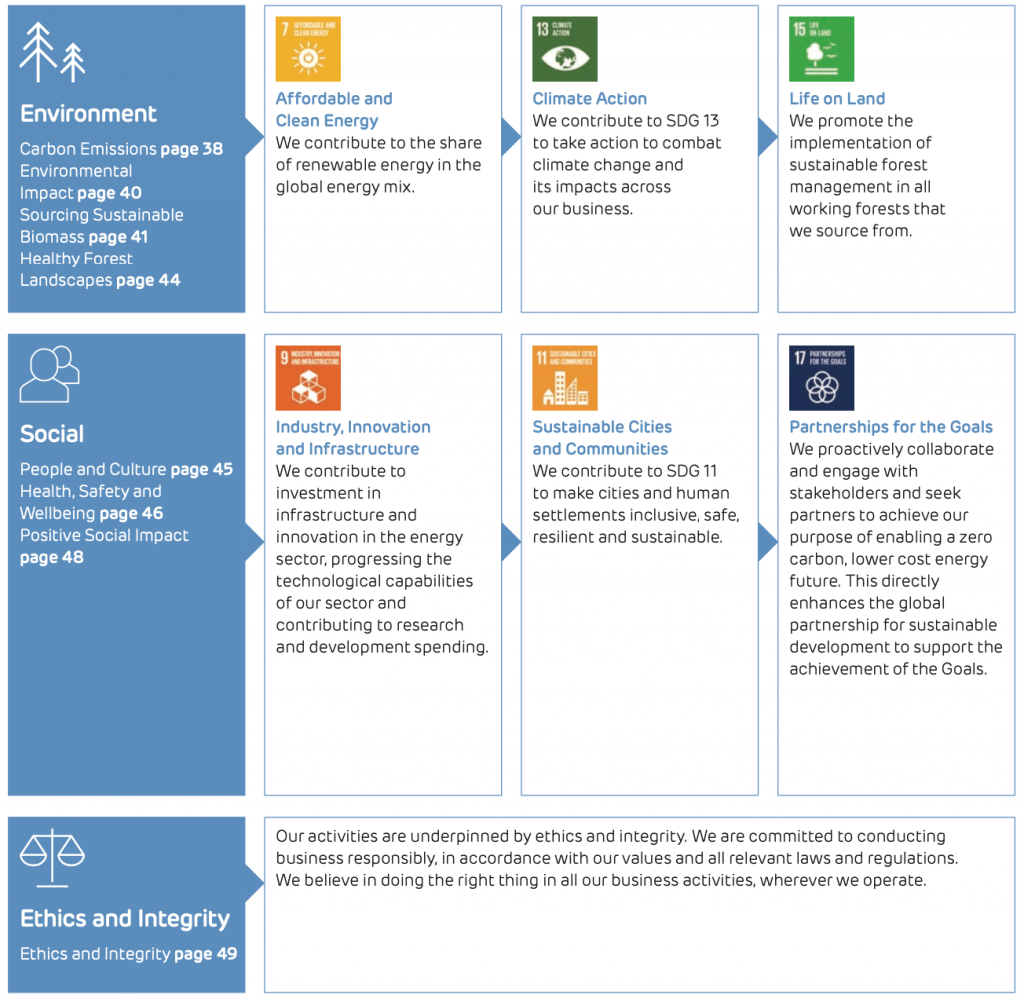

Governance and values

Sustainability is at the heart of the Group and its culture. It covers the sustainable sourcing of biomass, which is a core principle of the Group, and also long-term sustainability. This means achieving a positive economic, social and environmental impact and considering long, medium and short-term factors in our stewardship of the business.

We are committed to promoting the UN Global Compact principles on respect for human rights, labour rights, the environment and anti-corruption.

Our aim is to maintain an open and collaborative culture across the Group. Setting the right standards helps to protect the business and the interests of our stakeholders. We remain committed to the highest standards of corporate governance, and the Board and its committees play an active role in guiding the Company and leading its strategy.

In 2019 we saw several changes to the Board, including the appointment of Andy Skelton as Chief Financial Officer (CFO).

Andy is highly experienced, having previously served as CFO at Fidessa Group plc.

We greatly value the contribution made by our Non-Executive Directors and during a time of growth their role remains especially important. David Lindsell, Tony Thorne and Tim Cobbold each stepped down, and I would like to thank all three for their very significant contributions to the Board and the stewardship of the business.

John Baxter joined the Board in April 2019 and brings a wealth of industry, engineering and safety management expertise.

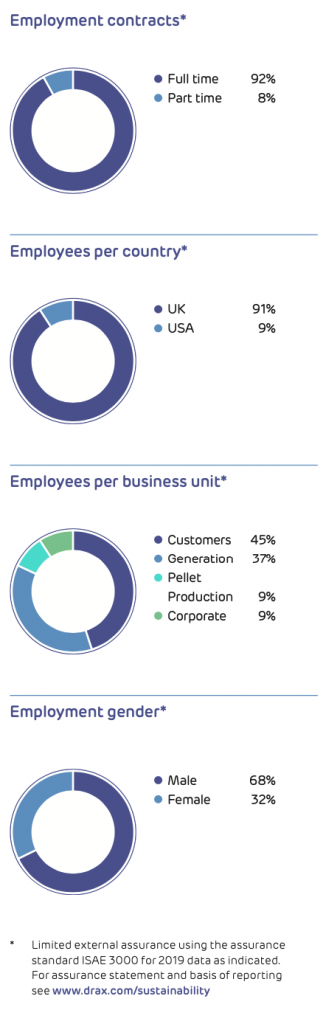

Our people

Our people – employees and contractors – remain a key asset of the business and we are focused on creating a diverse and inclusive working environment that is both safe and supportive.

We recognise the importance of listening to employees to understand their concerns and act on them. To that end, in 2019, we established an enhanced programme of workforce engagement to improve communication and feedback between the Board, senior management and our workforce. Together with Will Gardiner, our CEO, I participated in meetings with the chairs of our newly established engagement forums. More information on this can be found on page 28 of the full PDF report.

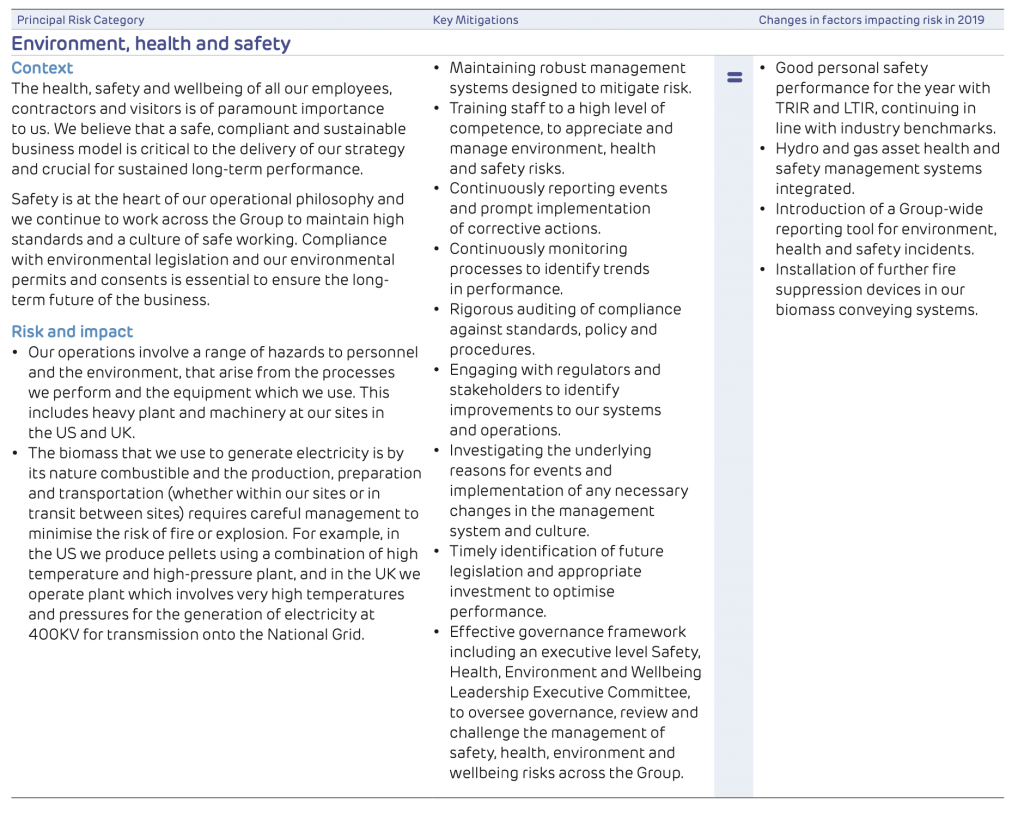

Safety is a long-held and central commitment of our operational philosophy. While the number of incidents is low, we need to remain vigilant and work to reduce them. We are committed to the highest standards and have continued our efforts to strengthen our approach to health, safety and wellbeing governance across the Group.

To conclude, in 2019 we delivered strong financial performance and made good progress with our strategic objectives. I look forward to building on these in 2020. Through this strategy we will deliver sustainable long-term value, support the communities in which we operate and realise our purpose of enabling a zero carbon, lower cost energy future.

Philip Cox CBE

Chair

Group CEO Review

2019 Highlights

-

Strong growth in Adjusted EBITDA

-

Delivered ahead of target net debt to Adjusted EBITDA ratio, after adjusting for deferred cash receipt of Capacity Market payments

-

Reduction in CO2

-

Reduction in biomass self-supply cost

-

Strong system support performance

-

Completion of private placement and ESG debt facilities

-

Development of Bioenergy Carbon Capture and Storage project

“Our ambition is to become a carbon negative company by 2030.”

Will Gardiner, Group CEO

2019 was an important year for Drax Group. Following the acquisition of the hydro and gas generation assets from ScottishPower in December 2018, we are now the UK’s fourth largest generator, meeting 5% of its power requirements, and generating 12% of the country’s renewable power.

In 2019, we continued to advance our purpose of enabling a zero carbon, lower cost energy future. In December 2019, we announced a world first ambition to become a carbon negative company by 2030, removing more CO2 from the atmosphere than we put into it. We have made significant progress towards that goal, as the carbon emissions from the Group have reduced by over 85% since 2012. We now expect to take this a step further with the end of commercial coal generation in 2021 and the formal closure of the coal units in 2022. For more information on this please see page 118 of the full PDF report.

The safety and wellbeing of our workforce is paramount to the Group. We continue to invest in the systems, governance and training to keep our workforce and assets safe.

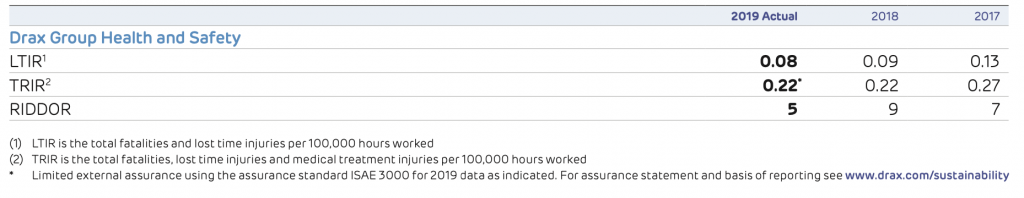

Total Recordable Incident Rate (TRIR), a key scorecard measure of safety, was 0.22. This was the same as in 2018 although behind the challenging scorecard target for 2019. Safety remains our priority and as always there is more we can do in our pursuit of zero incidents.

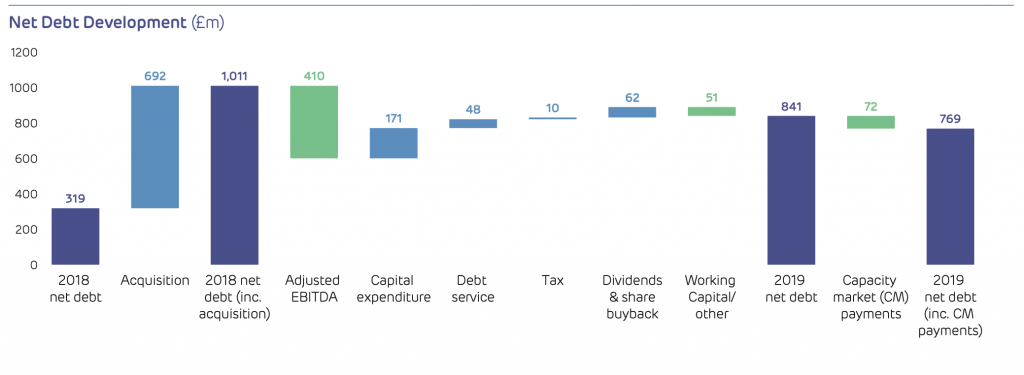

Alongside a good operational performance, we delivered Adjusted EBITDA of £410 million, an increase of 64% on 2018. We propose to pay a dividend in respect of 2019 of £63 million, an increase of 13% on 2018. By the end of 2019, net debt was £841 million, 1.9x net debt to EBITDA, ahead of target of 2.0x, after adjusting for deferred cash receipt of Capacity Market payments of £72 million, received in January 2020.

Purpose and Strategy

Drax’s purpose, to enable a zero carbon, lower cost energy future, sits at the heart of everything we do. We see growing opportunities to create value for shareholders as well as significant benefits for all stakeholders as we deliver that purpose.

2019 saw increasing global recognition of the need for urgent action to tackle climate change by reducing greenhouse gas emissions. The UK Government has taken a lead by putting in place legally binding targets to deliver net zero carbon emissions across the UK economy by 2050. This is an ambitious target which can only be delivered with action and investment now.

We are playing a key role in this transformation. The CO2 emissions at Drax Power Station were less than one million tonnes for the first time, a 97% reduction since 2012, and it is now the UK’s largest source of renewable power generation.

This was achieved through our continued focus on renewable biomass combined with operational excellence and innovative engineering.

While others target net zero, in December 2019, Drax became the first company in the world to announce an ambition to become carbon negative by 2030 – removing CO2 from the atmosphere using Bioenergy with Carbon Capture and Storage (BECCS) to safely capture and store CO2 at scale.

In May 2019 the UK Committee on Climate Change published its pathway for how the UK can deliver net zero carbon emissions by 2050. It highlighted the need for BECCS. Drax is in a leading position to deliver BECCS at scale in the UK and provide as much as a third of the negative emissions the UK will require. We believe we can deliver the engineering solution, but our ambition also requires the right regulatory framework and policy support to underpin an investment decision.

To support that process, in May 2019, we joined with National Grid and Equinor to advocate for a framework to support the development of a carbon cluster in the Humber region, one of the most carbon intensive areas of the UK. This programme is called Zero Carbon Humber.

The Group’s purpose informs the three pillars of our strategy (i) to build a long-term future for biomass, (ii) to be the leading provider of power system stability and (iii) to give our customers control of their energy.

In 2019 we continued to make good progress delivering our purpose and strategy. Through addressing UK energy needs, and those of our customers, our strategy is designed to deliver excellent long-term financial performance across the Group. In doing so we are reducing our historic exposure to commodity markets and delivering higher quality earnings, strong cash generation, increased dividends to shareholders and further opportunities for growth.

A good example of this is the successful integration of a generation portfolio of flexible, low-carbon and renewable hydro and gas generation assets acquired in December 2018. Our expanded asset base has improved the risk profile of the Group and provided more opportunities to deliver system support services to the UK energy market. Our expected EBITDA from these assets was £90-£110 million and they have delivered £114 million of high-quality earnings, with financial returns significantly ahead of the Group’s cost of capital.

As part of our strategy to deliver a long-term future for sustainable biomass, in November 2019, we announced plans to expand our supply chain to self-supply five million tonnes of biomass to our generation business by 2027. In 2019 we self-supplied 1.4 million tonnes. We expect this expansion to be delivered through existing sites, new developments and a wider fuel envelope of sustainable biomass. Through these initiatives we expect to reduce the cost of biomass from around £75/MWh to £50/MWh by 2027, assuming an exchange rate of $1.45/£. This is a level at which we believe renewable electricity from biomass can be economic without the current support mechanisms.

These activities, alongside the development of a biomass trading capability, could enable Drax to develop an unsubsidised biomass generation business by 2027, with the option to service wood pellet demand in Europe, North America and Asia.

Summary of 2019

Overall performance of the Group and its business units is measured as part of our Group Scorecard which covers a combination of financial, environmental, social and governance issues. The Group’s score in 2019 was 0.9, with a score of 1.0 being on target.

Adjusted EBITDA, a key financial KPI, of £410 million represents a 64% increase on 2018. This includes £78 million of Capacity Market income in respect of the whole of 2019 and the last two months of 2018.

Despite challenging weather conditions in early 2019, Pellet Production increased output across the full year from 1.35 million tonnes to 1.40 million tonnes. At the same time, the cost of producing and delivering wood pellets to our port facility at Baton Rouge reduced from $166/tonne in 2018 to $161/tonne in 2019, although challenges remain in terms of pellet quality.

In Generation, the integration and performance of the acquired assets was a success. At Drax Power Station we managed lower levels of biomass availability, which restricted generation in early 2019. By optimising biomass generation under the Renewables Obligation (RO) scheme we were able to partially offset the constraint by producing higher levels of biomass generation later in the year, particularly December, in which we reported record monthly renewable generation. The business also completed a programme of major planned outages across the portfolio.

In our Customers business, which supplies electricity and gas to business customers, we have made progress reducing cost, however performance elsewhere has been below our expectation. This in part reflects a challenging market and we have more work to do to deliver the opportunities we continue to see in this area.

During the year we completed the refinancing of the funding used to acquire the hydro and gas generation assets. These new facilities extend the Group’s debt maturity profile to 2029, incorporating a £125 million Environmental, Social and Governance (ESG) facility with a mechanism that adjusts the interest margin based on Drax’s carbon emissions against an annual benchmark. We believe we are one of the first companies to implement such a feature within its debt, demonstrating our commitment to embedding ESG in financial performance. The Group’s cost of debt is now below 4% and below 3% on the new facilities, reflecting a reduced business risk.

Operational review

In the US, our Pellet Production operations reported Adjusted EBITDA of £32 million up 52% (2018: £21 million).

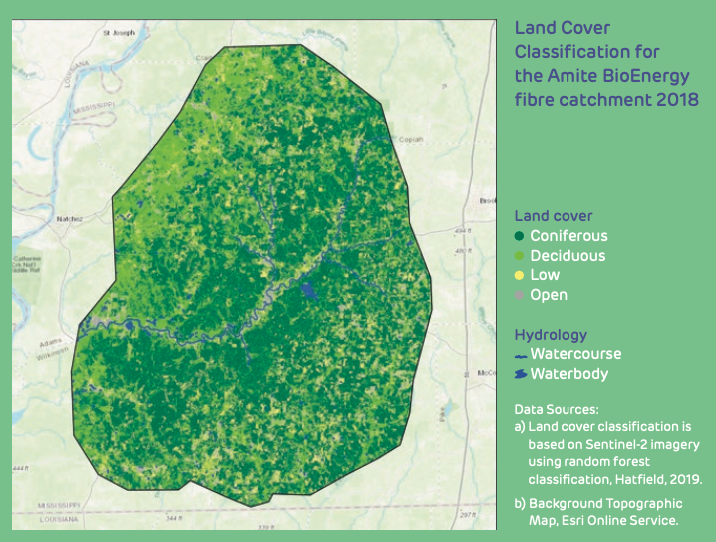

High levels of rainfall in the US Gulf in early 2019 restricted the level of commercial forest extraction and the availability of low-cost fibre for wood pellet production. This in turn had an impact on the shipment of pellets from the port of Baton Rouge. Since then commercial forestry processes, wood pellet production and shipments to the UK have increased. As a result, wood pellet volumes for 2019 were 1.40 million tonnes, up 4% (2018: 1.35 million tonnes).

Pellet quality, as measured by the amount of fines (larger particle-sized dust) in each cargo, is a KPI for the Group. Lower levels of fines result in fuel that is easier and safer to handle at ports and at Drax Power Station. The quality of the pellets we produced was below our target level in 2019 and we are taking steps to address this issue in 2020.

We have remained focused on opportunities across the supply chain to deliver improved operational performance and cost savings as part of our programme to reduce the cost of biomass to £50/MWh by 2027. We have made good progress with increased volumes, operational improvements and greater utilisation of low-cost fibre which have contributed to lower cost wood pellet production.

A co-location agreement with Hunt Forest Products (a sawmill operator) led to the development of a sawmill next to our LaSalle site. The sawmill commenced production in February 2019 providing greater access to low-cost sawmill residues, lower transportation costs and a reduction in the number of stages in the production process.

LaSalle pellet plant

A new rail spur linking LaSalle to the regional rail network and our port facility at Baton Rouge was commissioned in May 2019. This will increase transportation efficiency, provide economies of scale and reduce both cost and carbon footprint.

We expect to benefit from further economies of scale in rail associated with the commissioning of an enlarged chambering yard at the port of Baton Rouge in 2020, allowing 80-car train sets to operate from our LaSalle and Morehouse sites.

These initiatives and others have contributed to a year-on-year reduction in cost per tonne of 3%, which represents a saving of $5 per tonne compared to 2018.

We expect to deliver further savings by expanding our existing sites (LaSalle, Morehouse and Amite) by 350,000 tonnes over the next two years – an investment of £50 million. This will expand total capacity to 1.85Mt, provide economies of scale and allow greater utilisation of low-cost residues. We believe these projects offer returns significantly ahead of the Group’s cost of capital, with payback in advance of 2027.

These larger projects are accompanied by small operational improvements such as greater efficiency in the loading of road haulage, saving 50 cents per tonne. Over time these improvements, when applied across the supply chain, can deliver significant incremental savings.

Taking the savings in 2019 together with the other initiatives we have described, we believe there are opportunities to reduce the cost of biomass by $35 per tonne (£13/MWh) on our existing portfolio by 2022. This represents good progress, but more work and investment will be required to deliver our goal of making biomass power generation economically sustainable without subsidy. We expect to do this by using a greater proportion of lower cost wood residues, expanding our self-supply capacity to five million tonnes and exploring ways to expand our fuel envelope to include a wider range of sustainable low-cost biomass residues.

“We have remained focused on opportunities to reduce the cost of biomass to £50/MWh by 2027.”

Will Gardiner, Group CEO

Damhead Creek Power Station

In Generation, Adjusted EBITDA of £408 million was up 76% (2018: £232 million). This includes £114 million from the hydro and gas generation assets acquired in December 2018. These assets have performed strongly, exceeding our financial expectation in the first year of ownership.

Commercial availability, which measures the time we are available to operate in our markets, was 88% (2018: 89%). This was below our target and principally reflects restricted biomass generation in the first quarter of 2019 and gas unit outages.

The engineering challenges associated with such an outage are significant and the completion of the work and recommissioning, which allowed a strong operational performance, is testament to the skill and commitment of our people.

In 2019, we completed two major planned biomass outages, including the first in a series of three high-pressure turbine upgrades which we expect to increase thermal efficiency and reduce the cost of biomass generation.

Notwithstanding these planned outages our biomass units produced 11% of the UK’s renewable electricity – enough to power four million homes. This level of renewable generation, combined with the flexibility of our expanding portfolio, allows the Group to support the continued deployment of intermittent renewables and the UK’s plans for decarbonisation.

Over the last five years the operational experience with biomass generation has been positive and we are now exploring a wider range of sustainable biomass materials. In time we believe that utilisation of this expanded fuel mix will support a reduction in the cost of biomass generation.

Our hydro assets, which include the Cruachan pumped storage power station as well as Lanark and Galloway hydro schemes, have performed strongly, providing flexible, renewable and low carbon electricity. Cruachan Power Station – the largest of these assets (440MW) – plays an important role in the provision of system support services to the UK energy market. Over 80% of Cruachan’s earnings are from non- commodity sources, including Balancing Market activities, Ancillary Services and the Capacity Market.

We operate 2.0GW of Combined Cycle Gas Turbines (CCGT) – Damhead Creek, Shoreham, Rye House and Blackburn. These units produced 2.9TWh, representing around 17% of our total generation. The location of three of the four units in southeast England makes them well placed to provide system support services to the UK energy market.

During the year we completed two planned outages, including turbine repairs and interim inspection work at Shoreham Power Station, providing the option for a future turbine upgrade to take place.

Since the start of 2019 seasonal electricity prices have weakened, reflecting a mild winter and high levels of European gas storage. The market for coal generation has remained challenging and our two coal units continue to focus on short-term power market opportunities during higher demand periods. Coal generation of 0.6TWh represents 4% of the Group’s output.

Where we sold forward volumes on a limited basis, weaker power prices allowed us to buy back some of those volumes at a lower price, adding margin.

The flexibility and dispatchable nature of our generation portfolio is an important source of value and was a key factor in our acquisition of the hydro and gas generation assets. Given the shift towards wind generation, which will provide the majority of the UK’s future electricity requirements, we anticipate a growing need for system support services. In 2019 Value from Flexibility (a scorecard measure of the value from flexible power generation, system support services and attractively priced coal fuels) was £129 million (2018: £79 million), which was ahead of plan, reflecting a 63% increase on 2018.

We believe there is a need for flexible, large-scale dispatchable generation, but this must support the UK’s target of net zero carbon emissions by 2050. To that end we continue to develop options for four 299MW Open Cycle Gas Turbines (OCGTs) and 5.4GW of CCGTs between Damhead Creek and Drax Power Station.

We expect the CCGTs to be among the most efficient assets in their class and hence sit high in the UK merit order, in addition to being available for system support services. The OCGTs will perform a system support role and meet peak power demand at short notice.

An appropriate clearing price in a future Capacity Market will be required to underpin investment in new-build gas. We will remain disciplined through this process and at the most recent auction in January 2020 Drax did not accept a Capacity Market agreement for these projects. We remain committed to developing the most cost-effective capital programmes for all of our gas projects, which we believe can make them competitive in future capacity auctions.

Planning approval for the CCGT at Drax Power Station is subject to a judicial review and we will not participate in future Capacity Market auctions until the outcome is known.

Our Customers business, which focuses on B2B supply, has faced a challenging market environment. Taken together with integration costs, Adjusted EBITDA of £17 million is lower than prior year (2018: £28 million). This includes £8 million of investment in restructuring to integrate the Haven Power and Opus Energy brands under a single operating structure. The creation of a single management team is now complete and will help drive alignment of decision making, effective market segmentation and operational efficiencies.

During the year significant focus was given to cash collection to address historic challenges associated with bad debt at Opus Energy. As a result we have seen further improvements in the management of bad debts during the period, reflected in a reduced charge to the income statement of £18 million (2018: £31 million), whilst maintaining a prudent level of provision.

We have a differentiated market position – selling purely renewable power, helping over 2,000 independent renewable generators access the market and developing products which will meet our customers’ needs. We continue to believe this approach will support long-term growth.

Over time, we expect this business, through efficiency and demand-side response, to contribute increasingly to balancing the power system and we are excited about our opportunity to make a difference in this area.

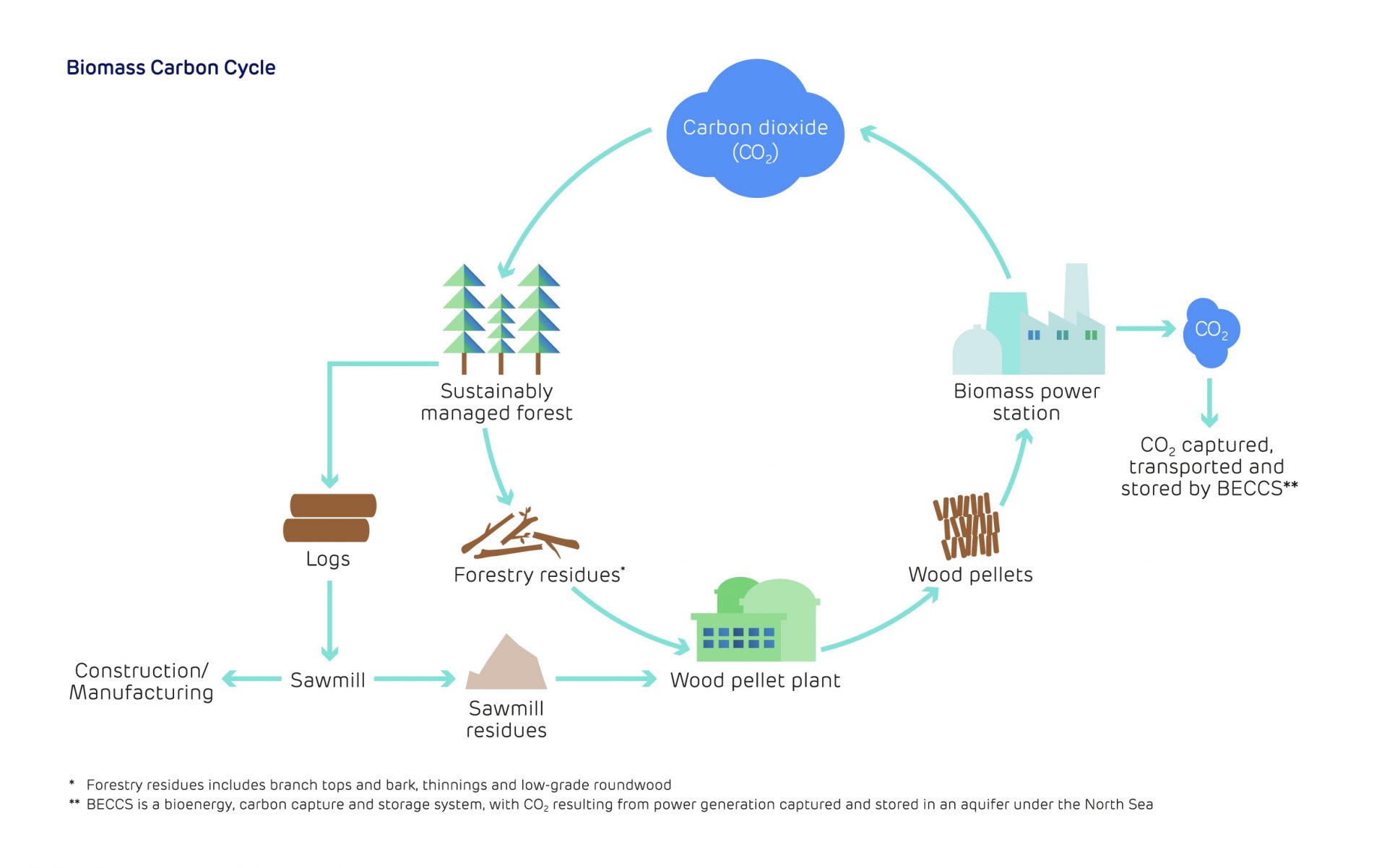

Biomass sustainability

Under well-established UK and European legislation, sustainably sourced biomass is a renewable source of electricity. The rules and the science which underpins this treatment are clear.

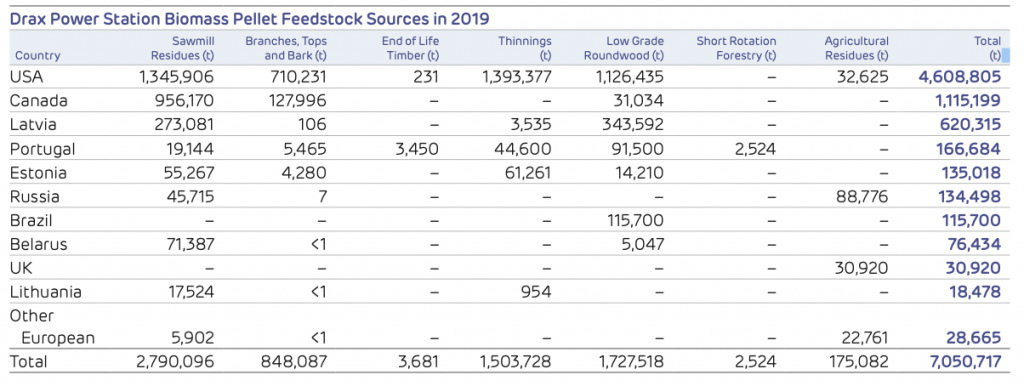

We source low-cost sawmill residues and forest residues, which are a by-product of commercial forestry processes, and thinnings from growing forests, which help improve forest stocks and forest health. The CO2 emissions are absorbed by new forest growth. We use feedstocks that have been shown to have no carbon debt associated with them.

“We maintain a rigorous and robust approach to biomass sustainability.”

Will Gardiner, Group CEO

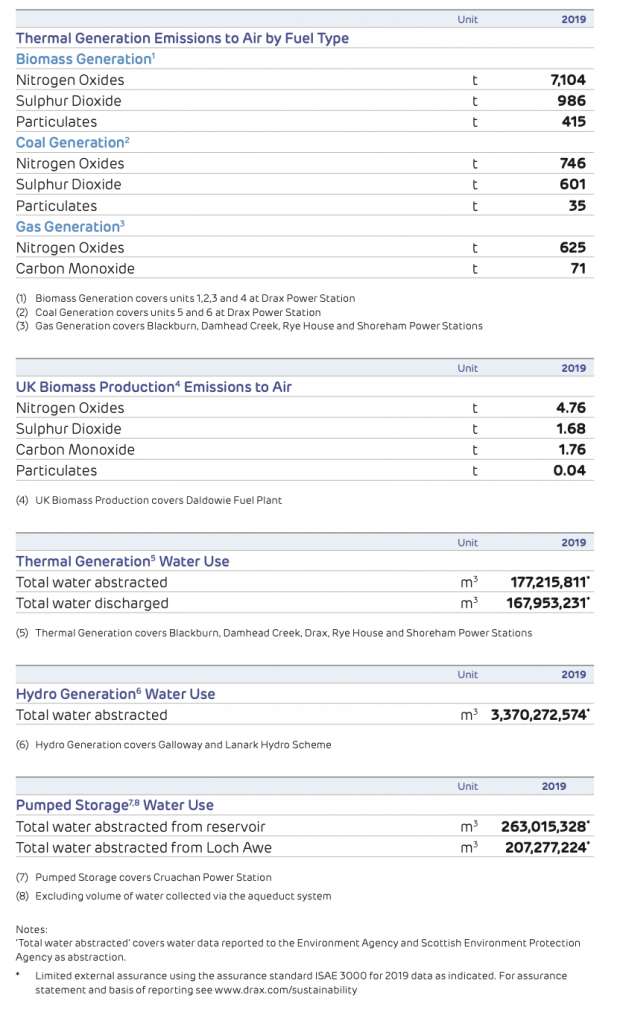

We maintain a rigorous and robust approach to biomass sustainability, ensuring the wood fibre used and pellets produced are fully compliant with the UK’s mandatory sustainability standards as well as those of the European Union. Since the introduction of the Renewable Obligation Certificate (ROC) scheme in 2002 Drax has maintained full compliance with UK and European legislation.

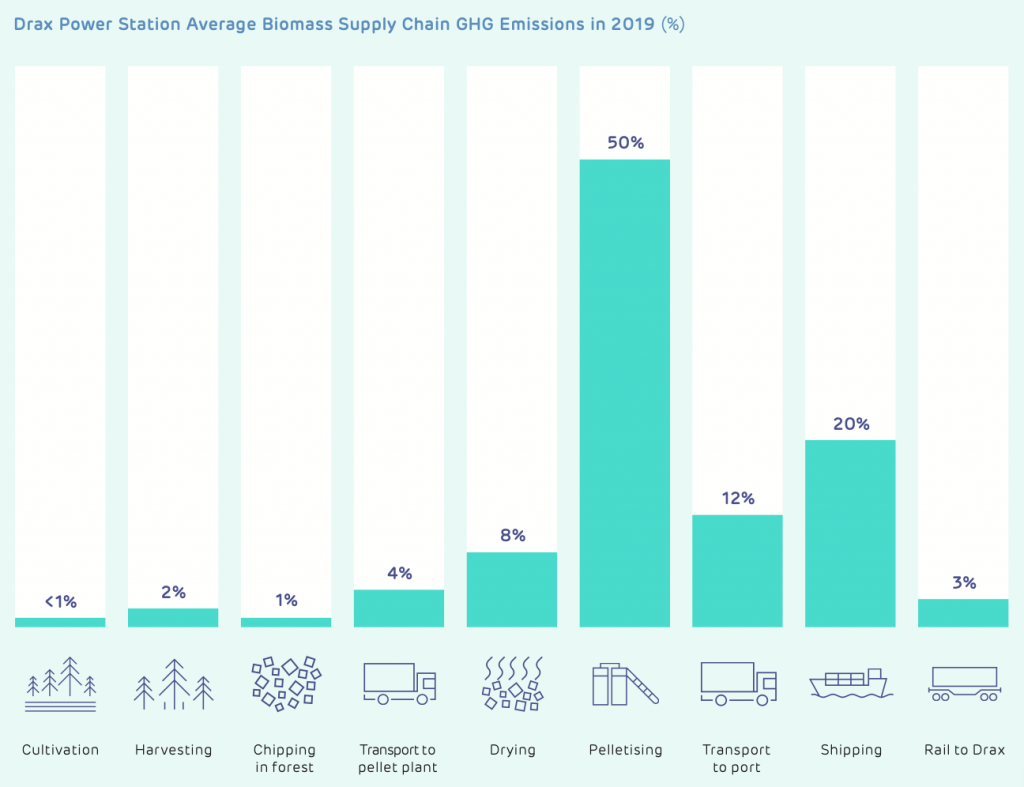

However, there are carbon emissions associated with the biomass supply chain. Under UK legislation biomass is the only source of electricity generation required to report its supply chain emissions. The Group’s biomass life cycle carbon emissions are 124 kgCO2-eq/MWh of electricity (2018: 131 kgCO2-eq/MWh), less than half the UK Government’s 285 kgCO2-eq/MWh of electricity limit for biomass. This equates to an 87% carbon emission saving against coal, inclusive of biomass supply chain emissions, but excluding those of coal, which means the actual saving from biomass is even greater.

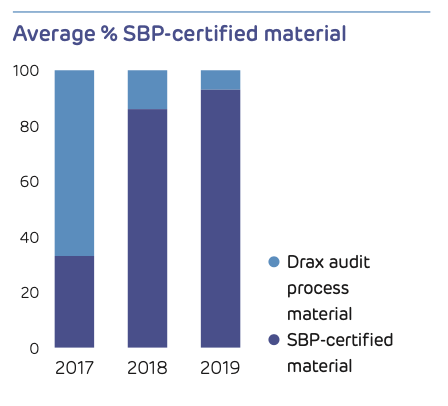

Reflecting this and a lower level of coal generation, reported carbon emissions under the European Union Emissions Trading Scheme fell by 50% to 113tCO2/ GWh (2018: 226tCO2/GWh).

Strengthening our leadership on biomass sustainability, we introduced a new Responsible Sourcing Policy for Biomass and established an Independent Advisory Board, chaired by Sir John Beddington, the UK’s former Chief Scientific Adviser. We responded to the Climate Disclosure Programme’s (CDP) Climate Change and Forests questionnaires.

Environmental, social and governance

The health, safety and wellbeing of our employees and contractors is vital to the success of the Group and remains our priority. We believe that a safe and sustainable business model is critical to our strategy and long-term performance. In 2019 we implemented a new Group- wide approach to health, safety and wellbeing, as well as the establishment of a new Group-wide workforce engagement forum.

In March 2019 we published our second gender pay report. While the data showed that our businesses were in line with the energy sector overall, it highlighted that we still have work to do.

In June 2019, we published our third statement on the prevention of slavery and human trafficking in compliance with the UK Modern Slavery Act (2015) and we are a signatory to the UN Global Compact (UNGC). We are committed to promoting the UNGC principles on respect for human rights, labour rights, the environment and anti-corruption.

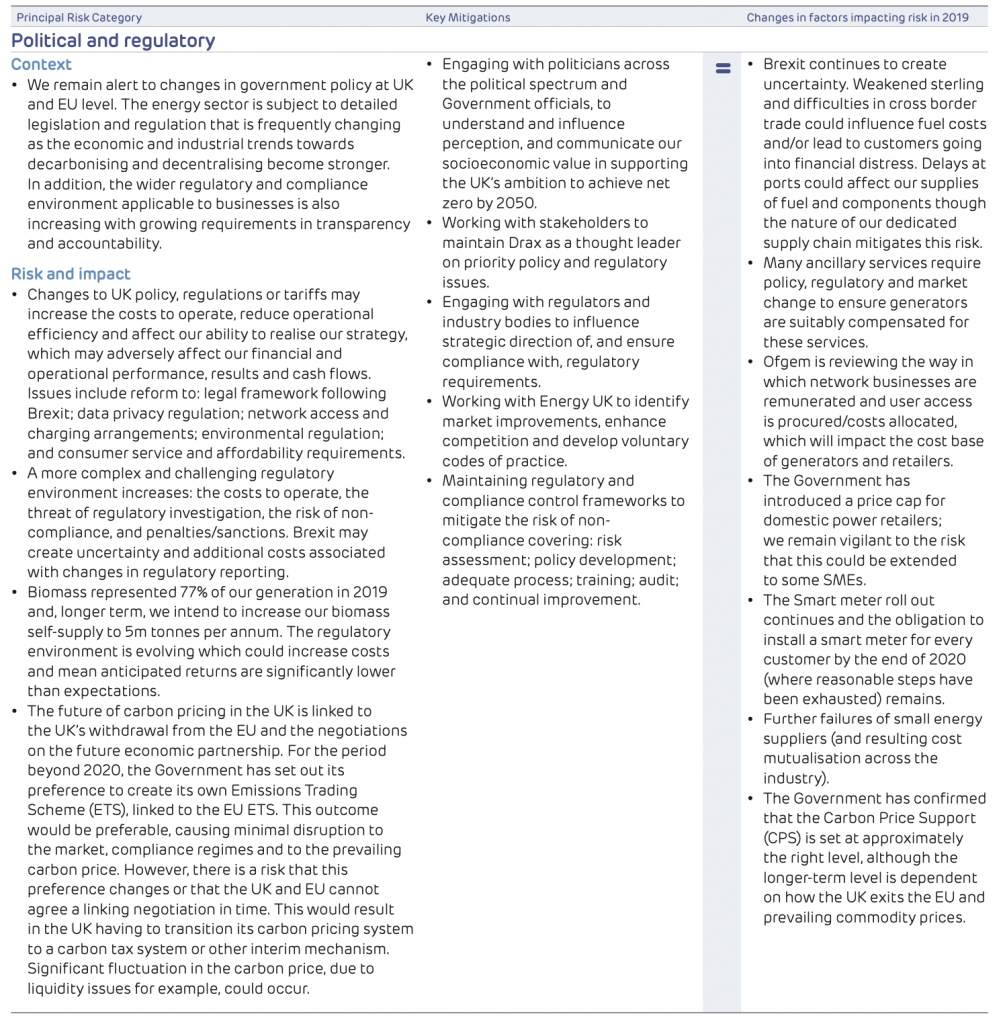

Brexit

Brexit remains a key issue for the UK.

To date, the impact on the Group has been limited, with the principal risk being weaker Sterling affecting the cost of biomass, which is generally denominated in US dollars. Through our use of medium- term foreign exchange hedges the Group has protected its position out to 2024 at rates close to those that we saw before the Brexit referendum vote.

Outlook

Our focus remains on progressing our strategy: to build a long-term future for sustainable biomass; to be the leading provider of system stability in the UK and to give customers control of their energy. Through achieving these strategic objectives we expect to deliver tangible financial benefits – long-term earnings growth, strong cash generation and attractive returns for our shareholders.

These activities continue to be underpinned by safety, sustainability and operational excellence.

In Pellet Production we remain focused on the production of good quality pellets at the lowest cost, cross-supply chain optimisation and an expanded self-supply capacity to five million tonnes by 2027.

Our Generation proposition is strong: flexible, renewable and low carbon electricity and system support services. We will continue to provide high levels of renewable electricity to the UK and support increased deployment of intermittent renewables necessary to support the UK’s transition to a net zero carbon economy.

Flexible dispatchable gas has an important long-term role to play in supporting the transition to a net zero carbon economy. We will optimise our portfolio to meet this demand and develop carbon capture and storage ready projects – options which could include hydrogen fuelling – subject to the right price in future capacity auctions.

Our ambition to become a carbon negative company is underpinned by the development of BECCS. Working in partnership, and with the right support from the UK Government, we could develop BECCS at scale before 2030. By reducing our biomass supply chain cost we will support this objective and deliver further attractive returns to shareholders.

In our Customers business we will remain focused on operational excellence, reducing our cost to serve customers, growing gross profit per MWh and managing bad debt. We will offer attractive propositions and develop our presence in the market for system support through flexible demand management and other value-added services.

We are making good progress with the delivery of our strategy and will build on this as we achieve our targets. We will also continue to play an important role in our markets as well as realising our purpose of enabling a zero carbon, lower cost energy future for the UK.

Will Gardiner

Group CEO

Q&A

How is Drax helping the UK reach its climate goal to be net zero by 2050?

We’re committed to a zero carbon, lower cost energy future and are stepping up our efforts to help the UK become net zero by 2050. We have already successfully converted two thirds of Drax Power Station to run on sustainable biomass instead of coal in what was the largest decarbonisation project in Europe. This means we’re generating 12% of the UK’s renewable electricity and we’ve reduced our carbon emissions by more than 85% since 2012.

We now want to become a carbon negative company by 2030, which we can do by applying carbon capture and storage technology to our biomass units. This is known as BECCS and, through our BECCS pilot project at Drax Power Station, we have the capability to capture one tonne of carbon a day. With the right investment framework and support mechanisms in place, we believe we could capture 16 million tonnes of CO2 a year.

What are negative emissions and why are they important?

Negative emissions mean Drax will be removing more carbon dioxide from the atmosphere than it produces from its operations. The UK needs negative emissions to help offset emissions from sectors that are harder to decarbonise than transport and power, for example aviation and shipping.

Both the UN’s Intergovernmental Panel on Climate Change and the UK’s Committee on Climate Change have said negative emissions with BECCS technology will be critical to limiting global temperature rise to 1.5 degrees.

What impact has the move to biomass had on Drax’s carbon emissions?

Biomass has been a critical element in the UK’s decarbonisation journey, helping the country get off coal much faster than anyone thought possible.

Since 2012, at Drax Power Station we have reduced our carbon emissions by 97%, becoming the largest decarbonisation project in Europe.

And we want to do more.

We’ve also expanded our generation operations to include hydro and gas generation, and we’ve continued to bring coal off the system.

What happens to the forests where Drax sources its biomass?

Sustainable biomass from managed forests is helping to promote healthy forest growth and biodiversity as well as decarbonising the UK’s energy system.

The biomass we use comes from sustainably managed forests that supply industries like construction and furniture. We use residues from forestry and sawmills, like sawdust, that other industries don’t use.

The biomass that we use is renewable because the forests are growing and continue to capture more carbon than we emit from the power station.

Why did you decide to work at Drax?

I want to use all of our capabilities to fight climate change. I also want to make sure that we listen to what everyone else has to say to ensure that we continue to do the right thing. Our people are very engaged on issues relating to climate change and I’m proud of the passion and innovation I see around the business.I took this job because Drax had already made a contribution to the energy transition in the UK. Climate change is the most important challenge we face and I passionately believe Drax has a crucial role in tackling it.

Does building gas power stations mean the UK will be tied into fossil fuels for decades to come?

Our energy system is changing rapidly, as we increase our use of wind and solar energy, but the wind doesn’t always blow and the sun doesn’t always shine, so we need technologies that can operate when needed to fill in those gaps.

We’re looking at a range of options to generate power and support the electricity system as it decarbonises. These include BECCS, hydrogen and gas, which can help enable more renewables to connect to the system.

As I said already, gas is one option we’re looking at but it won’t happen without the right investment conditions. If we do decide to build new natural gas plants, we will make sure that it is ready for carbon capture and storage. We will also look at converting the plants to run on hydrogen.

Chapter 4:

Financial Review

Group Financial Review

“We’ve delivered 64% growth in Adjusted EBITDA and a Net Debt to Adjusted EBITDA ratio ahead of our target of 2x.”

Andy Skelton, Chief Financial Officer

2019 Highlights

-

64% Adjusted EBITDA growth to £410 million

-

Delivered net debt to Adjusted EBITDA ratio ahead of target of 2x, after adjusting for deferred cash receipt of Capacity Market payments of £72 million, received in January 2020

-

Strong performance of acquired generation assets with Adjusted EBITDA of £114 million

-

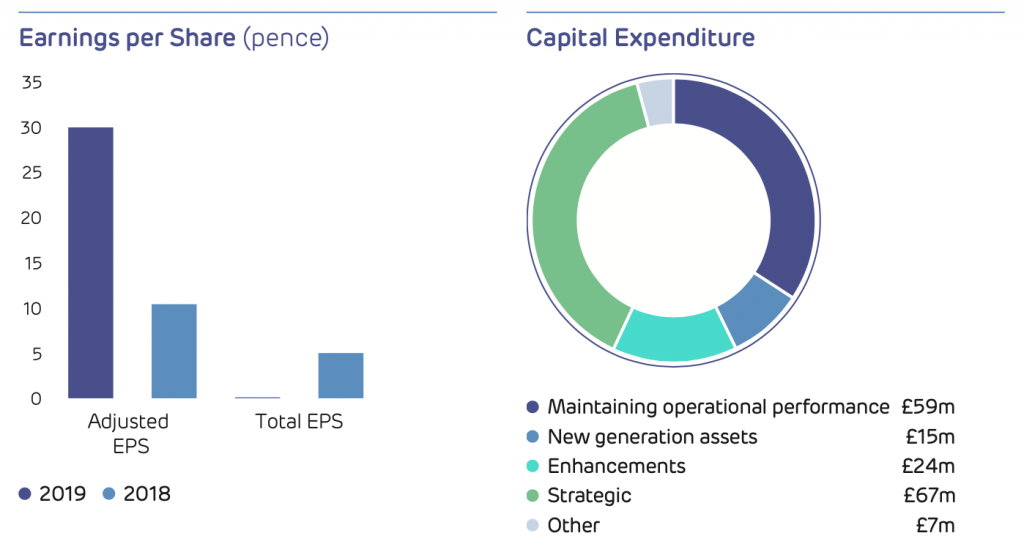

Significant increase in Adjusted profit after tax to £118 million resulting in improved Adjusted earnings per share of 30 pence

-

Total operating profit of £62 million, increased from £60 million

-

Net cash flow from operating activities of £413 million, compared to £311 million in 2018

-

13% increase in dividend to £63 million or 9 pence per share

Introduction

The Group has delivered significant growth during 2019, with Adjusted EBITDA increasing by 64% from £250 million in 2018, to £410 million.

Total operating profit, which includes the effect of remeasurement losses of £133 million (2018: remeasurement gains of £38 million) on derivative contracts, also increased from £60 million in 2018 to £62 million.

Our new portfolio of pumped storage, hydro and gas generation assets (hereafter referred to as the “new generation assets”), acquired on 31 December 2018, delivered Adjusted EBITDA of £114 million. Growth was further supported by an increased contribution from renewable power generation from sustainable biomass at Drax Power Station and our Pellet Production business.

This performance is particularly pleasing when considering the challenges we faced in the first half of the year where both our pellet production operations and biomass generation were impacted by lower levels of biomass supply as a result of historically bad weather conditions in the US Gulf.

Following the reinstatement of the UK Capacity Market in October 2019, the results for the year include £78 million of capacity market income, including £7 million for the period in 2018 after its suspension.

The associated cash was subsequently received after the year end and does not form part of our reported net debt at 31 December 2019.

The Group improved its access to capital during 2019. We refinanced the acquisition bridge facility, used to part-fund the acquisition in December 2018 of the new generation assets from ScottishPower, in three stages.

In May, we issued an additional US$200 million of the existing 2025 6.625% loan notes. In July, we entered into two new senior debt facility agreements, a £375 million private placement and a £125 million environmental, social and governance (ESG) facility. The average rate of the two new facilities is below 3%, reducing the Group’s overall cost of debt to below 4%, reflecting a reduced business risk profile.

Driven by strong cash generation in the period, supported by active management of working capital, net debt at 31 December 2019 was £841 million (2018: £319 million), delivering a net debt to Adjusted EBITDA ratio of 1.9x, ahead of our target of 2.0x for the year end after adjusting for the deferred receipt of £72 million cash in respect of Capacity Market payments received in January 2020.

We remain committed to a sustainable and growing dividend. The Board will recommend at the forthcoming Annual General Meeting a final dividend that takes total dividends for the financial year to £63 million, or 15.9 pence per share, an increase of £7 million or 1.8 pence per share when compared to 2018.

Financial Performance

Adjusted EBITDA

Group consolidated Adjusted EBITDA of £410 million includes a contribution of £114 million from our new generation assets, acquired at the end of 2018.

This is an excellent result and exceeds our forecast range of £90-£110 million, reflecting strong operational performance across the portfolio, better than expected performance in ancillary and balancing services and excellent progress with the integration of the assets into our existing generation business, which is now complete.

In total, the Generation business contributed Adjusted EBITDA of £408 million (2018: £232 million), an increase of £176 million or 76%. This performance comes despite industry- wide challenges with wood pellet production and associated supply constraints in the first half of the year, and includes the contribution of £114 million from our new generation assets, described above.

Following the reinstatement of the Capacity Market in October 2019, we have recognised related income totalling £78 million across the Generation portfolio. Our financial results for 2018 excluded £7 million of capacity market income following its suspension in October 2018, and this amount has now been recognised in 2019.

Total output at Drax Power Station reduced, as we continue our transition away from coal; however, our biomass units delivered output broadly in line with 2018, of 13.4TWh (2018: 13.7 TWh).

The small reduction in part reflected an outage over the summer period on Unit 1, which is supported by the Contract for Difference (CfD) regime.

Despite lower CfD generation, overall renewable support under the CfD and ROC regimes remained broadly in line with the prior period, due to higher ROC generation and indexation of support payments.

Overall captured spreads improved following efficiency gains as a result of our programme of investment in the performance of generating units at Drax Power Station and benefits from our trading position and portfolio.

We continue to derive value from flexibility (balancing mechanism, ancillary services and advantaged fuels), which improved from £79 million in the prior year to £129 million in 2019, an increase of 63%. Our new hydro and pumped storage assets performed particularly strongly in this area, a demonstration of the contribution of the acquisition to our strategy to become the leading provider of system stability in the UK.

The Generation business acquires biomass pellets predominantly in US dollars, which we actively hedge over a rolling five-year period, to manage our foreign currency exposure to a weaker pound. The renewable support (CfD and ROCs) received in respect of biomass generation are subject to UK inflation indices. This exposure is managed as part of our active long-term financial derivatives hedging programme.

We hold a large portfolio of forward and option contracts for various commodities and financial products, the nature, value and purpose of which is described in note 7.2 to the consolidated financial statements. These contracts are held to de-risk the business, by protecting the sterling value of future cash flows in relation to the sale of power or purchase of key commodities. We manage our exposures in accordance with our trading and risk management policies.

From time to time, for example where market conditions or our trading expectations change, action may be needed in accordance with these policies to rebalance our portfolio. This year such activity included restructuring in-the- money foreign currency exchange contracts, to balance short and long periods across the duration of the hedge. During 2019 we also realised value from closing out positions as expectations for coal generation reduced, the benefit of which is included in value from flexibility, above. The financial impact of these activities – which is driven by market prices at the point of execution – is recognised in the cost of sales of our Generation business and therefore is reflected in our Adjusted Gross profit and Adjusted EBITDA.

Our Customers business contributed Adjusted EBITDA of £17 million in 2019, an £11 million reduction when compared to 2018.

The 2019 result for Customers includes £8 million of investment cost in the restructuring of the business, to more closely integrate our two brands and bring them under one management team (In 2018, £3 million of restructuring and integration costs were treated as exceptional and excluded from Adjusted results in the first year post-acquisition of Opus Energy), and a further £7 million for the development of next-generation IT systems (2018: £6 million).

We delivered the new ERP system at Opus Energy during the second half of 2019 but have stopped the implementation of a new billing system and are in ongoing discussions with the supplier. We have incurred approximately £19 million of costs to date, held on the balance sheet, which we believe have value and will be recovered.

Overall volumes sold were down by 9% compared to 2018, which largely reflects a mild 2018/19 winter that led to a challenging first half of the year.

As a result, overall gross profit fell from £143 million in 2018 to £134 million in 2019.

During the year, significant attention was focused on improving cash collections, where we have seen a positive performance. As a result of this, in addition to a £6 million benefit in respect of resolution of legacy credit balances, bad debt charges reduced from £31 million in 2018 to £18 million in 2019. The higher charge in the prior year reflected an increased level of provisioning required due to reduced collection performance, plus a £3 million one-off expense in respect of SME business. The closing provision at 31 December 2019 of £41 million is slightly lower than the prior year (2018: £44 million), reflecting the improved performance during the year.

Pellet Production Adjusted EBITDA of £32 million increased 52% from £21 million in 2018.

Facilities at Drax Biomass include the LaSalle pellet plant and tree nursery at Weyerhaeuser

Production in the year increased slightly to 1,406kt (2018: 1,351kt), reflecting a full year of operations at the LaSalle pellet plant. This would have been higher but for challenging weather conditions in the first quarter, resulting from unseasonably high rainfall and associated high river levels, which materially restricted output at all three of our pellet plants and caused difficulties in loading ships at the port.

We have made good progress with biomass cost reduction projects in the year, with the average cost per gigajoule of our self-supplied pellets falling to US$161/tonne in 2019 compared to US$166/tonne in the prior year.

Key contributions to this saving came from the benefit of a full year of lower operational costs as a result of the headquarters relocation from Atlanta to Monroe during 2018 and the rail spur project at our LaSalle plant, commissioned in early May 2019, saving transport costs across the rest of 2019 with a positive impact on supply chain emissions. Furthermore, the sawmill co-location project at the same plant has delivered further savings.

The total savings from these projects delivered in 2019 was £14 million, which more than offset the weather impact described above.

Central and other costs of £46 million have increased by £18 million in 2019.

This increase includes incremental research and innovation costs associated with key strategic initiatives – including those relating to Bio-Energy Carbon Capture and Storage (BECCS).

As we described at the half year, and in connection with the integration of the acquired generation assets; we incurred one-off costs implementing a new organisational structure that we believe will enable us to execute our strategy more effectively. Costs associated with delivering working capital initiatives have also increased.

Total Operating Profit

Total operating profit of £62 million has increased 3% from £60 million in 2018. This includes the effect of acquisition and restructuring costs and remeasurement gains and losses on derivative contracts that are excluded from Adjusted results. Our policy and approach to calculating Adjusted results is set out on page 131 of the full PDF report.

Acquisition and restructuring related costs of £9 million (2018: £28 million) reflect the first-year costs of integrating the new generation assets into our existing Generation business, following transaction costs associated with the acquisition last year. The integration is now complete, and in line with our policy no further acquisition and restructuring costs in relation to the acquired assets will be excluded from Adjusted EBITDA in 2020.

Net fair value remeasurement losses on derivative contracts included in operating profit were £131 million (2018: gains of £38 million) reflecting movements in the mark-to-market position on our portfolio of commodity and financial derivative contracts, to the extent they do not qualify for hedge accounting.

The losses in 2019 are predominantly the result of the strengthening of sterling in the period and the resulting impact on the value of our extensive portfolio of foreign currency exchange contracts, which provide a rolling five-year hedge against changes in exchange rates for fuel purchases denominated in foreign currencies.

Profit After Tax and Earnings per Share Adjusted profit after tax of £118 million compares to £42 million for the prior year, resulting in Adjusted earnings per share (EPS) of 30 pence (2018: 10 pence) which represents a 200% increase.

Improvements in Adjusted profit after tax and EPS largely reflect the growth in Adjusted EBITDA described above, although this has been partially offset by higher depreciation charges resulting from the new generation assets, and an increase in interest charges as a result of the new debt issued to part-fund the acquisition, as described in further detail below.

Total profit after tax of £1 million is lower than £20 million for last year, with a corresponding reduction in Total EPS from 5 pence in 2018 to nil pence in 2019.

Total profit after tax reflects exceptional items and certain remeasurements, including the derivative remeasurements and acquisition and restructuring costs described above. In addition, it includes a further £5 million of interest charges relating to the acquisition bridge facility. These costs have been treated as exceptional given the direct link to the acquisition and their one-off nature (2018: £7 million).

The total tax credit of £3 million (2018: £6 million) reflects an effective tax rate that is lower than the standard rate of tax in the UK. This principally reflects the benefit of patent box tax credits in respect of biomass research and development expenditure. Total patent box credits included in the overall tax credit for 2019 are £8 million (2018: £8 million).

Cash taxes paid during the year were £9 million (2018: £1 million).

Capital Expenditure

We maintain a disciplined approach to capital expenditure, with all significant projects subject to appraisal and prioritisation by a Capital Committee prior to approval, overall ensuring adherence to our capital allocation policy and maintenance of an appropriate net leverage profile.

Total capital expenditure of £172 million in 2019 was higher than £114 million in the prior year.

The increase principally reflects additional expenditure in respect of the new generation assets, strategic projects and investments to progress our objective of increasing self-supply of pellets to 5 million tonnes and reduce the cost of pellets.

We have made an initial investment in biomass expansion projects in the Pellet Production business, ahead of full delivery in 2020, in line with our strategy to expand self-supply. We have also continued investment in our gas development projects – our four OCGT sites, a new CCGT at Drax Power Station and the expansion option at Damhead Creek.

Cash and Net Debt

At 31 December 2019, total borrowings were £1,245 million (2018: £608 million) and net debt was £841 million (2018: £319 million).

Following the reinstatement of the Capacity Market in October, we accrued the £78 million of associated income in full; however, the cash payments were not received until after the year end.

After adjusting for the receipt of £72 million of cash in January 2020 in respect of Capacity Market payments, covering the standstill period, this reflects a net debt to EBITDA ratio for 2019 of 1.9x (2018: 1.3x), within our target of less than 2x. Without adjusting year end net debt for this payment our closing net debt to EBITDA ratio was 2.1x.

The increase in borrowings and net debt in 2019 reflects the additional debt drawn to part-fund the acquisition of the new generation assets, for which the cash consideration was settled in January 2019.

Taking this into account, and allowing for a full year of EBITDA from the new generation assets in 2018, this represents a significant deleveraging on a like-for- like basis from a net debt to EBITDA ratio of 3.1x.

On 2 January 2019, the Group drew down £550 million from the £725 million acquisition bridge facility to partially fund the acquisition, with the remainder of the consideration funded from the Group’s cash resources. At inception, the acquisition bridge facility was due to mature in the second half of 2020.

During 2019, we refinanced the acquisition bridge facility in three stages, including two new long-term debt facilities.

On 16 May 2019, we issued an additional US $200 million of the existing 2025 6.625% US dollar loan notes. The proceeds from the issuance were used to repay £150 million of the drawn down acquisition bridge facility. Reflecting the strong investor appetite, the notes were issued at 101.5% of their face value which, when swapped back into sterling, achieved an interest rate of 4.74%.

On 24 July 2019, we entered into two new senior debt facilities agreements, a £375 million private placement with infrastructure lenders with maturities between 2024 and 2029, and a £125 million ESG facility agreement that matures in 2022. The ESG facility includes a mechanism that adjusts the margin based on carbon emissions against an annual benchmark.

Together these new facilities extend the Group’s debt maturity profile beyond 2027 and reduce the Group’s overall cost of debt to below 4%.

A full reconciliation of the Group’s borrowings in the period is provided in note 4.3 to the consolidated financial statements.

The Group continued to generate strong cash from operating activities in 2019, with a total inflow of £413 million in 2019 (2018: £311 million). The increase principally reflects improved profitability, the contribution from newly acquired generation assets and a disciplined approach to working capital, partially offset by increased interest payments on the expanded debt portfolio.

In addition to the improvements in operating performance described above, the Group has a strong focus on cash flow discipline. We also use various methods to manage liquidity through the business’ cash generation cycle.

The Group has access to a £315 million revolving credit facility, which can be used to manage low points in the cash cycle, which expires in 2021. No cash was drawn under this facility at 31 December 2019 (2018: £nil). We actively optimise our working capital position by managing payables, receivables and inventories to ensure that the working capital committed is closely aligned with operational requirements.

The key working capital benefits in 2019, in terms of cash flow, arise from making sales and purchases of ROC assets and rebasing foreign currency exchange contracts.

Historically, cash from ROCs has typically been realised several months after the ROC was earned at the end of the ROC compliance period; however, the Group is able to limit the overall impact of ROCs on working capital by making separate sales and purchases in the compliance period.

For 2019, such transactions generated a net cash inflow of £131 million and supported an overall working capital inflow from ROCs of £54 million. The Group also has access to facilities enabling it to sell ROC trade receivables arising on a non-recourse basis. These facilities were not utilised at 31 December 2019 (2018: £nil).

During 2019 the Group rebased several foreign currency contracts, which resulted in a working capital benefit. The total cash released from related trades still outstanding at the end of the year was £84 million (2018: £3 million) reflected in cash generated from operations. By undertaking a similar exercise on cross-currency swaps, we released a further cash benefit of £23 million (2018: £nil). This has no impact on Adjusted EBITDA, the gains are held on the Group’s balance sheet, until the rebased trades expire.

In addition, the Group has access to a £200 million receivables monetisation facility (extended from £150 million in 2018), which accelerates associated cash flows and mitigates exposure to credit risk, and a number of payment facilities to leverage scale and efficiencies in transaction processing. We also facilitate a supply chain financing scheme, which enables certain suppliers to access payment earlier than contractually agreed payment terms and supports the wider working capital efficiency of the Group. The balances outstanding at 31 December 2019 and change in utilisation in respect of each of these facilities is set out in note 4.4 to the consolidated financial statements.

The overall net cash inflow for the year was £122 million (2018: £66 million), after cash payments for capital expenditure of £171 million (2018: £104 million), dividend payments of £59 million (2018: £53 million), net proceeds from new borrowings of £653 million (2018: net repayment of £5 million) and payments in respect of acquisitions of £692 million (2018: £nil).

Distributions

We have a long-standing capital allocation policy – a commitment to robust financial metrics that underpins our strong credit rating, invest in our core business, pay a sustainable and growing dividend and return surplus capital to shareholders as appropriate.

At the Annual General Meeting on 17 April 2019, shareholders approved payment of a final dividend for the year ended 31 December 2018 of 8.5 pence per share (£34 million). The final dividend was paid on 10 May 2019.

On 23 July 2019, the Board resolved to pay an interim dividend for the six months ended 30 June 2019 of 6.4 pence per share (£25 million), representing 40% of the expected full year dividend. The interim dividend was paid on 11 October 2019.

At the forthcoming Annual General Meeting, on 22 April 2020, the Board will recommend to shareholders that a resolution is passed to approve payment of a final dividend for the year ended 31 December 2019 of 9.5 pence per share (£38 million), payable on or before 10 May 2020. Shares will be marked ex-dividend on 23 April 2020. This brings the total dividend payable for 2019 to £63 million and delivers 13% growth on 2018.

The Group’s £50 million share buy-back scheme, which commenced in April 2018, concluded in January 2019. In total, 13.8 million shares were repurchased and are now held in treasury.

Other Information

New Accounting Standards

The impact of adopting IFRS 16 during the financial year – the new accounting standard for leases – is set out in note 8.3 to the consolidated financial statements. On transition, the Group elected to use the practical expedient available, allowing the standard to only be applied to those contracts identified as leases under the previous standards. As a result, adoption of IFRS 16 has not resulted in any retrospective changes to amounts recognised in the Group’s annual consolidated financial statements for the year ended 31 December 2018.

Adoption of IFRS 16 has resulted in a reduction of operating costs in 2019 of £7.4 million, with the costs of leases now reflected as depreciation and interest charges.

Had the standard been applied in 2018, the equivalent reduction in operating costs for the year ended 31 December 2018 would have been £6.3 million.

Restatement of Comparative Financial Information

The Group consolidated financial statements (see page 133 of the full PDF report), include comparative information for the year ending 31 December 2018.

The 2018 comparatives have been restated, from those originally published, in respect of the following items:

- Finalisation of the opening values of assets and liabilities acquired in respect of the acquisition of the new generation assets on 31 December 2018. During 2019, we concluded a completion statement process and identified adjustments to fixed asset values totalling £4 million. The net effect of these changes was a £5 million increase in consideration payable and a £3 million reduction in goodwill. See note 5.1 to the financial statements.

- Correction of an historical error identified in respect of translation of fixed assets in our US-based business into the consolidated group financial Application of the correct foreign exchange rates resulted in an increase in fixed asset carrying values at 1 January and 31 December 2018 of £34 million and £56 million respectively, with an equivalent amount recognised in the translation reserve. The correction has no impact on previously reported profit or cash amounts.

Andy Skelton

Chief Financial Officer

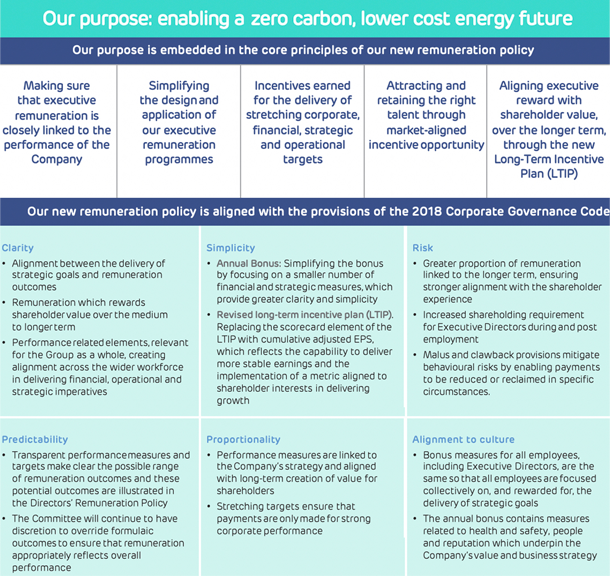

Remuneration At A Glance

A new Remuneration Policy which aligns with our purpose of enabling a zero carbon, lower cost energy future and rewards sustainable long-term performance

“The Committee has undertaken a full review of the policy, taking into account shareholder feedback.”

Nicola Hodson, Remuneration Committee Chair

Drax has continued to evolve since the last full review of the Directors’ Remuneration Policy (the policy). The Group has a broader position in the energy market following the biomass conversion programme and the acquisitions in the Customers business and, more recently, in Generation with the successful integration of the hydro, pumped storage and gas assets.

To ensure that our approach to remuneration supports the strategy, the Remuneration Committee has undertaken a full review of the policy, taking into account the Group’s strategy, shareholder feedback and the new provisions in the Corporate Governance Code.

Our principal aims are to ensure that executive pay is closely linked to Group performance, underpins our purpose of enabling a zero-carbon, lower cost energy future; better aligns reward with delivering the strategy; incorporates targets that reflect the Group’s progress, and are relevant and transparent for the wider workforce and our shareholders.

The proposed new policy is designed to support delivery of our core business against a smaller number of stretching annual financial, operational and strategic targets, rewarding the delivery of growth, innovation and sustainability over the long term.

The proposed new remuneration structure is simplified, with annual bonus payments linked to these goals – a decision informed by engagement with shareholders.

In the long-term incentive, Total Shareholder Return (TSR) will be retained but the Group scorecard will be replaced with cumulative adjusted EPS. We feel this change will help to drive further shareholder value over the medium to longer term.

Attracting and retaining the right talent capable of delivering high quality business performance and growth is critical in achieving our strategy.

We believe the new long-term incentive, focused on rewarding stretching performance, and with extended holding requirements will enable this.

I have met a number of our major shareholders and have incorporated their feedback. I welcome further feedback on the proposed policy.

Chapter 5:

Market Context, Working With Stakeholders & Biomass Cost Reduction

Decarbonisation, electrification and flexibility

Globally the energy market in 2019 was marked by geopolitical tension, commodity prices which varied within a relatively stable range and, most importantly, rising awareness of climate change and its implications. The UK energy market is increasingly shaped by three major trends: the pace of decarbonisation of the sector is increasing; the need for electrification and more electricity is growing as the heat and transport sectors decarbonise; and the need for flexible sources of power is greater than ever.

Decarbonisation – In July 2019 the UK Government passed legislation requiring the UK economy to be net zero carbon by 2050. Tackling climate change is high in the public consciousness and widespread engagement and activism suggests that the UK public increasingly expects the Government and industry to work together to provide solutions. To date the power sector has led the way in the UK’s efforts to decarbonise, and we believe it will have an even greater role in helping to realise net zero. In fact, to hit net zero by 2050, including the hard to decarbonise sectors such as aviation and agriculture, we envisage that the power sector will have to contribute negative emissions to the overall carbon balance.

Electrification – Decarbonisation on the scale outlined above is likely to require an absolute increase in the amount of electricity produced and consumed due to the electrification of heating and transport.

The UK Government has signalled a commitment to end diesel and petrol car sales by the middle of the next decade, which is expected to increase the number of electric vehicles on the road and further add to the demand for electrification. Furthermore, a report from the Energy Transitions Commission (November 2018) estimated that electricity’s contribution to global energy supply must rise from 20% to 60% by 2060.

Flexibility – Renewable power generation, driven by wind and solar, is increasing and is expected to provide over 80% of power by 2050. Delivered by smaller, more widely distributed, sources of generation this will mean the UK power grid will need to manage more volatility, and energy customers will increasingly need more control over the way they use or generate their own energy. The need for more flexible generation was thrown into sharp relief by the power supply issues on 9 August 2019 which saw over one million people go without power when 1.9GW of power failed in a short period of time.

On the next page we explore three aspects of Drax’s response to changes in the energy market in more detail.

Towards a net zero carbon future

Hitting net zero and limiting average temperature rises to less than 1.5 degrees Celsius will require huge investment.

1. Meeting the net zero by 2050 target

The precise path to achieve this goal is not yet certain for all sectors but it is becoming increasingly clear that carbon removal technologies and negative emissions will have a significant role to play. Organisations such as the International Panel on Climate Change and the UK’s Committee on Climate Change agree that carbon capture technologies, in particular those which could lead to the removal of carbon from the atmosphere, will be important.

Our response

In 2019 Drax produced 13.7 TWh of renewable power and we have reduced our carbon footprint by over 85% since 2012. Coal accounted for only 4% of Drax’s generation in 2019. In December 2019 we announced an ambition to become a carbon negative company by 2030. This means by 2030 Drax would be removing more carbon dioxide from the atmosphere than we are emitting.

2. Evolving mix of generation

The use of intermittent renewables, such as wind and solar, continues to increase. Flexible, thermal generation, such as coal and older gas plant generation continues to decline. This places additional pressure to balance the energy system. More distributed generation and the increase in intermittent renewables are driving increased levels of volatility in short-term prices and a need for assets to provide system support services. There is an increasing need for flexible sources of power which can provide services such as response, reserve, reactive power, black start and inertia.

Our response

Drax’s portfolio of flexible generation assets (biomass, hydro and gas) provide these increasingly important balancing services. Drax now has generation assets with a capacity of 6.5GW distributed across Scotland, northern and south east England, and options to develop generation assets in Wales and the East of England.

Drax saw a 63% increase in the value derived from flexibility in 2019 compared to 2018.

3. Changing customer behaviours and expectations

The business-to-business energy market is highly competitive and customers demand access to both low cost and renewable power. Customers want more control of their energy in order to manage both cost and their environmental impact. Energy suppliers therefore need to provide the services which customers need. Our business customers increasingly seek to create value from their portfolios through the installation of their own generation capabilities, the provision of demand side response and energy trading.

Our response

Drax is now the third largest supplier of energy to businesses and supplies more of its customers with 100% renewable power than any of its competitors.

Our investment in digital technologies is providing new opportunities, a reduced cost to serve and an enhanced customer experience.

In 2019 Drax launched a partnership with SES Water to provide an end-to-end electric vehicle offer, and a new partnership with Eaton allowed Drax to install batteries as an energy service on our customers’ property. Services like this mean Drax can open up power and flexibility markets to more of our customers and ultimately generate value for both us and our customers through our trading expertise.

See more online at www.drax.com and more details about trends in the electricity sector at www.electricinsights.co.uk

Working with our stakeholders

Engaging with our stakeholders is fundamental to our success. We recognise that we need to listen to, and work with, a diverse range of interested parties to achieve our purpose: to enable a zero carbon, lower cost energy future. In this section, we explain how we have identified our stakeholders and engaged with them to inform the way we operated our business in 2019.

Stakeholder relations

High quality engagement with the full breadth of our stakeholders is key to well-informed decision-making that pays appropriate regard to stakeholder views.

Drax has a wide range of stakeholders and takes care to ensure that the Group, and the Board, has an effective strategy to identify and engage with those stakeholders.

We have a comprehensive stakeholder engagement strategy. This is detailed in the Communications Strategy, which is presented to the Board at least annually and sets out our stakeholders and provides oversight of how the Group intends to engage with them.

Engagement with stakeholders informs both our day-to-day decision making, that ensures the smooth running of the business, and the strategic decisions which help set our direction for the years and decades to come.

Drax employs dedicated teams to engage both proactively and reactively with particular stakeholder groups.

This includes a stakeholder relations team, an investor relations team, an internal relations team, a sustainable business team, a business ethics team, a media relations team and a digital engagement team.

Methods of engagement with stakeholders vary according to the issue at hand and the stakeholder concerned. The table on page 25 of the full PDF report sets out the broad stakeholder groups that we identified and engaged with during 2019. It also highlights why we engaged, how we engaged and the areas of focus.

Companies Act, Section 172 Statement

Meaningful engagement with all our stakeholder groups supports our obligations under Section 172 of the Companies Act 2006.